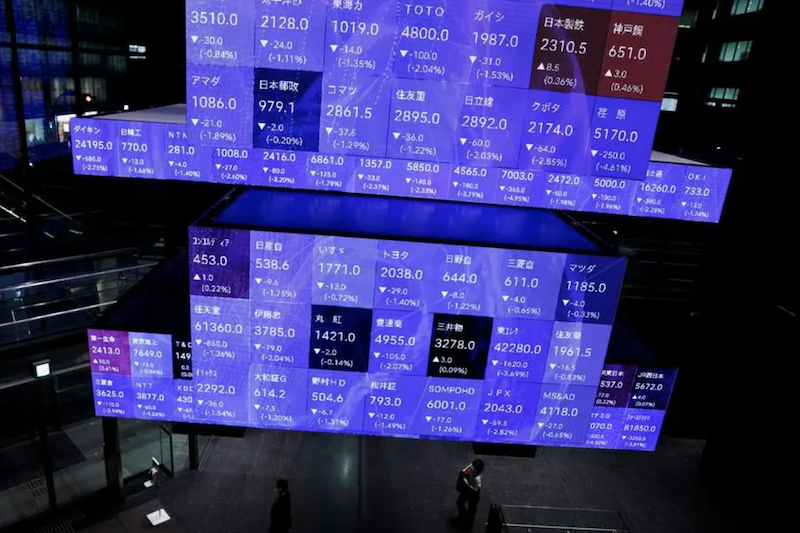

Asia’s major stock indexes were largely back in the green on Friday as bond market turbulence continued to fade, though there was some nervousness ahead of the latest US jobs data.

The figures will be a key driver of the Federal Reserve’s direction on interest rates, with investors on edge fearing another bond market sell-off if those job numbers are too strong.

Japan’s Nikkei share average was the outlier, ending lower as it was dragged down by declines in its heavyweight technology stocks, as well as fears over which way the US jobs report will go.

Also on AF: US Set to Close Loopholes in Curbs on Chips Tools For China

The Nikkei index edged down 0.26% at 30,994.67. The index was volatile this week, losing 2.7% on Wednesday and gaining 1.8% in the previous session. For the week, it lost 2.7%. The broader Topix crept up 0.01%, or 0.32 points, to 2,264.08.

Interest-rate sensitive large growth stocks fell, with chip-making equipment maker Tokyo Electron down 1.59% and chip-testing making equipment maker Advantest slipping 1.65%.

Hong Kong stocks, however, extended gains for a second session, tracking firmer overseas markets.

Traders were also adjusting their positions and preparing for the re-opening of China markets next week after the Golden Week holiday, while also awaiting a catalyst for economic growth.

Brokers also said a meeting of China and US leaders will help improve market sentiment.

The White House is making plans for a face-to-face meeting between US President Joe Biden and Chinese leader Xi Jinping in San Francisco next month as the two countries seek to stabilise troubled relations, the Washington Post reported.

The Hang Seng Index gained 1.58%, or 272.11 points, to 17,485.98, and the Hang Seng China Enterprises Index climbed 1.47%.

Shares of Sunac China rose as much as 5.9%, extending gains for the third straight session after the property developer obtained a Hong Kong court approval on Thursday on its $9 billion offshore restructuring proposal.

Mainland markets remained closed for the National Day holiday and will reopen on October 9.

Elsewhere across the region, in earlier trade, Singapore, Seoul and Mumbai were also up. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.9%.

Yen Fighting Back

Ten-year US Treasury yields were mercifully steady at 4.72% through the Asia session, but have climbed 55 basis points in a five-week-long sell-off that has dragged on bond markets and appetite for risk-taking around the world.

Another round of bond selling, which could happen if the US job numbers come in too strong, would likely propel the dollar further along a weekly winning streak that is already its longest ever against the euro. The dollar index is up 12 weeks in a row, equalling a streak that ran from July to October 2014.

The run-up has the euro, at $1.0542, pinned near an 11-month low and sterling not far from a seven-month trough. The dollar index was steady on Friday at 106.4.

Surprisingly, only the beleaguered yen has showed much of a fight, since a sudden jump in the Japanese currency during the London afternoon on Tuesday stoked speculation authorities had intervened.

Japanese money-market data showed no anomalies of a kind that might have accompanied intervention. But the move was eye-catching enough to keep traders on their guard.

The yen was last steady at 148.5 per dollar. Gold was also steady at $1,822 an ounce after nine days of losses driven by rising global bond yields.

Oil’s flip from surging to sliding has also provided respite, with Brent crude futures at $84.50 a barrel, some $13 or 13.5% cheaper than last week’s 11-month high.

Key figures

Tokyo – Nikkei 225 < DOWN 0.26% at 30,994.67 (close)

Hong Kong – Hang Seng Index > UP 1.58% at 17,485.98 (close)

Shanghai – Composite <> CLOSED

London – FTSE 100 > UP 0.31% at 7,474.89 (close)

New York – Dow < DOWN 0.03% at 33,119.57 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Beijing Seen Taking Over China Evergrande’s Debt Revamp

Japan Silent on Yen Intervention as Currency’s Slide Continues

Bond Market Sell-Off Sparks Global Slowdown Alarm Bell

Nikkei, Hang Seng Rebound as Bonds Turbulence Subsides