Trillions of dollars of actual and promised spending by central banks and governments stabilized global equity and credit markets today, but only just.

Credit risk stabilized at extremely wide levels and equity markets gained about 2% after yesterday’s 5% decline. The only risk market with substantial gains is Italian government debt and other European peripherals, which jumped after the European Central Bak promised 750 billion euros in additional bond buying.

Never in the course of financial events have so few spent so much for so many and with so little effect. The US Federal Reserve offered $500 billion in temporary help for the repurchase market (short-term lending against Treasury and other high-quality securities), then another $500 billion of permanent purchases of Treasuries, and then at least another $130 billion in swap lines to foreign central banks (which help foreign banks support the purchase of US assets). US President Donald Trump promised a $1.3 billion economic support package in place of the mere $850 billion that Treasury Secretary Steve Mnuchin proposed Monday. The ECB, the Bank of Japan and the Bank of England together cobbled together another trillion.

Compared to the $700 billion that the TARP (Troubled Asset Relief Program) put into the banking system after Lehman Brothers’ failure in September 2008, the scale of government and central bank support is Brobdingnagian, but the results have been disappointingly Lilliputian.

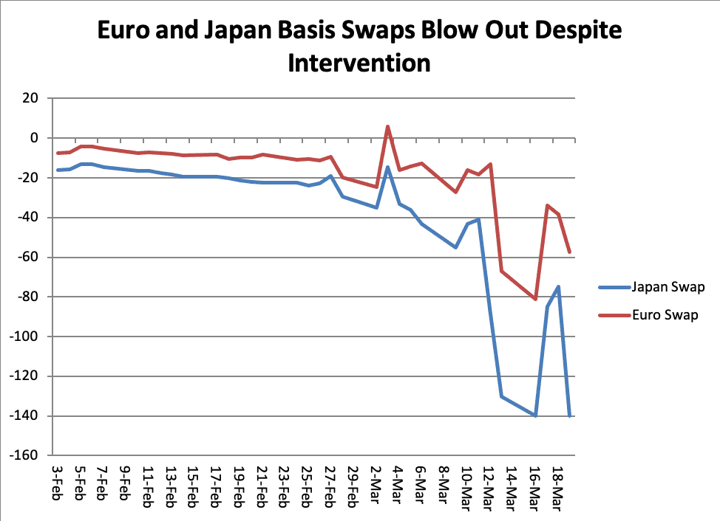

As I reported last week, the epicenter of the illiquidity shock to the banking system is American banks’ dollar loans to European banks, a vulnerability first flagged by the Bank for International Settlements in its September 2017 Quarterly Report. With $12 trillion in outstanding net liabilities to American banks, European banks faced a funding squeeze gauged by the so-called cross currency basis swap – the cost of swapping Euro or yen cash flows for dollars.

After a brief respite yesterday, the basis swaps for yen and Euro blew out to levels that effectively shut down transactions. The record $130 billion in emergency liquidity provision by the Fed barely made a difference in the shrinkage of the $12 trillion liability mountain.

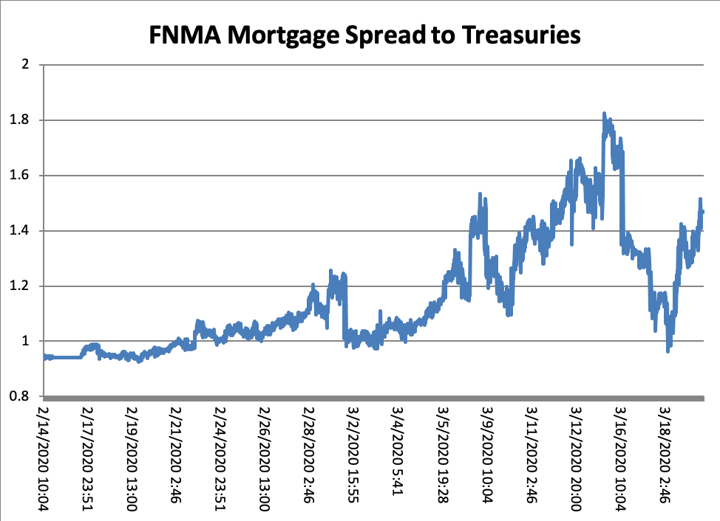

This has knock-on effects. When European and Japanese investors can’t borrow dollars to hedge the foreign exchange risk of buying US securities, they sell instead of buying. Government-sponsored US mortgage-backed securities, which have virtually no credit risk, were the victims of the funding squeeze. The spread between mortgages and Treasuries blew out in consequence. It came back in yesterday, as basis swaps improved briefly, and then widened back out.

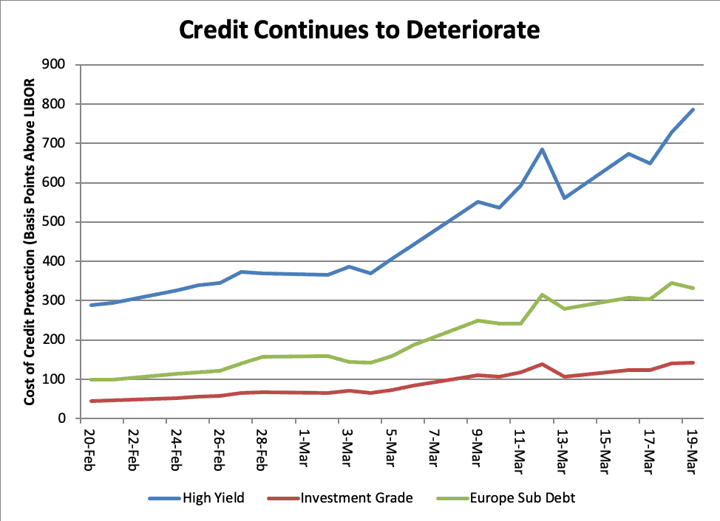

Credit spreads remain at levels not seen since the 2008 crash. The cost of protection of subordinated debt of European financial institutions remains extremely high, at LIBOR +300 basis points or more, indicating that the European Central Bank’s EUR 750 billion bazooka hasn’t persuaded investors to take on bank risk.

US real yields (the yield on Treasury Inflation-Protected Securities) stabilized, but remain about 1.2% higher than they were on March 6, before the US government and the Federal Reserve offered multi-trillion dollar bailouts for banks, commercial paper issuers, consumers, and anyone else who asked.

This looks a bit like a Wile E. Coyote moment (the point at which the cartoon canine runs off a cliff, and grimaces in mid-air for a moment before falling to the valley floor below), but probably isn’t. For the time being the governments and central banks have held the line, but at the expense of revealing their ultimate vulnerability. There is a limit past which the credit of governments will not stretch, and the market threatens to puke up the mass of government bond issuance required for the bailout.

If the coronavirus recession follows the V-shaped pattern that most forecasters anticipate for China and the U shape they expect for the industrial world, a revival of economic activity later this year will have justified the multi-trillion-dollar deluge of government support. If the world economy takes longer to recover or remains in recession through the early months of 2021, we will be in a financial mess that none of us have lived through before.