(ATF) In a big win for Amazon, the Delhi High Court on Thursday restrained the Future Group from going ahead with the $3.4 billion sale of its retail assets to Reliance Retail, following the American e-commerce giant’s challenge to the deal.

The court also upheld Amazon’s argument that the Emergency Award of the Singapore International Arbitration Centre (SIAC) should be adhered to, asked why the Future Group founder Kishore Biyani and others shouldn’t be sent to civil prison, and ordered Biyani to recall all the approvals granted for the Future Retail-Reliance deal.

Yet, while cases are being fought at various forums, the increasingly fierce legal tussle that actually embroils two of the world’s richest men – Amazon’s Jeff Bezos and Reliance’s Mukesh Ambani, could have a far reaching impact on India’s $84 billion pandemic-hit shopping sector, say experts.

“The decision of the Delhi Hugh Court with regard to the applicability of the foreign arbitration interim award in India are of course going to be far reaching [for the Indian retail sector],” Salim Waris, partner and an e-commerce law expert with TechLegis Advocates & Solicitors told Asia Times Financial.

“It is still unclear if this judgment would have an immediate direct impact on other similar deals, this is more so because of the specific legal complications were a result of the legal complexities revolving round the breach of non-compete clause in the Future Group Amazon agreement. [Still] one probable development in the long term could be that Indian dealmakers will have to be more careful about the specificities of the clauses in their contracts with international vendors,” he added.

And, a possible big impact of the tussle could be a re-negotiation of the Tata-Walmart deal as well, he said.

American retail giant Walmart Inc is reportedly negotiating with Tata Group for a potential investment of up to $25 billion in the Indian salt-to-software conglomerate’s new “super app”.

This “super app” would be a joint venture between Tata and Walmart, leveraging on the synergies between Tata’s e-commerce business and Flipkart, Walmart’s e-commerce unit, according to the report.

BLOW FOR FUTURE

That aside, the impact of the ruling that puts on hold Reliance’s acquisitions of Future Retail, agreeing with the order of the SIAC in September 2020, is going to be disastrous for Future Group as well.

Future, which carries a debt burden of $4 billion, already said that it sees no future investment as long as “Amazon is able to bully them around.”

Biyani also claims that the Group has over 50,000 employees and works with around 6,000 small-medium businesses in the country.

Blocking the deal and the consequent drought of funding would mean the inevitable insolvency of the company and the loss of livelihood.

Biyani’s lawyers also argue that the Group’s banks and other stakeholders too would stand to lose heavily if the battle goes on for too long.

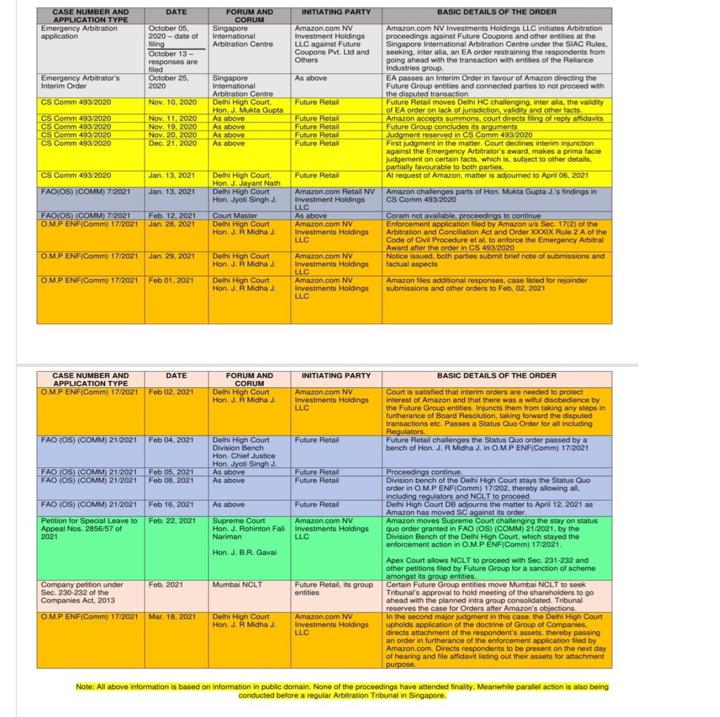

The twists and turns of the Amazon-Future deal

CONTRACT BREACHED

Amazon though says that battle is just a consequence of Future breaching a contract that gave the e-commerce giant the right of first refusal.

In 2019, Amazon had acquired a 49% stake in Future Coupons, the holding company of the Future Group, on an agreement that it would be given of the first right of refusal in any asset sell-off by Future.

The deal also specified the SIAC rules for arbitrating any disputes

In August 2020, when the Future group struck the asset sale deal with Reliance, Amazon was quick in sending legal notice to Future, alleging that the deal had breached those agreements.

Two months later Amazon bagged a stay order on the Future Retail and Reliance deal from the SIAC, and requested Indian regulators to uphold the decision.

Future also appealed to SIAC to remove Future Retail from the fight with Amazon.

And, last month, the Delhi High Court ordered maintenance of the status quo in the deal until the final verdict by the SIAC, but Future subsequently managed to obtain a stay on that too.

Amazon’s appeal against the stay order on that status quo is now pending before the country’s Supreme Court.

Still, according to some, Thursday’s order sends a positive message to all foreign investors as well, despite its complications and that it is going on for months now.

“The judgement revalidates that Indian courts respect contractual obligation and uphold the sanctity of contracts or investments dispassionately and objectively, as well as the fact that Indian courts respect foreign court or tribunal’s orders,” Vaibhav Kakkar, partner, at the Delhi-based law firm, L&L Partners, told ATF.

READ MORE

Amazon-Future tussle over Reliance Retail deal baffles analysts

Amazon-Ambani fight for Future Group is just starting, lawyers say