Patchy rains in India’s grain belt, a heatwave in China, floods in Bangladesh and quality downgrades in Vietnam threaten rice output in four of the world’s top five producers and a price spike that may stoke food inflation that already is near record highs.

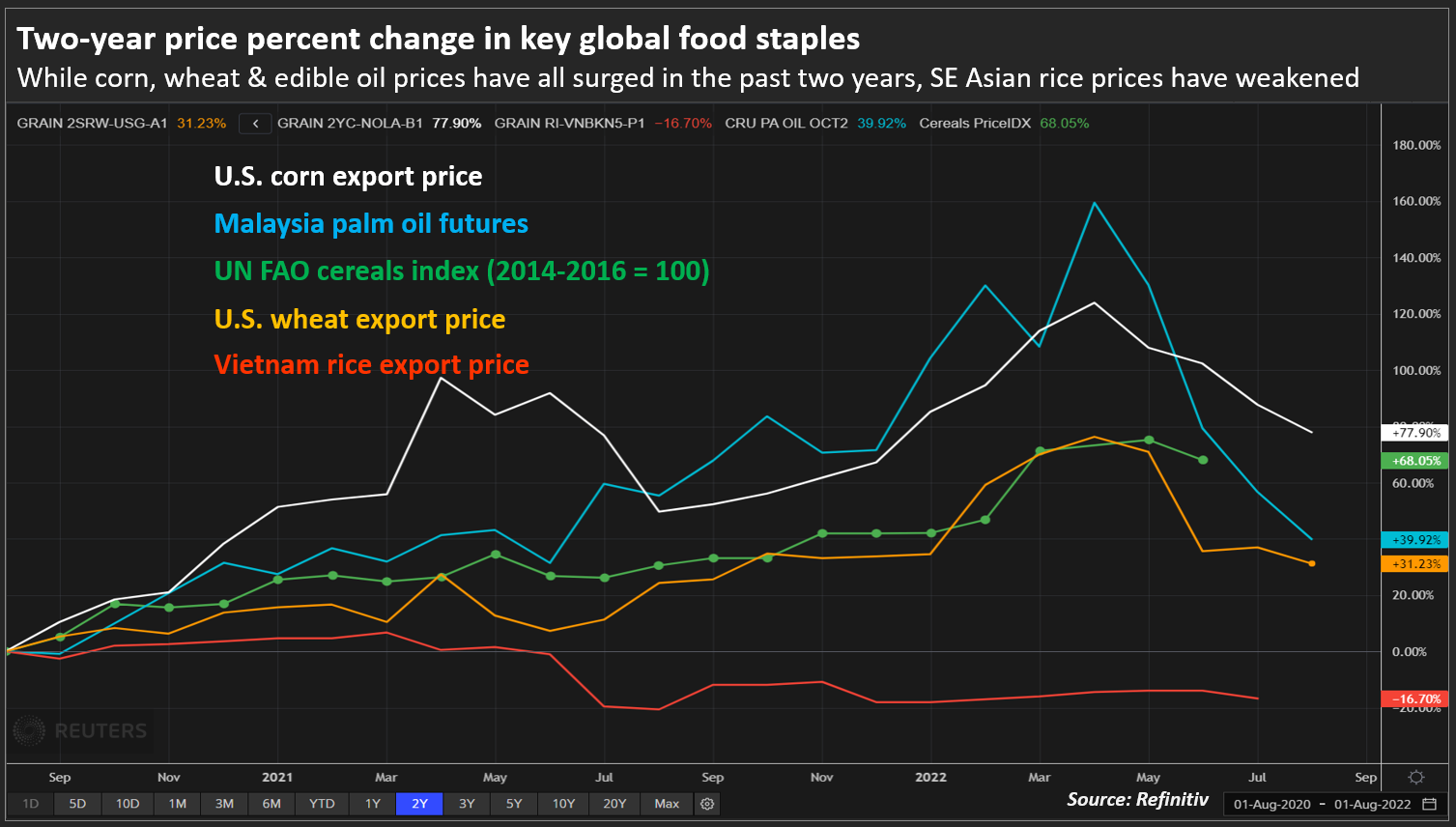

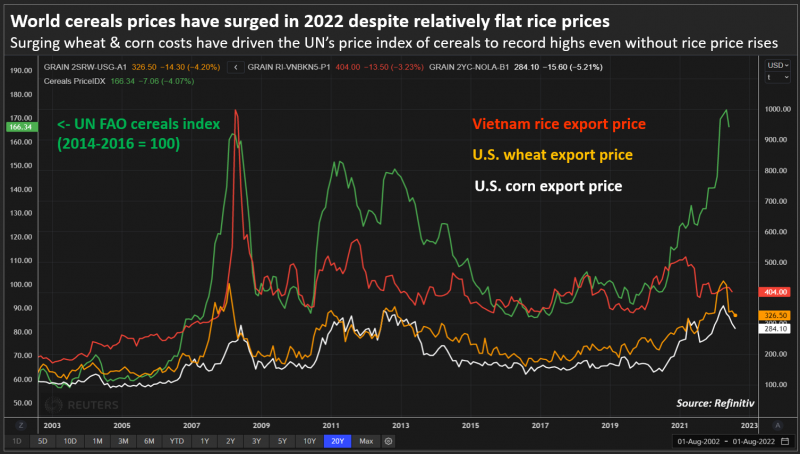

Bumper crops and large inventories held by major exporters had previously helped rice, the world’s most important food staple, avoid the trend of higher food prices in recent years, despite supply disruptions from Russia’s war in Ukraine that sent food inflation to record levels.

But the effects of adverse weather are now triggering concerns that rice prices may also shoot higher.

“There is an upside potential for rice prices with the possibility of production downgrades in key exporting countries,” said Phin Ziebell, an agribusiness economist at National Australia Bank. “An increase in rice prices would add to already major challenges for food affordability in parts of the developing world,” Ziebell said.

‘Production Drop is Certain’

India’s top rice-producing states of Bihar, Jharkhand, West Bengal and Uttar Pradesh have recorded a monsoon rainfall deficit of as much as 45% so far this season, data from the state-run weather department shows.

That has in part led to a 13% drop in rice planting this year, which could result in production falling by 10 million tonnes or around 8% from last year, BV Krishna Rao, president of the All India Rice Exporters Association, said.

The area under rice cultivation is down also because some farmers shifted to pulses and oilseeds, Rao said.

India’s summer-sown rice accounts for more than 85% of its annual production, which jumped to a record 129.66 million tonnes in the crop year to June 2022.

“A production drop is certain, but the big question is how the government will react,” a Mumbai-based dealer with a global trading firm said.

Milled and paddy rice stocks in India as of July 1 totalled 55 million tonnes, versus the target of 13.54 million tonnes.

That has kept rice prices down in the past year together with India’s record 21.5 million tonnes shipment in 2021, which was more than the total shipped by the world’s next four biggest exporters – Thailand, Vietnam, Pakistan and the United States.

“But the government is hyper-sensitive about prices. A small rise could prompt it to impose export curbs,” the trader said.

Meanwhile, rains during harvest have damaged grain quality in Vietnam.

“Never before have I seen it rain that much during harvest. It’s just abnormal,” Tran Cong Dang, a 50-year-old farmer based in the Mekong Delta province of Bac Lieu, said.

“In just 10 days, the total measured rain is somewhat equal to the whole of the previous month,” said Dang, who estimated a 70% output loss on his 2-hectare paddy field due to floods.

ALSO SEE: Russia-Ukraine War Causes ‘Once in a Generation’ Food Crisis

Imports, Prices

China, the world’s biggest rice consumer and importer, has suffered yield losses from extreme heat in grain growing areas and is expected to lift imports to a record 6 million tonnes in 2022/23, according to the US Department of Agriculture.

China imported 5.9 million tonnes a year ago.

And the world’s third-biggest consumer, Bangladesh, is also expected to import more rice following flood-damage in its main producing regions, traders said.

The full extent of shortfalls in countries other than India has yet to be estimated by analysts or government agencies that often only publish output data later in the year.

But the impact of unfriendly crop weather can already be seen in the slight rise in export prices from India and Thailand this week.

“Rice prices are already close to the bottom and we see the market rising from current levels,” a Singapore-based trader at one of the world’s biggest rice merchants, said.

“The demand is picking up with buyers such as the Philippines and others in Africa looking to book cargoes.”

Reuters

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Cities Issue Red Alerts as Heatwave Scorches Nation

China Faces Economic Hit From Extreme Weather in July, August