Asian stocks edged ahead on Tuesday with investors reassured by an apparent easing in the threat of a banking sector crisis.

Global stocks and US bond yields rose after a US regulator-backed deal by First Citizens BancShares to buy failed Silicon Valley Bank soothed wider worries about problems in the sector.

That calmed worried traders across Asia and Japanese shares ended higher as its bank stocks rose following the deal.

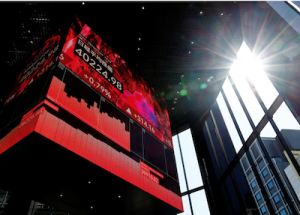

The Nikkei share average edged up 0.15%, or 41.38 points, to close at 27,518.25, while the broader Topix gained 0.25%, or 4.83 points, to 1,966.67.

Also on AF: Ex-Taiwan President Ma Lands in China in Controversial Visit

The bank index rose 1.96% to become the top performer in the Tokyo Stock Exchange’s 33 industry sub-indexes.

Hong Kong stocks rose as well, with investors buoyed after Silicon Valley Bank secured a buyer. Chinese shares, however, had a mixed performance as a string of weak earnings reports dashed hopes of a swift economic recovery this year.

Hong Kong’s benchmark Hang Seng Index advanced 1.11%, or 216.96 points, to 19,784.65, while the China Enterprises Index climbed 0.7%.

Financial shares traded in Hong Kong rose 1.2%, with HSBC Holdings and AIA Group up 1.6% and 1.9%, respectively.

But the Shanghai Composite Index fell 0.19%, or 6.02 points, to 3,245.38, while the Shenzhen Composite Index on China’s second exchange dropped 0.70%, or 14.81 points, to 2,104.37.

Elsewhere across the region, Singapore and Seoul also gained. Indian stocks slipped with Mumbai’s signature Nifty 50 index down 0.39%, or 66.90 points, at 16,918.80.

Australian shares jumped more than 1%, as lithium and commodity stocks rallied sharply after battery metals explorer Liontown Resources rejected a $3.7 billion buyout bid from Albemarle Corp.

MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.3% by early morning Hong Kong time.

US Small Banks Concerns

Top US banking regulators said on Monday that they planned to tell Congress that the overall financial system remains on solid footing despite recent bank failures, but vowed to review their policies in a bid to prevent future collapses.

The concerns, however, haven’t completely gone away as Federal Reserve Governor Philip Jefferson said on Monday that stress among small banks could hit small businesses hardest.

The dollar slid to 130.76 yen from the late New York high of 131.75 and 131.54 early Asia.

“This round of uncertainty that we’re seeing, it will likely continue for some more time,” said Manishi Raychaudhuri, Asia-Pacific head of equity research at BNP Paribas. “We haven’t seen the end of it.”

He expects continued volatility for global markets going forward for at least one or two quarters.

On Monday, the S&P 500 ended slightly higher as the deal for Silicon Valley Bank’s assets helped to boost bank shares, while technology-related stocks dipped amid profit taking after a strong quarter.

Oil Prices Boosted

US Treasury yields rose on optimism that stress in the banking sector could be contained and as the Treasury Department saw soft demand for a sale of two-year notes.

Benchmark 10-year yields rose to 3.5317%, up from its US close of 3.528% on Monday. They are also up from a six-month low of 3.285% reached on Friday, but remain below a 15-year high of 4.338% from October 21.

Two-year yields rose to 3.957%, up from a six-month low of 3.555% on Friday but below the almost 16-year high of 5.084% hit on March 8.

On the other hand, oil prices rose more than $3 on Monday as a halt to some exports from Iraq’s Kurdistan region added to worries about oil supplies.

By Tuesday morning Hong Kong time, Brent crude futures and West Texas Intermediate US crude were both hovering around Monday’s closing levels.

Gold was slightly higher. Spot gold was traded at $1,957.96 per ounce.

Key figures

Tokyo – Nikkei 225 > UP 0.15% at 27,518.25 (close)

Hong Kong – Hang Seng Index > UP 1.11% at 19,784.65 (close)

Shanghai – Composite < DOWN 0.19% at 3,245.38 (close)

London – FTSE 100 > UP 0.37% at 7,499.28 (0935 GMT)

New York – Dow > UP 0.60% at 32,432.08 (Monday close)

- Reuters with additional editing by Sean O’Meara

Read more:

US, Japan Set to Sign Trade Deal on EV Battery Minerals

Jack Ma Returns to China in Sign of Easing Tech Crackdown