(ATF) Chinese bonds delivered losses to investors Wednesday after economic data showed inflationary pressures had increased.

Corporate and financial companies led declines for a second day on the the ATF China Bond 50 Index of AAA rated Chinese non-sovereign debt. The privately issued securities tracked declines on sovereign bonds as global investors took stock of poor sales yesterday of the year’s first green bond issuance and a slump in convertible notes.

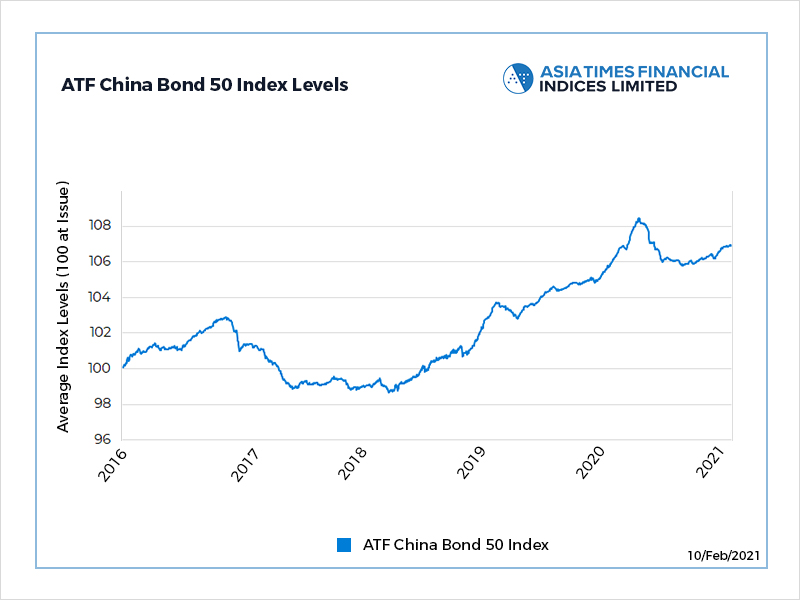

The CB50, which gauges returns on China’s most liquid corporate and local government bonds, fell 0.02% for a second day to 106.90. It fell from a six-month high yesterday. China has the second-largest bond market in the world, and while corporate debt accounts for an estimated 1% of it, that still equates to about $40 billion of securities.

Chinese credits have been rallying since the autumn on growing evidence that the Chinese economy is strengthening, the only major economy in the world to do so. They’ve also been boosted by government measures to increase foreign participation in China’s capital markets.

The CB50 fell today after rising commodity costs drove up producer price inflation to 0.3% in January, the first gain in a year, according to data from the National Bureau of Statistics. Consumer prices fell 0.3%.

Bonds usually fall when inflation rises because the higher cost of living tends to erode the value of the fixed payments on the securities.

Corporate bonds, which have been trading at a notional loss on the sub-index since 2017, also fell 0.02%, as did the Enterprise sub-gauge. Financials fell 0.01%.