Asian shares edged ahead on Friday with the mood remaining upbeat as the threat of a global banking crisis continued to fade and positive data out of China boosted sentiment too.

Japan’s Nikkei share average rose – on what was the last trading day of the country’s fiscal year – posting its best week in two months, as those banking meltdown concerns easing and a weaker yen bolstered investor sentiment.

However, the benchmark ended well shy of the day’s highs as shippers tumbled for a second day after going ex-dividend. Investors were also keeping their powder dry ahead of potentially key US inflation data due later in the day.

Also on AF: Britain Becomes 12th State in Trans-Pacific Trade Pact

The Nikkei finished the day up 0.93% at 28,041.48, staying above the psychological 28,000-mark. For the week, the Nikkei rallied 2.4%, the most since January 27. It jumped 7.46% over the quarter, the best performance since the end of 2020.

The broader Topix ended 1.02% higher at 2,003.50, after topping the 2,000-mark for the first time since March 13. It has advanced 2.46% this week, also the most in two months.

The Tokyo Stock Exchange’s (TSE) banking index gained 1.19% and securities firms added 1.21%, putting them among the top performing of the Tokyo Stock Exchange’s 33 industry groups.

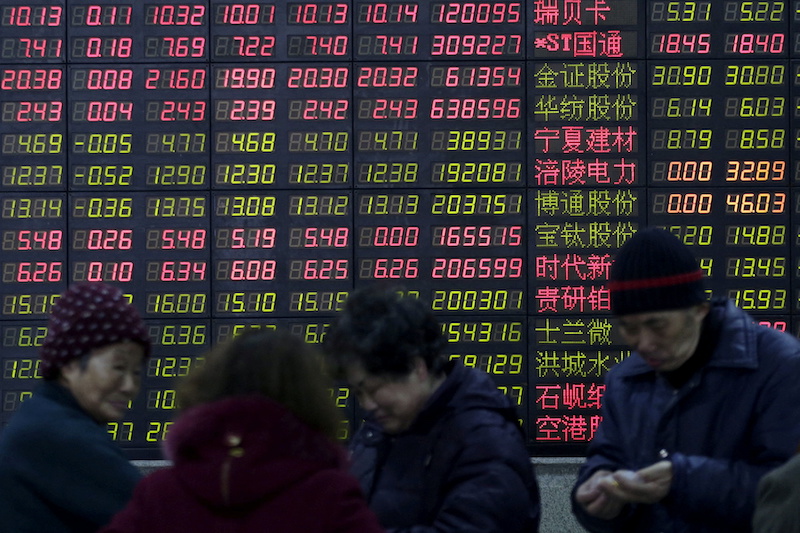

China stocks edged up and Hong Kong shares rose, even as Chinese manufacturing activity expanded at a slower pace in March, while spin-off and listing plans of some internet giants boosted sentiment.

China’s official manufacturing purchasing managers’ index (PMI) stood at 51.9, against 52.6 in February, slightly exceeding expectations of 51.5, and showing that a recovery in the services sector was gathering pace.

JD.com Share Jump

The Shanghai Composite Index rose 0.36%, or 11.61 points, to 3,272.86, while the Shenzhen Composite Index on China’s second exchange edged up 0.78%, or 16.47 points, to 2,124.76.

Tech giants listed in Hong Kong advanced 0.7%. Chinese e-commerce firm JD.com Inc jumped 7% after the company said it planned to spin off its property and industrial units and list them on the Hong Kong Stock Exchange.

And investors were still cheering a major revamp plan by Alibaba Group, taking it as a signal that Beijing’s regulatory crackdown on technology firms was ending. Alibaba’s shares jumped 3.5%, bringing its weekly gain to a whopping 17%.

Hong Kong’s Hang Seng Index gained 0.45%, or 90.98 points, to 20,400.11, and the Hang Seng China Enterprises Index was up 1.1%.

Elsewhere across the region, Sydney, Seoul, Mumbai, Singapore and Taipei were also in positive territory, though there was selling in Manila, Jakarta and Wellington.

Trump Indicted

Globally, also making headlines was Donald Trump who was indicted after a probe into hush money paid to porn star Stormy Daniels, becoming the first former US president to face criminal charges even as he makes another run for the White House.

The buoyant mood in the US and Asia is likely to run into resistance in Europe, though, with caution setting in ahead of the euro zone inflation data. The pan-region Euro Stoxx 50 futures was flat, while S&P 500 futures eked out a gain of 0.2%.

On Thursday, Wall Street was boosted by gains in technology-related shares, although regional bank shares fell after Treasury Secretary Janet Yellen said banking regulation and supervisory rules need to be re-examined.

The Dow Jones rose 0.4%, the S&P 500 gained 0.6% and the Nasdaq Composite added 0.7%.

Markets are shifting their focus back to inflation and the outlook for interest rate hikes on hopes that the recent bank turmoil has been largely contained.

US Dollar Facing Monthly Drop

However, there is still an expectation that banks will tighten lending following troubles at US regional banks and the Credit Suisse takeover, so central banks do not have to hike more.

Overnight, three Fed officials kept the door open to more rate rises, although two of them noted that banking sector problems could generate enough headwinds on the economy to help cool price pressures faster than expected.

Moves in foreign exchange markets were muted on Friday, but the US dollar is on course for a 2.7% monthly drop against six of its peers.

Oil prices seesawed on Friday, and were down more than 3% for the month. US crude futures were flat at $74.40 per barrel, while Brent crude futures slipped 0.1% to $78.52 per barrel.

Gold hovered around the highest since April last year, up more than 8% for the month to $1,980.20 per ounce.

Key figures

Tokyo – Nikkei 225 > UP 0.93% at 28,041.48 (close)

Hong Kong – Hang Seng Index > UP 0.45% at 20,400.11 (close)

Shanghai – Composite > UP 0.36% at 3,272.86 (close)

London – FTSE 100 > UP 0.11% at 7,628.82 (0937 GMT)

New York – Dow > UP 0.43% at 32,859.03 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Factory Growth Slows in China, Clouding Recovery Prospects

China’s Big 5 Banks Warn on Recovery Despite Healthy Profits

China’s Top Developer Hit by 90% Plunge in Core Profit