Asia’s major share indexes were in retreat on Tuesday, forced back by worries over central bank tightening, rising geopolitical tensions and weak economic data.

The prospect of the US central bank having to stay on its hawkish path weighed on sentiment, with investors waiting on the minutes of the last Federal Reserve meeting for further monetary policy clues.

Japan’s stock markets ended lower as investor confidence was rattled by a business survey that showed the country’s manufacturing activity contracted at its fastest pace in 30 months in February.

Also on AF: China Bank Reassures Staff Over Star CEO’s Disappearance

The Nikkei index closed 0.21% lower at 27,473.10 points, led by consumer stocks as the weakening factory data hinted that the world’s third largest economy could still be plagued by falling demand and cost pressures.

The broader Topix index turned negative in the afternoon trade to end 0.11% lower at 1,997.46 points. The benchmark failed to hold on to its intra-day high of 2,003.46, last seen in end-November.

Incoming Bank of Japan Governor Kazuo Ueda is scheduled to testify before parliament on Friday, the same day the country is due to release January inflation data, which is likely to have accelerated to a new 41-year high, above 4%, according to a Reuters poll.

Meanwhile, the yen weakened 0.11% to 134.38 per dollar.

Mainland China stocks were subdued, while Hong Kong shares fell, as geopolitical worries ahead of the Ukraine war’s one-year anniversary and doubts around China’s economic recovery weighed on equities.

The recent underperformance of Chinese equities appears to reflect scepticism about the likely strength of China’s recovery, Goldman Sachs analysts said in a note.

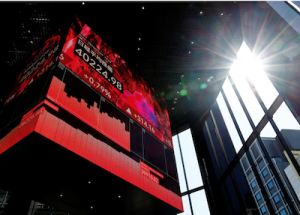

Among individual stocks and sectors, tech giants listed in Hong Kong slumped 2.5% to lead the decline. The Hang Seng Index dropped 1.71%, or 357.47 points, to 20,529.49.

Meanwhile, the Shanghai Composite Index rose 0.49%, or 16.19 points, to 3,306.52, while the Shenzhen Composite Index on China’s second exchange edged up 0.19%, or 4.11 points, to 2,165.77.

US Rate Hike Fears Persist

Elsewhere across the region, Mumbai, Sydney, Singapore, Jakarta and Wellington were down. Seoul, Taipei, Bangkok and Manila edged up.

MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.7% to 529.97, hovering around six-week lows of 529.30 touched last week.

The index is down nearly 3% this month, after jumping 8.6% in January, after a slew of robust US economic data reinforced fears that interest rates may need to rise further and stay higher for longer.

European stock futures indicated stocks were set to decline, with Eurostoxx 50 futures down 0.14%, German DAX futures 0.07% lower and FTSE futures down 0.13%.

“The backdrop of inflation concerns in the US is still keeping risks of a tighter-than-expected monetary policy, and yields remain a key focus as US markets return later today,” strategists at Saxo Markets said.

US markets were closed on Monday due to President’s Day holiday. E-mini futures for the S&P 500 fell 0.45%.

Dollar Shy of Recent Peaks

The yield on 10-year Treasury notes was up 2.3 basis points to 3.852%, after touching a three-month high of 3.929% on Friday.

The yield on the 30-year Treasury bond was up 1.1 basis points to 3.899%, while that of the two-year US Treasury paper, which typically moves in step with interest rate expectations, was up 3.5 basis points at 4.658%.

In the currency market, the dollar was just shy of recent peaks as a three-week rally faded, with traders looking to European and US manufacturing data out later on Tuesday and Friday’s core PCE price index to help guide their next steps.

The dollar index, which measures the US currency against six other rivals, was last at 103.99, just below a six-week high of 104.67 touched on Friday.

US crude fell 0.08% to $76.28 per barrel and Brent was at $83.01, down 1.26% on the day.

Key figures

Tokyo – Nikkei 225 < DOWN 0.21% at 27,473.10 (close)

Hong Kong – Hang Seng Index < DOWN 1.71% at 20,529.49 (close)

Shanghai – Composite > UP 0.49% at 3,306.52 (close)

London – FTSE 100 < DOWN 0.21% at 7,997.29 (0936 GMT)

New York – Dow > UP 0.39% at 33,826.69 (Friday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China’s Offshore Listing Rules Spur Fear on Approval Process

Taiwan’s Export Orders Fall For Fifth Month in a Row