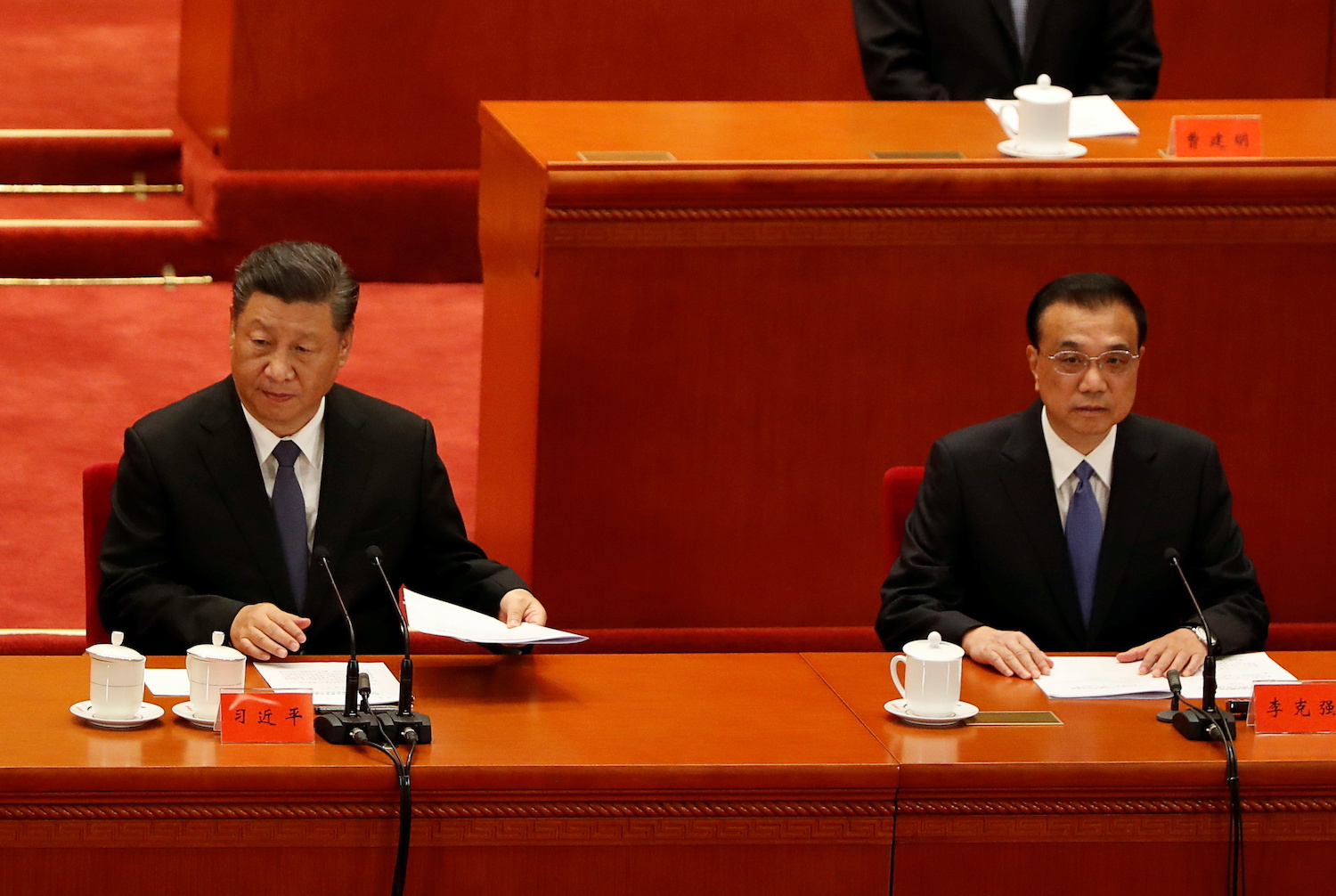

(ATF) China has a long history of companies and individuals keen to avoid paying tax – if possible – during its many years of economic reform. But President Xi is leading a push to replenish state finances by getting private businesses to pay a greater share of the country’s huge social costs.

Taxes are mostly paid by State-Owned Enterprises (SOEs), foreign enterprises and employees, and some private enterprises. Stamp duty on house sales is also a big earner for the tax bureau.

Up to October this year (2020), the number of registered general taxpayers rose from 10.25 million to 11.1 million, mostly after the economic upheaval caused by the coronavirus pandemic in the first quarter, with an average monthly increase of 105,000, basically reaching a similar level to the same period last year.

But, out of a population of 1.4 billion, that is not a high number.

That is why Chinese President Xi Jinping has, since last last month, been emphasizing the need to “vigorously strengthen ideological and moral construction”, saying: “Lei Feng, Guo Mingyi, and Luo Yang possess the energy of faith, the heart of great love, the spirit of selflessness, and the spirit of enterprising spirit, which are the best portrayal of our national spirit. They are all of us…”

The names hark back to old political sloganeering, but the most interesting is Guo Ming, an ancient private businessman famous for philanthropic deeds. Put simply, the private sector is being urged to model itself on Guo Ming in 2021 and to start shouldering some of China’s huge social responsibilities.

To get rich is glorious, but one must pay taxes.

All workers must pay

The strategy, as outlined in the Peoples’ Daily, is to get the general populace paying taxes first. For those in traditional work units, the changes are minimal but significant. Those in the private sector will now become much more aware of the issue. Officials will communicate with taxpayers mostly via mobile apps. This move aims to increase funds raised from private businesses.

As we approach the end of the year, personal income tax declarations has become a hot topic in China. Significantly, home loans and rents will not be tax deductible.

For most of 2020 there were tax holidays for firms and individuals, due to the tsunami of traumas – the epidemic, huge and historic floods, the global slowdown, and now power shortages.

The State Administration of Taxation has further simplified and optimized methods for withholding and prepaying personal income tax for some taxpayers. What do these new methods of withholding and prepaying mean? How should the withholding agent operate? What are the ways to confirm information about special additional deductions?

Zhang Yi, an employee at an advertising company in Taiyuan in Shanxi province, said: “In the past, even if only one or two months of salary income exceeded 5,000 yuan in a year, tax deductions were possible. My monthly salary income was different. If the total salary income in a year did not exceed 60,000 yuan, I had to apply for a tax refund at the end of the year. The new method is more convenient and more user-friendly.”

Starting from January 1, 2021, for eligible taxpayers, no withholding and prepayment of personal income tax will be possible in the months before their cumulative income reaches 60,000 yuan. If their cumulative income exceeds 60,000 yuan in the current month and subsequent months of the year, their personal income tax will be withheld and prepaid.

Bonuses no longer exempt

Traditionally, Chinese workers get a ’13th’ monthly salary as a bonus at Chinese New Year, but this will be included in tax assessments now.

Why adopt new methods? The taxation department found that in actual operations some taxpayers who regularly receive their wages from one place have an annual income of less than 60,000 yuan (US$9,154) and do not need to pay taxes during the year. However, some workers’ income fluctuates greatly from month to month. Months of pay can be withheld or paid in advance. When the general ledger is settled at the end of the year, these people have no more than 60,000 yuan in their annual income, and they have to apply for a tax refund. But those earning over 60,000, will, of course, have to pay tax.

In the near future, individual taxpayers will also be anxious to confirm and modify the special additional deduction information before the end of the year. Taxpayers are required to confirm special additional deductions for 2021 before December 31 this year in order to enjoy a policy dividend.

Lan Min, director of the Personal Income Tax Division at Shanghai Municipal Taxation Bureau, which is part of the State Administration of Taxation, said there are several situations where additional deduction information needs to be modified: basic details on children and the elderly need to be modified, with deductions for children’s education and support for the elderly in the coming year.

From 2021, the special deduction for housing loan interest will no longer apply. Rent and housing loans need to be replaced by deductions – as housing rent will not be declared, while home loan interest will be declared instead of “loans” per se.

Personal income tax app

Zhang Bin, vice president of the University of the Chinese Academy of Social Sciences, believes the tax department makes full use of new technologies, such as mobile internet and online payment to provide a variety of convenient and fast tax payment service channels, especially through a “personal income tax” app to provide taxpayers with information about prepayment, getting tax refunds online and supplementary services – greatly reducing the cost of tax compliance.

From March 1 to June 30 this year, the majority of individual taxpayers across the country conducted annual tax calculations through mobile phones and other means.

This has been a vivid education course about the legal payment of tax, allowing everyone to understand taxation and strengthen tax law awareness.

Yang Zhiyong, deputy dean of the Institute of Financial Strategy at the Chinese Academy of Social Sciences, believes that personal income tax is an important part of the country’s direct tax system.

Participating in the annual tax calculation has further enhanced taxpayers’ taxation awareness and laid a good foundation for further improvement of the direct tax system in the future, he said.