(ATF) The People’s Bank of China (PBoC) set central parity of the yuan (CNY) with the US dollar at 6.9405 this Friday morning, the strongest level since March 10. The CNY is allowed to trade in a +/- 2% band around that figure, which has been stronger than 7.0000 to the US dollar since July 28.

Is the PBoC’s judgement on the strength of the currency justified?

First, a brief explanation on central parity. While the daily rate is based on polling of ten banks similar to daily Libor, the PBoC has quite a bit of discretion in setting the actual rate.

The last time it exercised that was at about this time of year, in August 2015. On August 10, central parity was set at 6.1162. On August 11 at 6.2298. On August 12 at 6.3306. On August 13 at 6.4010. Then stability returned. The PBoC had in fact engineered a one-off devaluation of the CNY. The current rules on parity fixing were announced shortly thereafter.

In light of this, let’s ask again if the ongoing parity appreciation is justified.

The short answer is yes.

Currency strategists make exchange rate forecasts on the basis of several currency fundamentals, notably the current account balance, interest rate differentials, portfolio flows and debt ratios.

When political and natural event risk intervenes, of course, forecasts based on fundamentals can go horribly wrong.

But let’s check on the fundamentals first.

In each and every one of those categories, China beats the US and – given the vast Chinese outperformance in coping with the Covid-19 pandemic – will continue to move further ahead in the race.

The US current account balance (reported quarterly) was -US$104.2 billion for the 1st quarter of 2020; China’s was +119.6 billion. US imports declined substantially in the 1st quarter, but will recover as the economy recovers from virus-related shutdowns. Chinese shutdowns are over. Exports regained significant traction in the 2nd quarter and in July. The relative current account balances will clearly favour the yuan going forward.

Yields? The US 10-year Treasury yield stands at 0.69%. China’s 10-year is 2.9724%. There are few reasons why the substantial yield difference should change any time soon. The US Fed has pledged to stay the zero interest-rate course for however long it takes. China has no reason to think about lowering policy rates, as the economy is performing well without it. The US dollar risk is for real rates, which are already negative now, to drop further unless the USD decline can be arrested.

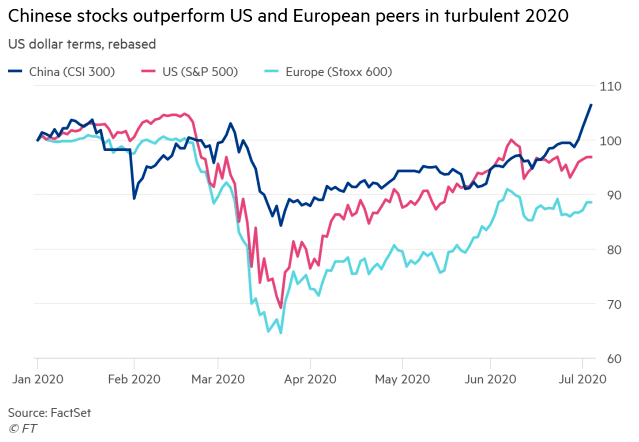

Chinese stocks have significantly outperformed US and European stocks. There is no evidence that this picture will change in coming months. Chinese stock performance is based on solid economic performance. US stocks performance looks well out of line with real economic data.

Lastly, debt. Former New York Fed President Dudley has forecast that the Fed balance sheet will reach $10 trillion by the end of this year, up from $4 trillion in February. No forecasters expect the Fed balance sheet to be below $8 trillion. The downward pressure on the USD of such massive money printing hugely favours the CNY.

Such are the fundamentals.

As I noted above, there is at the same time large event risk that needs to be taken into account.

The US – China tension could worsen further and negatively impact the yuan.

The November US presidential election could provide some relief from China-US political and economic rows.

A Covid-19 vaccine could come on line and help halt the dollar decline at least temporarily.

I will not attempt crystal ball gazing. But I’m of the firm belief that Chinese overall economic outperformance will continue and underpin further yuan strengthening.

Today’s currency action provides no new clues. At 7pm HK time, the US dollar on the dollar index (DXY) traded at 93.2380, down 0.1%. The offshore yuan (CNH) stood at 6.9480 to the dollar, virtually unchanged.

Technicians (I don’t consider myself one of them) will point out that USD-CNH has broken below a significant long-term trendline from April 2019 that comes in at 6.96.

They will also point out that the January 2020 low of 6.86 is a plausible CNH target level.

With that judgement, I find myself in agreement.