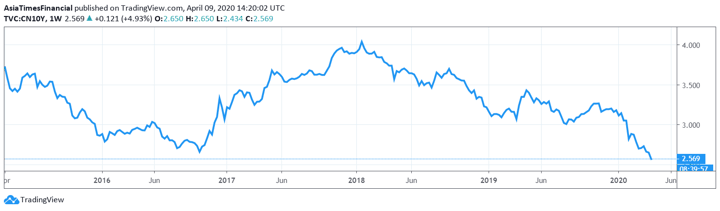

(ATF) The yield level of China Bond 10-year treasury bonds fell below 2.5% yesterday. The last time this level was reached was in 2002. The three main treasury bond futures all hit a new historical closing high yesterday.

The industry believes the expectation of policy easing is the core logic of the current ‘bond bull market.’

The 10-year treasury yield has always been regarded as the pricing centre for medium and long-term funds, Sina Finance reported.

Earlier this year, the yield on the 10-year treasury bond remained at around 3%. Since then, the central bank has sharply cut RRR and the reduction of open market operating interest rates.

The yield on the active 10-year treasury note 19015 has fallen to 2.4675% from 2.4824%.

“This is not only a response to the policy operation of the central bank’s targeted RRR cut and reduction of the excess deposit reserve interest rate last Friday, but also a reflection of further expectations of ensuring loose liquidity slack,” said Tang Jianwei, chief analyst at Bank of Communications Financial Research Centre.

As the lower limit of the “interest rate corridor”, the excess reserve interest rate was lowered from 0.99% to 0.72% during the 2008 global financial crisis. This week, the excess reserve interest rate has been significantly reduced from 0.72% to 0.35%, which not only helps commercial banks improve the efficiency of capital use, but also gradually reduces the “interest rate corridor” track and guides the money market to lower the content of money.

A person from a financial institution anonymously told Sina that after lowering the lower limit of the “interest rate corridor” to the level of demand deposit interest rates, there is not much room for the future, but there is a signal that the “interest rate corridor” is opening downward.

Record highs

Affected by this, treasury bond futures have soared since the beginning of this week and hit record highs.

Yesterday, the soaring treasury bond futures rose again late in the day, and the two-year, five-year and ten-year varieties all hit record highs.

Li Mingyu, head of the macro and financial group at the New Lake Futures Research Institute, said the late performance of the three major debt varieties yesterday may have been affected by relaxed expectations.

According to Sina, there are rumours in the market that banks have lowered the institutions’ demand deposit settlement rate, which is also considered by the market as a signal to further reduce costs. Secondly, the interest rate on the interbank certificate of deposit market continued to fall, and the number of interbank certificates of deposit in the first-tier market declined by 10 basis points from Tuesday. At the same time, the market believes that the recent inflation data is slowing down, and the expectation of lowering deposit interest rates is rising.

Amid multiple factors, national bond futures rose collectively yesterday, and the three major contracts all hit record highs.

Tang Jianwei believes that it is expected with “a high probability” that the 1-year MLF operating rate will be lowered by 10 to 20 basis points. The time for the interest rate cut may be when the MLF of 200 billion yuan expires on April 17, which would lead to the same frequency of the April 20 LPR quote rate decline.

‘Bull curve’ pattern

Qi Sheng, chief analyst of Founder Securities’ solid income, said the expected reduction in the cost of bank debt stacking up the time window on the demand side has not yet recovered, and that is conducive to a stronger bond market. It is currently a typical bond “bull curve” pattern.

The so-called “bull curve” refers to the steepening phenomenon in the overall downward shift of bond yield curve. In this pattern, short-term and medium-term varieties tend to perform better than long-end varieties.

Li Mingyu said the performance of the two-year and five-year varieties this week was significantly stronger than that of the ten-year varieties, which was mainly related to the reduction of the excess deposit reserve interest rate last Friday. Since the beginning of this year, the liquidity of the banking system has been ample, and the bank ‘s overnight repurchase rate has continued to fall, once down to around 0.8%, which is only one step away from the 0.72% excess deposit reserve rate before adjustment. Previously, the lower limit of 0.72% had limited the space for the repo rate to continue to fall.

The reduction of the excess deposit reserve interest rate to 0.35% means that the lower limit of the interest rate in the money market will be opened again. First of all, it will benefit the continued decline in the yield of short- and medium-term bonds. The yield curve of the short-term bond market will continue to show a “bull curve” trend, and the favourable reduction of the excess reserve rate in the later period will continue to be transmitted to the medium and long end. The yield curve may change from “bull curve” to “bull flat.”