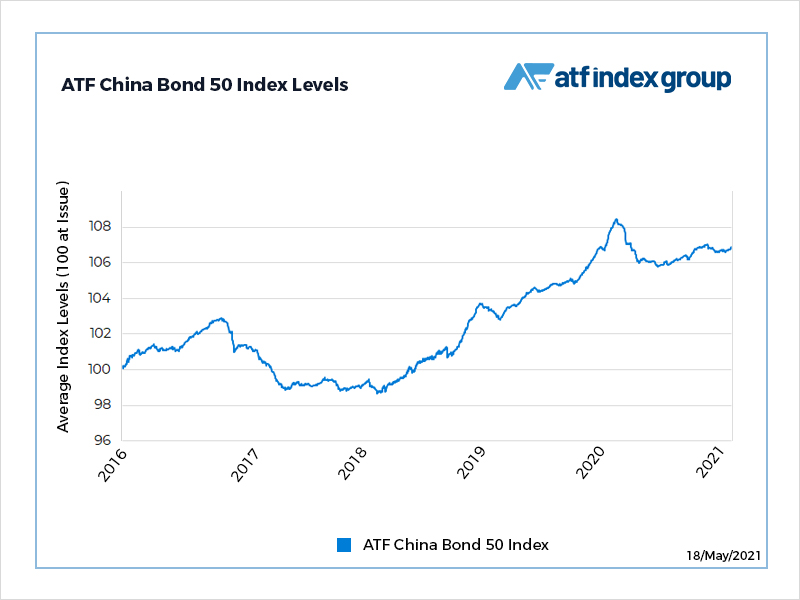

(ATF) Investors reaped higher returns on China credits for a tenth straight day Tuesday as data suggested the central bank would keep a lid on interest rates.

The ATF China Bond 50 powered to its longest winning streak since early March after reports showed that credit growth is slowing, giving the People’s Bank of China more room to keep interest rates unchanged despite climbing inflation.

The ATF CB50 rose 0.02% to 106.91. The returns-focused measure of 50 most liquid AAA corporate and local government bonds, has gained 0.29% this month, reversing three consecutive months of declines, as the nation’s economic outlook continued to strengthen.

Also on ATF

- Canada warns Kyrgyzstan over nationalisation of gold mine

- Reflation bulls are back

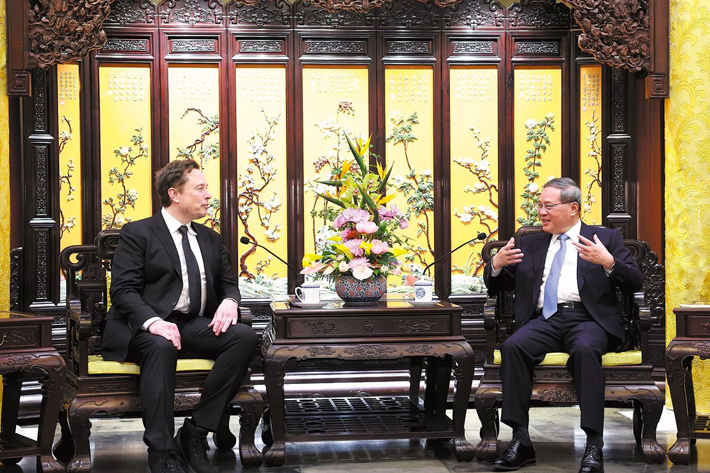

- Burry of ‘Big Short’ fame reveals $530m bet against Tesla

With the crisis easing, local governments are reducing their borrowing. Total social financing slowed to 11.6% YoY in April from 13.6% last year, wrote Bank of Singapore chief economist Mansoor Mohi-uddin.

“China’s V-shaped recovery is starting to put upward pressure on inflation,” Mohi-uddin wrote. “In April, producer prices increased . Consumer prices also rose, though at 0.9% YoY headline inflation remains tame, enabling the People’s Bank of China to refrain from raising interest rates despite the economy’s rebound.

“The central bank may also keep interest rates unchanged this year as credit growth is slowing.”