(ATF) A spike in US Treasury yields is causing investors to reassess their global risk exposure. Warren Buffett warned this weekend that “bonds are not the place to be”, but Chinese corporate debt offers a big enough spread pick-up to provide comfort about returns.

A wave of Treasury selling that took the benchmark 10-year yield up to 1.61% late last week caused shockwaves across global markets and left investors scrambling to reassess the value on offer from different global assets.

Federal Reserve chairman Jerome Powell is due to speak at a conference on Thursday March 4 in what may be his last public appearance before a policy-setting Fed meeting starting on March 16. Investors are keen to see if he takes a different approach to the line used last week by Powell and many other Fed officials that a rise in yields was simply a reflection of confidence in an economic recovery.

A weak reception for a seven-year Treasury auction on Thursday February 25 instead sparked a wave of selling that was compounded by mortgage market participants who added to the upward pressure on yields by hedging their convexity exposure.

The yield spike led to a more fundamental reassessment of global relative value for different asset classes that included selling of technology stocks such as Tesla, which fell 8% as bonds slumped.

Legendary US investor Warren Buffett weighed in with his views with the release of his annual Berkshire Hathaway shareholder letter on Saturday February 27.

He pointed out that Berkshire Hathaway’s insurance businesses are more oriented to equity investments than competitors that focus on bonds for regulatory or credit-rating reasons.

“And bonds are not the place to be these days,” Buffett said. “Can you believe that the income recently available from a 10-year US Treasury bond – the yield was 0.93% at year end – had fallen 94% from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.”

Buffett was looking at a longer time horizon than most investors when he mentioned the shift in Treasury yields from the levels seen in 1981, after Federal Reserve chairman Paul Volcker hiked the federal funds rate as high as 20% to combat inflation.

The attitude of Volcker’s successor Jerome Powell towards inflation and the appropriate level of interest rates will be the key driver of global markets in the short-term as investors refocus on yield differentials and relative value.

Buffett was right to point out that investors in German bunds and Japanese government bonds (JGBs) still face negative yields in shorter maturities, even after seeing selling pressure to rival the recent Treasury price dip.

Five-year JGBs sold off sharply last week but held at -0.055%, for example, though yields in the 10-year and beyond are positive.

The Chinese debt markets offer both positive yields and recent currency appreciation, however, with the yuan one of the best-performing currencies so far this year.

The recent rise in US Treasury yields may have narrowed the spread gap to Chinese government and corporate bonds in some maturities but it also helped to highlight the much bigger return cushion on offer. Five-year China government bonds closed last week at a yield of 3.07% and the 10-year at 3.32%, for a 1.92% pick-up over the comparable 10-year US Treasury yield, which fell from its high of 1.61% to end Friday at 1.40% after panic selling eased.

Chinese corporate bonds offer an even starker return pick-up, after a shift towards allowing some defaults by inefficient companies with state backing pushed yields higher in late 2020.

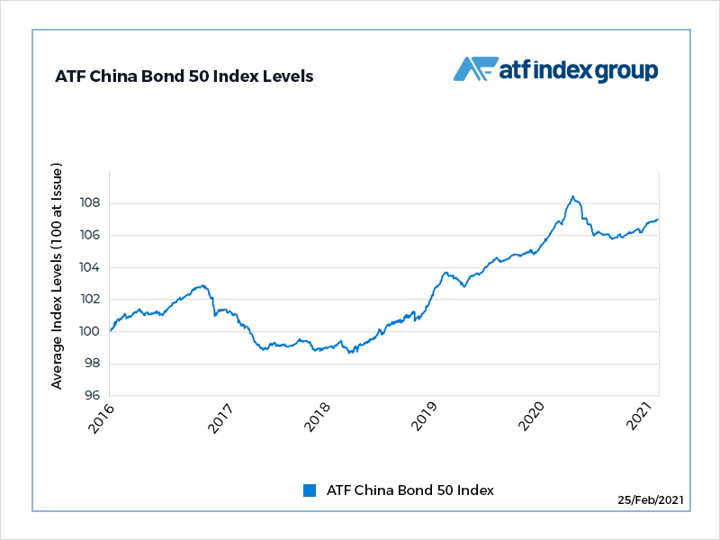

The ATF China Bond 50 index yield is currently close to 4%, for example.

Fed chairman Jerome Powell may take steps to arrest the recent spike in Treasury yields with a shift in the tone of his public statements – in a possible step towards a yield curve control policy that has been the subject of speculation among analysts recently.

Multiple other Fed officials are also due to make public appearances before Powell speaks on Thursday.

Fed “qualitative easing” – an attempt to talk down yields – could help to renew appetite for risky assets such as technology stocks.

But the yield spike seen recently – and likely future bouts of government bond market selling – have already served as a reminder to global investors of the need to reevaluate the relative returns on offer from key asset classes.