Economic events

(ATF) Financial markets will trade with a lot of caution this week watching for a resurgence in the infection count as various national governments loosen their lockdown restrictions and investors brace for a rash of weak economic data. A host of PMIs, retail sales and trade data will reveal the impact of the coronavirus, so investors will also keep an eye on oil prices to gauge demand in a virus-battered global economy.

“Manufacturing PMI data for China, already released up to April, have meanwhile shown only a very modest recovery, suffering a re-acceleration in the rate of export decline, hinting strongly that the recovery could fade,” said Chris Williamson, Chief Business Economist at IHS Markit.

“So far the service sectors have taken the hardest hit from social distancing. With China having started removing some of the restrictions earlier, markets will therefore be looking to the Chinese service sector PMI data for indications of the extent of potential rebounds.”

Investors have been spooked by deflationary fears after China reported its official PMI fell to 50.8 in April, from 52 in March. These worries have been compounded by the spectacular crash in oil prices, even though China is a net importer.

“An oil price collapse generates a formidable deflationary force, which will further depress China’s industrial pricing power and profit growth in Q2,” Jing Sima, China Strategist at BCA Research, said.

Deflationary headwinds

“The collapse in oil prices since March will generate substantial deflationary headwinds to China’s economy in the months ahead. Producer prices are already in contraction. An imported deflation from low oil prices will weaken industrial pricing power even more, pushing up real rates,” said Jing adding that the oil price crash was symptomatic of a sharp decline in global demand, and is usually accompanied by a spike in the US dollar, and can cause turmoil in global financial markets.

“A deepening in PPI contraction means industrial profit growth will remain underwater, underscoring our view that the near-term outlook for Chinese stocks is yet to turn sanguine,” BCA’s Jing said.

First-quarter GDP numbers from Hong Kong, the Philippines and Indonesia will also reveal the extent of the damage from the coronavirus pandemic. ING Bank economists estimate that these will probably be the worst figures in nearly a decade, with a fall of as much as 10% in Hong Kong compared to a year ago.

China’s financial markets will be shut for a five-day holiday which began on May 1 and is expected to boost the hospitality, tourism and airline sectors.

Fund flow

Investors’ flows sought havens in the last week of April as equity funds witnessed exits amid uncertainty about when the coronavirus pandemic would see a peak and volatility in oil prices. Reflecting the risk aversion, money market funds took in a net $91.5 billion that pushed their year-to-date total to over $1.1 trillion, funds tracker EPFR said.

It said bond funds attracted a net $10.5 billion and equity funds posted a collective outflow of $6.7 billion – with half of that accounted for by Emerging Markets Equity Funds.

“Some governments have prolonged restrictive and economically painful measures as the number of confirmed virus cases has risen further, while partial reopening considerations have had to be pushed back in some cases,” Barclays analysts said in a note. “However, the fundamental outlook remains challenging in many parts of EM, which at least partially explains the absence of a rebound in flows, in our view.”

Driven by outflows from China and South Korea, emerging markets saw their biggest outflow since 2015, according to Jefferies & Co.

“It feels again that the reach for quality yield is back, as inflows into high-grade and government bond funds are strengthening, while those into riskier pockets of yield, like high-yield, equities and EM debt are showing signs of fatigue,” BofA Securities analysts said in a note.

“Amid growing uncertainty on the growth outlook across the globe, investors feel less comfortable buying ‘growth’ proxies, and focus on those pockets that are directly within the ECB’s mandate.”

Flows into Europe Bond Funds hit a 30-week high and both US and Global Bond Funds recorded solid inflows, according to EPFR.

“Stepped-up purchases of sovereign and other forms of Eurozone debt also bolstered investor appetite for Europe Bond Funds. The bulk of the week’s fresh money went to the two big regional groups, with UK Bond Funds the only country group to attract over $100 million. Managers of Europe Bond Funds continue to cut their allocations to the UK, whose average weighting is now at its lowest level since 4Q 2007 while those for Switzerland and the Netherlands are at their highest levels since 2Q 2016 and 1Q 2006 respectively.”

Companies in focus

CITIC Ltd after it reported in the first quarter a sharp increase in expected credit losses and impairment which will offset operating cost savings.

R&F properties reported its quarterly earnings on Sunday, which showed a steep fall in net profit despite the boost from investment gains.

Chongqing iron & Steel posted a sharp fall in net profit for the March quarter and it continued to post cash outflows from operations. The company reported a small increase in production volumes across all product categories. It is China’s oldest steelmaker and was rescued from the brink of bankruptcy in 2018.

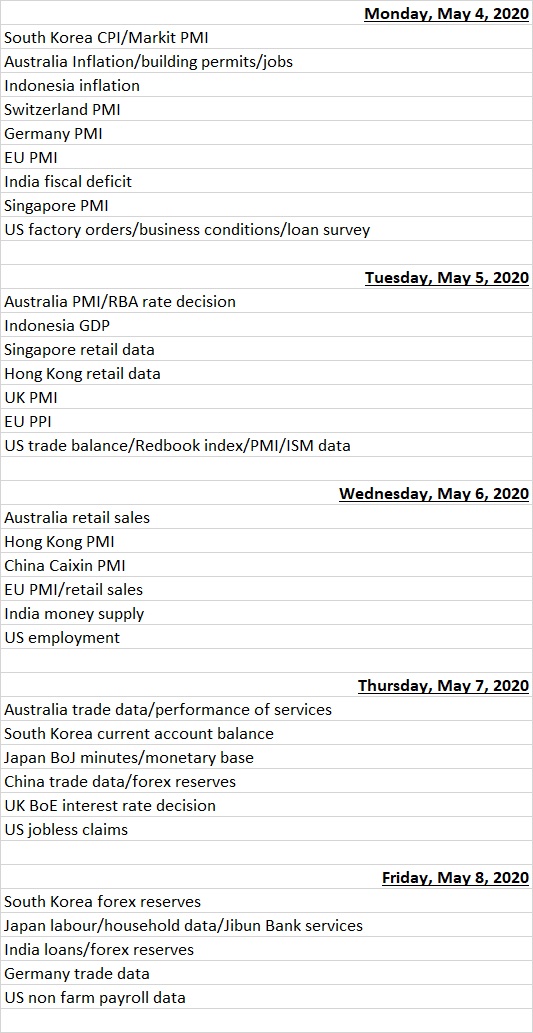

Economic data calendar