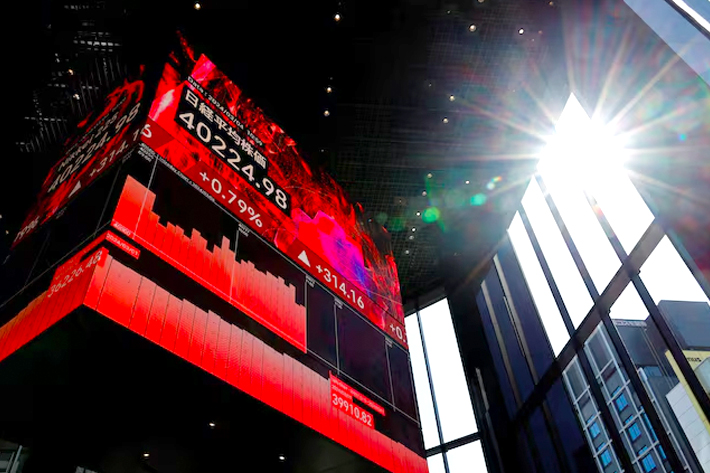

Asia’s major stock indexes experienced contrasting fortunes on Thursday as policy boosts in China helped in some corners while a tech stocks droop hindered in others.

Shares were mixed across the region with solid Chinese trade data helping China stocks outperform, while the yen stabilised after three days of decline pressuring Japanese equities.

That saw Tokyo’s Nikkei shed early gains to end lower, though it was also pulled down by lacklustre performances in chip-related stocks, as Tokyo Electron tracked a slump in Arm Holdings after the British chip designer missed market expectations for annual revenue.

Also on AF: US Warns it Could Ban Connected Chinese Electric Vehicles

The Nikkei share average was down 0.34%, or 128.39 points, to close at 38,073.98, after rising as much as 0.5% earlier in the session. The broader Topix was ahead 0.26%, or 7.03 points, to 2,713.46.

Shares of Tokyo Electron, a Japanese chip-making equipment maker, slipped nearly 3% to become the biggest drag on the Nikkei. Technology investor SoftBank Group, which owns around 90% stake in Arm Holdings, also dropped about 3%.

Meanwhile, it emerged board members at the Bank of Japan turned overwhelmingly hawkish at their April policy meeting, with many calling for the need to raise rates steadily, a summary of opinions at the meeting showed.

The Japanese yen steadied at 155.60 per dollar after falling for three sessions. It rose more than 3% last week with market participants pointing to likely intervention by Japanese authorities twice to stem its fast decline.

However, Japan’s real wages in March fell 2.5% from a year earlier, marking the second year of decline, an argument for policymakers to not hike aggressively.

Japan’s 10-year government bond yield rose as high as 0.91%, its highest since April 26. Higher yields could hurt growth stocks such as chip-related and other technology companies, whose appeal lies in future cash flows.

China stocks rose after solid April trade data added to signs of a pick-up in demand, while the latest property policy rollouts also improved sentiment.

China’s exports and imports returned to growth in April after contracting in the previous month, signalling an encouraging improvement in demand at home and overseas.

Also, China’s eastern metropolis of Hangzhou said on Thursday it will lift all home purchase restrictions to shore up its real estate market, raising the prospect of other cities following suit.

Lenovo Leads H-Share Gains

China’s blue-chip CSI 300 index was up 0.95% with, earlier in the session, its financial sub-index, consumer staples, real estate index and healthcare sub-index rising between 0.01% and 3.67%.

The Shanghai Composite Index rose 0.83%, or 25.84 points, to 3,154.32, while the Shenzhen Composite Index on China’s second exchange rallied 1.34%, or 23.78 points, to 1,796.61.

Chinese H-shares listed in Hong Kong – stocks belonging to companies from the Chinese mainland – jumped 1.63% to 6,561.93, while the Hang Seng Index gained 1.22%, or 223.95 points, to close at 18,537.81.

Lenovo, Longfor Group Holdings and Sunny Optical Technology Group were the top gainers among H-shares, up 6.28% 5.74% and 5.29% respectively.

Elsewhere across the region, in earlier trade, Manila was also up but Sydney, Singapore, Seoul, Mumbai, Wellington and Taipei edged down.

MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.2% but was hovering not far from a 15-month high hit earlier in the week after Fed Chair Jerome Powell reiterated a stance for policy easing later this year.

Europe looked set for a subdued open, with Eurostoxx 50 futures flat, although the FTSE 100 was up 0.1% ahead of an interest rate decision from the Bank of England later in the global day.

In the Treasuries market, yields were little changed after edging up the day before, with movement likely to be muted ahead of the US inflation report next week. Two-year yields held at 4.8511%, while the 10-year yield was at 4.5062%, having risen 3 basis points overnight to 4.4920%.

Oil prices were higher on Thursday, having bounced off two-month lows the previous session. Brent futures rose 0.4% to $83.91 a barrel, while US crude gained 0.5% to $79.40 a barrel.

Key figures

Tokyo – Nikkei 225 < DOWN 0.34% at 38,073.98 (close)

Hong Kong – Hang Seng Index > UP 1.22% at 18,537.81 (close)

Shanghai – Composite > UP 0.83% at 3,154.32 (close)

London – FTSE 100 > UP 0.08% at 8,360.34 (0950 BST)

New York – Dow > UP 0.44% at 39,056.39 (close)

- Reuters with additional editing by Sean O’Meara

Read more:

Over 130 Firms Drop IPO Plans as China Ramps up Scrutiny

China’s Elderly Workers Can’t Afford to Retire, Numbers Soaring

Nikkei Slips on Rates Uncertainty, Property Drags on Hang Seng

Asian Markets Lose $2.5 Billion as Outflows Continue in April