(ATF) Hong Kong: Financial markets retreated on Tuesday amid escalating US-China tensions, seen climbing a notch after data showed China’s monthly trade surplus with the US widened further.

Sentiment is also jittery after coronavirus infections soared by a million cases in five days – to more than 13 million worldwide.

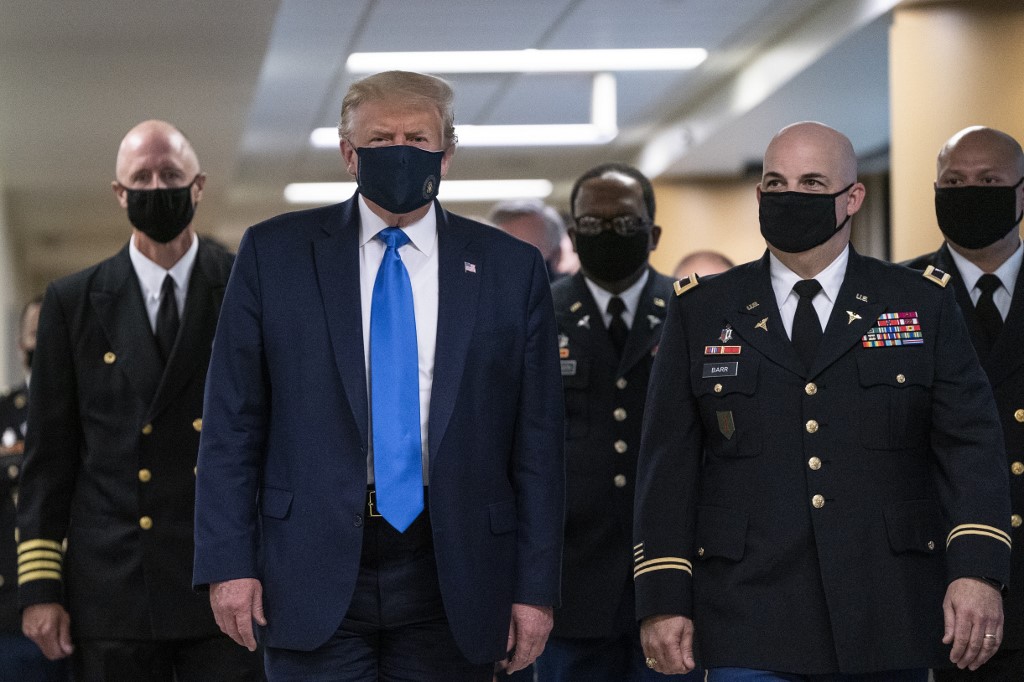

“China’s politically sensitive monthly trade surplus with the US widened further to US$29.4 billion in June. The growing trade surplus came at a time of escalating friction between the two countries,” said Nathan Chow, DBS Bank economist referring to US President Donald Trump’s comments last week he was no longer confident about negotiating a phase-two trade deal with China.

Reuters calculations showed China’s trade surplus with the United States stood at $29.41 billion in June, up from a $27.89 billion surplus a month earlier.

“One would not be surprised to see it coming given the downward spiralling relations between Beijing and Washington since the pandemic outbreak. Perhaps more importantly, Chinese imports are still far behind the pace needed to meet the terms of the ‘phase-one’ deal.”

Tensions between the world’s two most powerful countries are already on the boil.

Overnight, US Secretary of State Michael Pompeo challenged China’s position on the South China Sea and said in a statement that “Beijing’s claims to offshore resources across most of the South China Sea are completely unlawful, as is its campaign of bullying to control them.”

He said China’s “predatory world view has no place in the 21st century” and “the world will not allow Beijing to treat the South China Sea as its maritime empire.”

“Asian markets were set up for falls after the US market fell on the back of California reversing some its reopening and US/China tensions with the US not recognising China’s claims to the South China Sea. So it’s really more of the same: coronavirus and US/China tensions,” Shane Oliver, Head of Investment Strategy and Chief Economist at AMP Capital, told Asia Times Financial.

“The latter is likely to continue to escalate up until the US election at least – particularly if President Trump thinks he has nothing to lose, which may cause him to take more risks with the economy and share market.”

Markets retreat

The Nikkei 225 fell 0.87% on the eve of the BoJ rate decision, the Australian S&P ASX 200 was off 0.61% and the CSI 300 tumbled 0.95%. Hong Kong’s HIS benchmark has tumbled 1.14%.

The coronavirus-linked disruptions continue to roil the global economy with Singapore entering a technical recession after shrinking by 41.2% in the second quarter.

“This will be marked as the bottom of the current downturn,” said ING economist Prakash Sakpal, while adding that second-quarter data caused a revision of ING’s full-year 2020 growth forecast, down to -6.9% from -6.1%. That put it near the weak end of the government’s forecast range of -4% to -7%.

“But recovery from here on is going to be weak. Hopes are based on a large stimulus in preserving jobs and preventing further weakness in spending over the rest of the year. But persistent external uncertainty depressing exports and tourism provide no hope of a return to positive year-on-year GDP growth anytime soon, at least not over the rest of this year,” he said.

Credit markets are also edgy in line with the overall risk outlook with the Asia IG index widening by a basis point to 80/81 bps. Still the near-zero interest rate environment continues to draw investors to new issues with Melco Resorts, Goodman HK and Yunnan Construction in the market with bond offerings.

“We like credit on a strategic basis as valuations compensate for default risks and we prefer credit over equities on a tactical basis,” said BlackRock analysts said in a note. “We recently moved to a strategic overweight on credit after being underweight for the past year. Cheaper valuations compensated for the risk of corporate defaults and downgrades in the wake of the Covid-19 pandemic, in our view. Extraordinary central bank easing, including renewed purchases of corporate debt, underpin the asset class.”

Also on Asia Times Financial

GF Securities under administration, activities frozen

China to bounce back into the black, analysts say

Damage from flooding in China could top $100 billion

US brands Beijing’s South China Sea claims illegal

Foreign Exchange: Virus worries back to the forefront, Chinese currencies shrug

Asia Stocks

# Japan’s Nikkei 225 slumped 0.87%

# Australia’s S&P ASX 200 weakened 0.61%

# Hong Kong’s Hang Seng index dropped 1.14%

# China’s CSI300 retreated 0.95%

# The MSCI Asia Pacific index fell 0.66%.

Stock of the day

Macau gaming stocks surged after the removal of the 14-day mandatory quarantine requirement for travel between Macao SAR and Guangdong province. Chinese tourists accounted for 70% of tourist arrivals in 2019 and for a similar percentage of gaming operators’ revenue, according to Moody’s. Sands China soared 8.9%, Galaxy Ent Group charged up 11.11% and Wynn Macau surged 16.3%.

“We expect the removal of the quarantine requirement will lead to a rebound in Macao’s gross gaming revenue following a 77% drop in the first half of 2020, and help reduce gaming operators’ cash burn,” said Sean Hwang, analyst at Moody’s Investors Service.