(ATF) – With the inflow of funds seeking a safe haven, bond yields in China have fallen sharply. China’s 10-year government bond yield is currently around 2.52% – a record low that brought back memories of when the SARS outbreak occurred.

Meanwhile, the yields on US Treasury bonds are hitting historic records – less than 1% across the board for the first time, Caijing news reports.

As the markets near a 7-year low on bond yields traders are quite limited in what they can take. Jing Hui, deputy director of the Nordic Fund’s fixed income department, said that in large-scale asset allocation, you can still pay attention to the safe-haven value of the bond market and the relative returns of the top real-estate company bonds. You can also actively participate in the long-term interest rate debt operation.

Credit spreads and term spreads have been compressed to low levels, and average bond yields have also been at a nearly 7-year low. Bond fund managers have told ChinaFund News that “they have no way to start, and they cannot find a suitable bond allocation for new funds to purchase”.

READ MORE: Foreign investors pouring money into China bonds

The ChinaFund report said multiple bond funds have suspended large purchases, as central banks of various countries have adopted a monetary policy to cut interest rates and lower standards to inject liquidity into financial markets. The bond market, a traditional safe haven for capital, once again has a bull market atmosphere.

US Treasury yields have fallen rapidly. The lowest 10-year Treasury yield has hit a record low of 0.35%. The 30-year Treasury yield also fell below the historical low of 0.8%.

The price of open-ended bonds rose wildly in China. ChinaFund said many bond funds have begun to refuse large purchases. Dongcai choice data shows that since March, nearly 60 bond funds have announced the suspension of large-scale subscription announcements. There were also as many as 48 bond funds with large subscriptions suspended in February.

Large purchases suspended

ChubaFund said the Peng Huazhong Bond, a one-to-three-year China Development Bank bond index fund, announced that from March 16, on a single day, the cumulative purchase, conversion and transfer of a single fund’s account will be set at 1 million yuan. Similarly, Tianhong Tianli Bond Fund also announced that it will suspend applications for a single purchase of more than 10 million yuan.

-

![]()

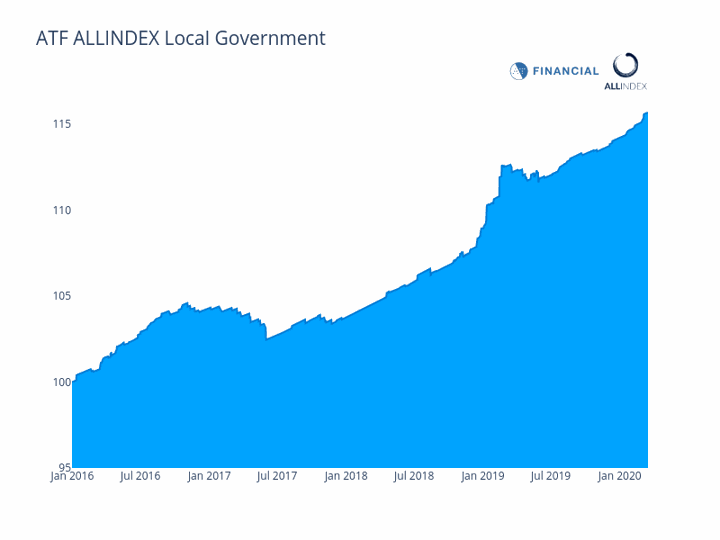

Returns on the ATF AllIndex Local Government Index climbed 0.03% on Monday, the most in a week.

Since the beginning of this year, many bond funds have suspended large-scale purchases. For example, Ping An Medium and Short-term Bond Fund suspended large-scale purchases of more than 10 million yuan on January 8, and reduced the large-scale purchase cap to 5 million yuan on February 13. On February 27, the fund further reduced the subscription amount of A and E fund shares to 10,000 yuan. However, more than 10 Internet sales channels such as Tiantian Fund, Ant Fund, and Lufax are not subject to the above restrictions. Only one day later, on February 28, Ping An’s short- and medium-term debt was re-announced to cancel the channels that were not previously restricted by large purchases.

Wells Fargo Industrial Bond Fund also ordered the suspension of two large-scale purchase announcements in January and February respectively, while the maximum purchase limit for Class A shares was lowered from 10 million yuan to 2 million yuan.

Fund managers are finding it increasingly difficult to allocate resources.

‘Sweet troubles’

On one hand, the price of holding bonds has risen, and the fund’s net value has also gone up. On the other hand, bond yields have been at a low level for nearly seven years, and new funds have faced the problem of opening positions. Bond fund managers are now beset by “sweet troubles,” Caijing says

A bond fund manager who asked to remain anonymous reported that from recent observations, “the recent suspension of large-scale purchases by multiple bond funds is not a large amount of funds flowing into bond funds. Instead, the fund manager believes that currently there are no cost-effective bonds in the bond market.”

“Now both the credit spread and the term spread are very narrow. Except for ultra-long-term national bonds with a term of more than 30 years, there are also term spreads. It was sold to a very low position in the market. If there is a large amount of funds entering at this time, the fund manager cannot find a suitable bond to match, it will also lead to a decrease in the efficiency of fund use,” the bond fund manager explained.

- READ MORE: West Air bonds go into ‘death spiral’

The bond fund manager was also worried that the current yield of the pure bond market is relatively low and presents a certain “asset shortage” situation. It may be difficult to fully meet the returns that investors hope for in the future.

Another Shanghai-based bond fund manager, who also wanted to stay anonymous, expressed a similar view. “Most of the original portfolios of bond funds are credit bond types, but recently the credit spread on the bond market has been compressed too much, and the liquidity of credit bonds is not good. It is difficult to buy funds to buy credit bonds. Funds can only buy interest rate bonds, and the yield on interest rate bonds of the same maturity is generally lower than that of credit bonds, which will lower the yield of the entire fund portfolio.

“Recently, the yield of the bond market has fallen too quickly. If new funds continue to enter the bond foundation to dilute the income of the original holders, and the bond fund holders represent a high proportion of institutions – in this case, institutional customers in general – there will be a request to suspend large purchases,” a general manager of the fund company’s institutional department said.

Falling yields

He said that the bond fund of the company he represents has not restricted large-scale purchases at present because institutional clients in the bond fund are relatively scattered. Although there will be some institutional pressure, yields continue to fall, and the possibility of purchase restrictions cannot be ruled out in the future.

Overall the current bond market was hit by downgrade expectations on the afternoon of Friday March 13, when the central bank issued a notice and decided to reduce the quota on March 16, 2020, and released 500 billion yuan of long-term funds.

So, how can investors deal with asset shortages?

A Shanghai-based bond fund manager said that in the near future, large funds in the market can only buy interest rate bonds if they reduce their income expectations.

“At this point in time, the first effort is to do a good job of liquidity management. Offensively, you can only rely on convertible bonds and long-term interest rate bonds. But whether you can do a good job of these two investments depends mainly on the fund manager’s ability and connection,” Shanghai-based bond fund manager said.

Looking ahead – according to market trends, a bond fund manager said that in the future, in the context of orderly management of the bond market, credit bond defaults will continue but the risks are controllable. Given the epidemic, future credit bond investments need to be screened, and investments must not be too aggressive. He was also optimistic about the investment opportunities of interest rate bonds in the first half of the year, but also said that if there is economic recovery, players in the interest rate bond market in the second half of the year will need to pay attention to the risk of retreat.

“At present, under the control of credit default risks, we can only find some ‘corner-to-corner’ investment opportunities. For example, although some ABS products have poor liquidity, the returns are still cost-effective,” the general manager of the fund company’s institutional department said.