(ATF) China is studying the feasibility of allowing citizens to invest in overseas securities and insurance policies with an annual individual limit of $50,000, an official from China’s foreign exchange authority said. Analysts say the move would help cool the excessive rise of the yuan.

China’s State Administration of Foreign Exchange (SAFE) is mulling relaxing capital control measures for individuals, Ye Haisheng, director of SAFE’s capital account management department, said in an article published by the government-sponsored China Forex Magazine last Friday.

The forex authority will also consider amending rules to allow Chinese citizens to participate in stock incentive plans by companies listed overseas and lift the annual currency conversion cap for individuals, Ye said.

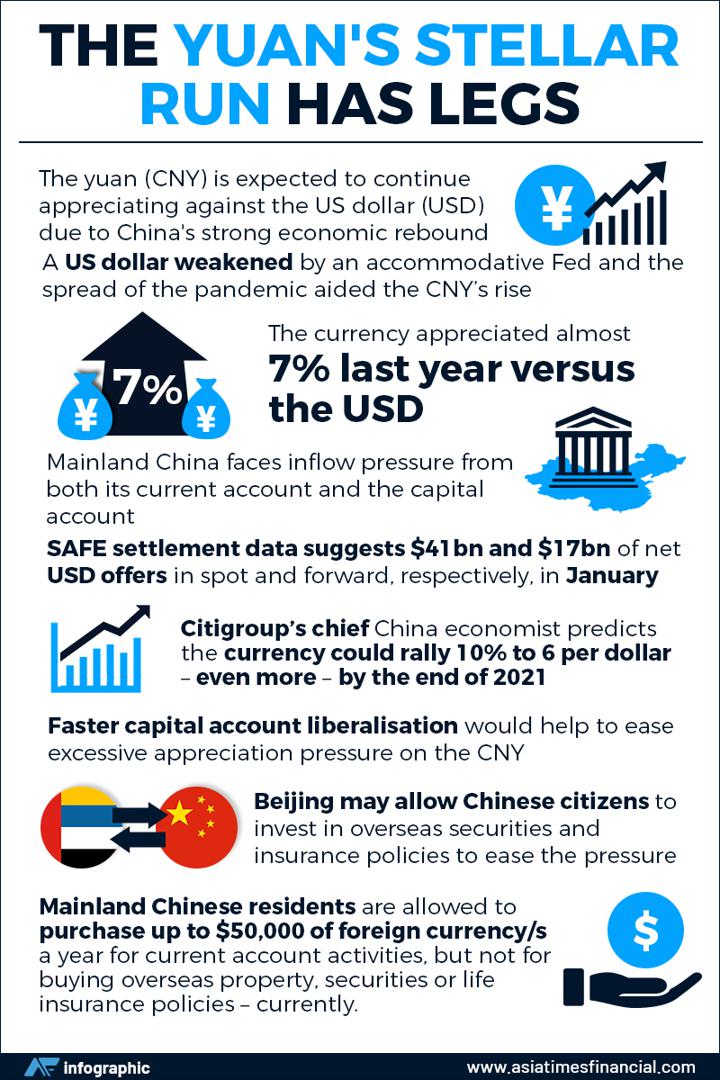

Currently, mainland Chinese residents are allowed to purchase up to $50,000 worth of foreign currencies a year for travel, overseas study or work. But they are not permitted to transfer assets overseas to buy property, securities or life insurance policies.

There are several schemes that allow cross-border investment by individuals, such as Qualified Domestic Institutional Investor (QDII), Stock Connect and Bond Connect, but an investor must hold an aggregate balance of not less than 500,000 yuan ($77,400) to be eligible.

Another cross-border investment scheme is Wealth Management Connect, which is in pilot phase and allows retail investors living in the Guangdong-Hong Kong-Macao Greater Bay Area to purchase wealth management products abroad.

Analysts expect transactions under Wealth Management Connect to be able to circumvent the $50,000 currency exchange limit, but be subject to aggregate and individual investor quotas.

SAFE will work with the central bank to support the Wealth Management Connect pilot, Ye noted.

‘Liberalisation of outbound capital flow’

Though most of the measures are still in a research phase, SAFE’s policy direction is clear – to liberalize outbound flow of capital, analysts from HSBC said.

“Mainland China currently faces inflow pressure from both the current account and the capital account… Faster capital account liberalisation would help to ease excessive appreciation pressure on the renminbi,” they said.

SAFE settlement data show $41 billion and $17 billion of net dollar offers in spot and forward respectively in January. These have moderated from $67 billion and $17 billion, recorded respectively in December, but are still above the average levels seen in recent years.

“While these inflows could shrink eventually on weaker terms of trade, narrower mainland China-US yield differential (at the long end) and normalization of outbound tourism, they are expected to be large in 1H,” HSBC said.

Given the Covid-19 pandemic has made it almost impossible for Chinese to travel overseas and shop, the possible easing of capital account restrictions could provide new ways to make foreign currency purchases.

Driven by China’s strong post-coronavirus recovery and greater financial opening up, retail investors from the Chinese mainland are already on a shopping spree for stocks offshore through the ‘southbound’ leg of the Stock Connect trading scheme.

Data released by SAFE showed that mainland investors bought $40.1 billion in shares through Stock Connect last month, cashing in on the government’s relaxation of outflows.

The data did not include previous monthly figures but it is more than one-tenth of the 2.13 trillion yuan ($328 billion) of Hong Kong-bound investment reported in the six years of the scheme.

This was in line with data from the Hong Kong Stock Exchange that indicated a sharp rise in Hong Kong-bound purchases from $60.2 billion (US$7.7 billion) in December to $310.6 billion in January.

China’s quick economic recovery from the coronavirus pandemic sent the yuan soaring in the second half of 2020, causing it to bounce back to a level not seen since before the US-China trade war started in July 2018.

As of Wednesday, China’s central bank set the yuan’s midpoint price at 6.4615 per dollar, almost level with the rate in June 2018 and 8% stronger than in July last year.