(ATF) Shortly after 2pm New York time yesterday, US Treasury yields jumped, stocks dropped sharply and the dollar registered its first gains in over a week.

What grave disaster had struck?

The equivalent of a natural disaster in the world of finance: The US Fed had just released the minutes of the July 28/29 FOMC meeting and those minutes contained some unforeseen and highly unwelcome passages.

First off, the minutes portrayed a rather more gloomy economic outlook than Fed chair Powell had let on in his post-meeting press conference.

Second – somewhat technical, but highly meaningful to market professionals – the minutes contained the ominous sentence that “many [meeting] participants judged that yield caps and targets were not warranted in the current [economic] environment.”

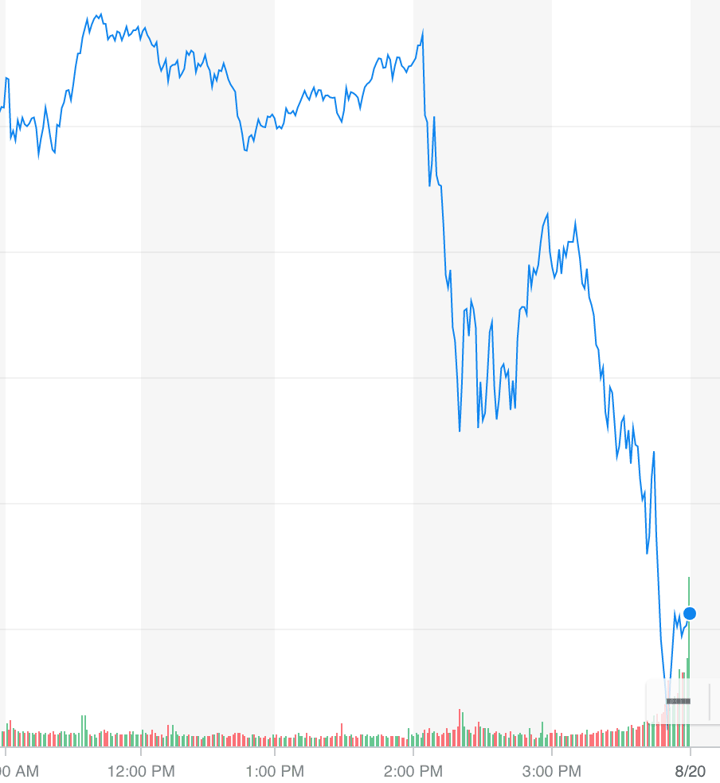

This graph by Yahoo Finance shows how stocks fell on the S&P 500 around 2pm on Wednesday.

So, yield curve control, the policy the Bank of Japan has pursued since 2016 to keep rates super low, is not warranted?

On that news, 10-year Treasury yields jumped by three basis points instantaneously to just below 0.69%, real yields that strip out inflation reacted even more sharply and rose by over 5 basis points to -0.852%.

Alas, the ‘spook’ did not last … except that US stock market losses carried over into Asia and into Europe, where major indexes are down over 1% as at this writing (7pm HK time).

Investors in stocks are, of course, worried that unlimited liquidity won’t last forever and took it hard that there appears to be a majority of FOMC members who are not prepared to make unconditional promises.

Bonds, meanwhile, have largely retraced yesterday’s losses and the US 10-year yield now stands at 0.65%. The US dollar, which got a lift from the real yield rise, has given most of it back and trades at 92.9380 on the DXY, the lower end of the day’s trading range of 93.1940 – 92.8750.

China’s currencies cared little about the raucous New York action. The CNH, the offshore yuan, stands at 6.9151 to the USD. It had opened at 6.9220, in line with the PBoC’s morning fixing of central parity for the CNY (onshore) at 6.9274.

The storm in the New York teapot demonstrates just how nervous markets are about the combination of established and lasting US inability to cope with the Covid-19 pandemic and vastly extended equity valuations discounting a fast and lasting economic recovery.

The dollar is resuming its decline because fundamentals remain unchanged and more debt will have to be piled onto the US balance sheet to keep the economy afloat.

The yuan will continue its steady rise because its fundamentals in all major respects are continuing to improve.