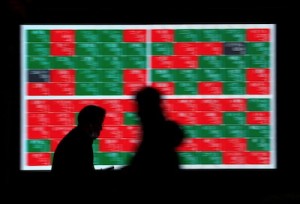

Asian stock indexes were pulled in all directions on Wednesday with poor factory data and China’s Covid woes weighing on one side and hopes of a vaccination rollout and more economic support from Beijing tugging on the other.

Investors remain cautious about China’s path to reopening its economy after it released disappointing manufacturing data, with China and Hong Kong stocks wiping out strong gains from the previous day early on before staging a mini-recovery.

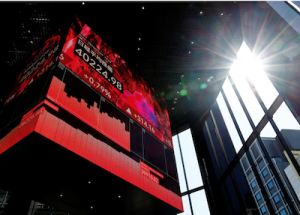

There was also weak factory output data out of Japan where the Nikkei index fell for a fourth straight session on concerns of a global economic slowdown, with investors also awaiting US Federal Reserve Chair Jerome Powell’s latest speech for policy clues.

Read more: China Factory, Service Sectors Drop to Seven Month Lows

Fed Chair Powell will speak at a Brookings Institution event later in the day about the outlook for the US economy and the labour market.

The Nikkei share average ended 0.21% lower at 27,968.99, after hitting its lowest since November 16. The broader Topix slipped 0.37% to 1,985.57.

Japan’s factory output fell for a second consecutive month in October, as stalling global demand and lingering supply bottlenecks put a lid on Japanese manufacturers’ production plans.

And China’s factory activity contracted at a faster pace in November, weighed down by softening global demand and Covid-19 restrictions.

But it’s China’s Covid situation, which has seen unprecedented social unrest break out in recent days over Beijing’s uncompromising zero-Covid policy, that has been investors’ main focus.

After early losses in Hong Kong and mainland China, its indexes enjoyed a bump with traders banking on Chinese officials’ promise that the country would speed up Covid-19 vaccinations for the elderly.

China’s Vaccination Push

The vaccination push is seen as crucial to unwinding nearly three years of strict curbs in the world’s second-largest economy that have eroded economic growth, disrupted the lives of millions and sparked unprecedented protests this past weekend.

“Headlines from China regarding Covid restrictions and protests are causing jitters among investors. Although some Covid easing measures are being considered, it may not be enough to prevent further economic disruption,” said Anderson Alves, global macro analyst at ActivTrades.

“Expectations are that as Covid cases continue to rise, restrictions will be re-tightened before year-end, bringing with it more uncertainty over the impact on the economy,” he said in a research note on Wednesday.

The Hang Seng Index gained 2.16%, or 392.55 points, to 18,597.23.

The Shanghai Composite Index rose 0.05%, or 1.59 points, to 3,151.34, while the Shenzhen Composite Index on China’s second exchange was up 0.12%, or 2.47 points, to 2,018.69.

MSCI’s gauge of Asia Pacific stocks outside Japan was up 0.02% at 0201 GMT, paring earlier losses. At current levels, the index is set to post its biggest monthly gain since April 1999.

US Labour Market Data

Elsewhere across the region, Australia’s S&P/ASX 200 gained 0.43% while Indian stocks rose with Mumbai’s signature Nifty 50 index up 0.75%, or 140.30 points, at 18,758.35.

Globally, the S&P 500 closed lower on Tuesday as investors wait for hints on the US Federal Reserve’s path of interest rate hikes.

Investors are also waiting for US labour market data for November and gross domestic product numbers for the third quarter.

“This week will offer an interesting test for markets as we have a look at the next important data macro data points out of the US, especially the PCE inflation data and the Friday November jobs report,” said Redmond Wong, Greater China market strategist at Saxo Markets in Hong Kong.

The US ISM manufacturing survey for the month on Thursday is also expected to slip into contraction, Wong said.

Oil prices continued to rise after a buoyant Tuesday, with US crude up 0.873% to $78.87 a barrel and Brent up 0.76% to $83.66 a barrel. Spot gold rose 0.13%.

Key figures

Tokyo – Nikkei 225 < DOWN 0.21% at 27,968.99 (close)

Hong Kong – Hang Seng Index > UP 2.16% at 18,597.23 (close)

Shanghai – Composite > UP 0.05% at 3,151.34 (close)

London – FTSE 100 > UP 0.66% at 7,561.35 (0940 GMT)

New York – Dow > UP 0.01% at 33,852.53 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Bitfront Becomes Latest Crypto Exchange to Cease Trading

Yuan-Rouble Dealings Skyrocket as Russia Embraces the Redback