(ATF) On Sunday, Sept 13, Nvidia issued a statement to say it would spend $40 billion to acquire UK microchip designer ARM – the largest acquisition in the history of the chip industry.

According to the agreement, Nvidia will pay $21.5 billion worth of its shares and $12 billion in cash for the British company, including $2 billion paid immediately upon signing of the contract.

The two companies said in a joint statement that SoftBank may also receive an additional $5 billion in cash or stock. And if ARM’s future performance reaches a specific target, $1.5 billion worth of Nvidia stock that will be paid to ARM employees. With this acquisition, SoftBank’s stock price rose its highest in nearly six months, China Finance reported.

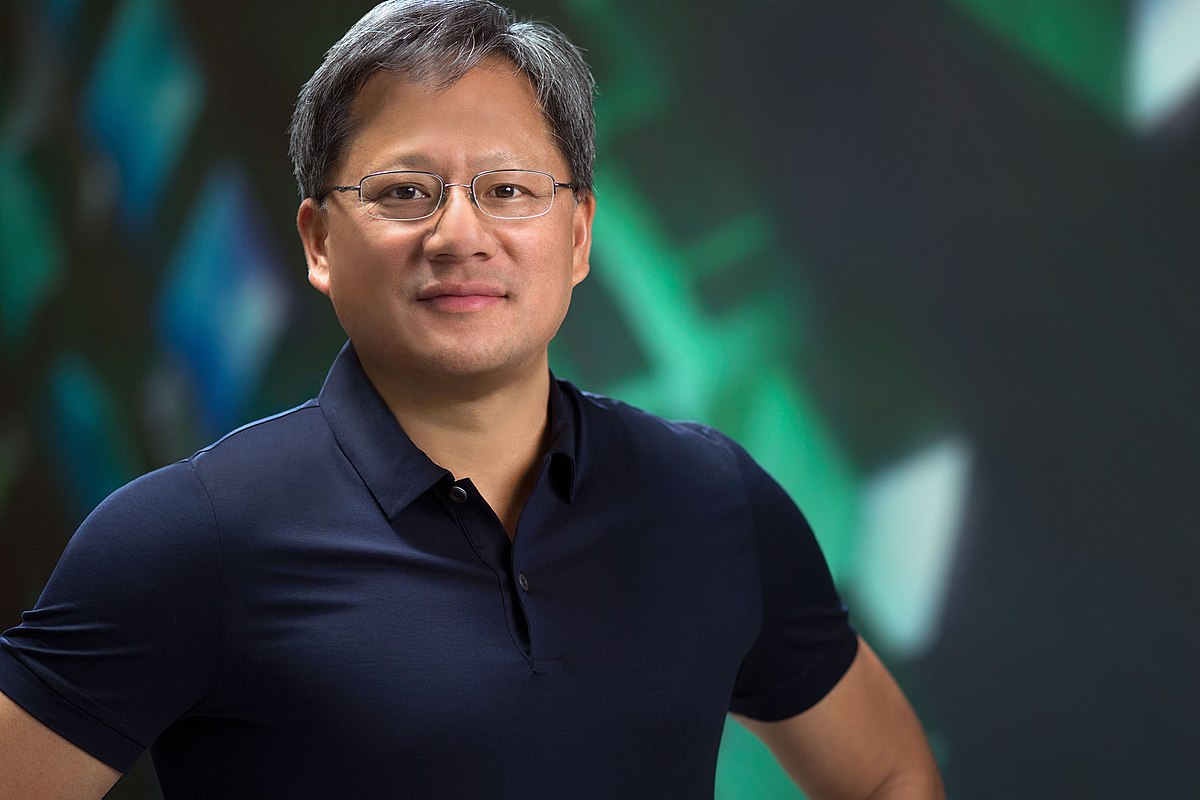

Nvidia was founded in 1993 by 30-year-old Huang Renxun and two other partners. In 1997 Nvidia launched the third-generation product Riva 128. At the end of 1999, Huang Renxun unexpectedly launched a new architecture display chip, namely GeForce256, which took the lead in bringing the display chip industry into the GPU era. It is now the number one chip manufacturer in the United States by market value.

Nvidia’s conspiracy and British concerns

China Finance reported that the acquisition may damage Britain’s “technical sovereignty”. At present, ARM says that it has nearly 90% of the mobile processor market, and a relatively advantageous share in the field of autonomous vehicles. If Nvidia acquires ARM, it would be equivalent to handing over relevant intellectual property rights to a US company, and this may plunge ARM into the increasingly fierce “technical conflict” between China and the United States.

British Prime Minister Boris Johnson has the right to stop this transaction. Although the United Kingdom lacks an institution equivalent to the Committee on Foreign Investment in the United States (CFIUS) to “gate” the acquisition of domestic assets by overseas buyers, relevant laws in the United Kingdom actually allow the government to intervene in transactions that may threaten “national security”.

In order to dispel Britain’s concerns, Nvidia specifically talked about its commitment to Britain. Huang Renxun said: “ARM’s headquarters will continue to be located in Cambridge. We will expand and build world-class AI research facilities in this excellent place to support healthcare, life sciences, robotics, autonomous vehicles and other fields of development. And, in order to attract researchers and scientists from the UK and around the world for groundbreaking work, Nvidia will build the most advanced AI supercomputer powered by ARM CPU.”

China has no worries

Commenting on the sale an official Chinese blogger called “military state” on the government backed Baidu.com said: “Due to the increasing number of Chinese Internet users and the huge population of China, technology companies that can stand out in the Chinese market have strong technical support. China’s 5G technology has also developed to the forefront of the world. Sanctions continue, but none of them can completely defeat Huawei’s leading position in the 5G field.” The blog also claimed that ZTE already leads in 6G development.

According to ZTE’s understanding of 6G, it will provide more technical support in more areas that 5G. 6G is being developed for use in space and deepsea areas.

ARM – a potted history

The Chinese paper reported that ARM, which was founded in Cambridge in 1991, is known as the “overlord” of chips, although it does not produce chips. Global shipments of ARM-based chips have reached $138 billion and 95% of the world’s mobile phones and tablets use ARM technology. Almost all major companies, including Apple, Samsung, Qualcomm, and MediaTek, have inseparable business cooperation with ARM.

ARM itself is a supplier of chip architecture, and its main business is to continuously develop new technologies, then license these to major chip giants around the world for patent fees.

In the 1980s, Britain’s Ministry of Industry decided to vigorously develop computer education, and this plan was very ambitious. The winning bidder’s computer products would enter every classroom in the UK. The god of luck favoured a company called ACORN, responsible for the production of BBC-branded computers.

At first, ACORN planned to use Motorola’s chips, but Motorola’s chips were too expensive and too slow. They then turned to Intel, hoping to get the 286 chip authorisation. But Intel was not interested, and flatly rejected their request for cooperation. That left ACORN with the only option of independent research and development.

In 1990, Apple wanted to build the world’s first handheld computer and set its sights on low-cost, low-power ACORN chips. Apple invested 1.5 million pounds to acquire 42% of ACORN’s shares. ACORN was then merged with another chip manufacturer and was renamed as ARM.

In a later downturn, Apple survived by selling ARM stock.

After completing the reorganisation, they also changed their previous business model and decided not to produce chips. After all, the investment in producing chips is high and the risks also significant high. So ARM decided to transfer their designs to other chip companies.

The real rise of ARM was its cooperation with Nokia. Nokia used the ARM framework chip on its mobile phone 6110.

In 2007, Apple’s iPhone went on the market, and adopted a chip designed by Samsung based on the ARM framework. In 2008, the Android system launched by Google was also based on the ARM framework. In 2008, ARM’s annual shipments reached 10 billion, becoming the out-and-out mobile Internet hegemon.

In 2011, Microsoft announced that the next version of Windows would support ARM processors, which marked a break in the Microsoft Wintel combination.

SoftBank acquired ARM in 2016 for $32 billion. After four years it has made a healthy return, which the likelihood of more to come.