Lawmakers in Japan have been talks on a legal change that would cut the number of reports companies are required to file, according to Nikkei Asia.

The move would see listed businesses allowed to report twice a year instead of having to file quarterly financial reports.

The proposed amendment to Japan’s Financial Instruments and Exchange Act stipulates that from April, quarterly reports for the first and third quarters of the fiscal year will be eliminated, with their content summarised in financial statements, Nikkei Asia said.

ALSO SEE: Japan, South Korea Share Tech, Energy Tie-Up Ambitions

The bill, which was approved by Japan’s upper house Financial Affairs Committee late last week, would require listed companies to submit semiannual reports, which has been a requirement for nonlisted companies for some time.

It aims to address the current process of financial document preparation by businesses where the content of quarterly reports overlaps with financial statements.

Japanese lawmakers are also debating a business bill that would shorten the time it takes for startup companies to go public, the magazine said.

Japanese shares rise on strong earnings, demand

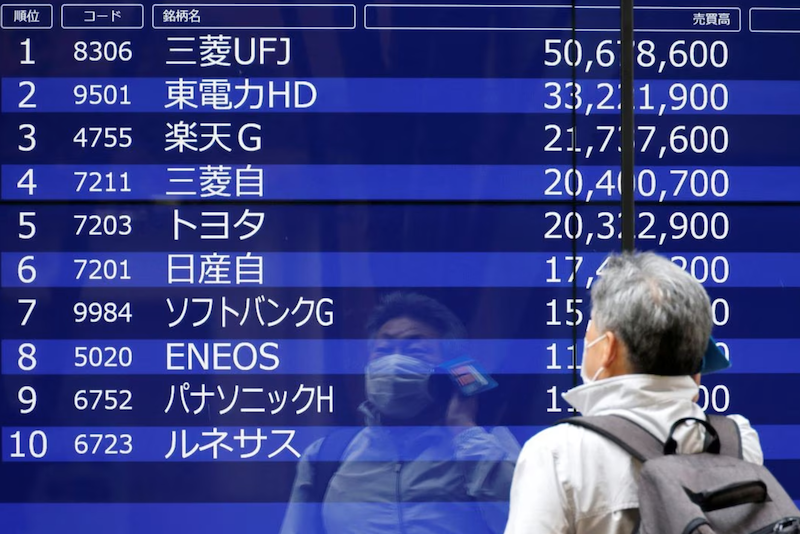

Meanwhile, Japanese shares hit highs not seen since 1990 on Monday as strong earnings and offshore demand fuelled a three-week winning streak, while the yuan was pushed higher by China’s central bank leading to broader softness in the dollar.

Japan’s Nikkei share index ran into profit-taking at the peak but was still up 8.2% for the month so far with the Topix not far behind.

Financial shares led the gains on Monday as investors prepare for an eventual end to negative rates, while auto makers have been benefiting from a weak yen and high exports.

MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.8%, having climbed 2.8% last week to a two-month high.

There were media reports Israel, the US and Hamas had reached a tentative agreement to free dozens of hostages in Gaza in exchange for a five-day pause in fighting, but no confirmation as yet.

Chinese blue chips dipped 0.2% as the country’s central bank held rates steady as widely expected, but set a firm fix for the yuan that saw the dollar slip under 7.2000 to a three-month low.

EUROSTOXX 50 futures held steady, while FTSE futures were a fraction firmer. S&P 500 futures eased 0.15% and Nasdaq futures lost 0.35%. The S&P is now up nearly 18% for the year and less than 2% away from its July peak.

Markets have all but priced out the risk of a further hike in December or next year, and imply a 30% chance of an easing starting in March. Futures also imply around 100 basis points of cuts for 2024, up from 77 basis points before the benign October inflation report shook markets.

Bonds rally

That outlook helped bonds rally, with 10-year Treasury yields at 4.45% having dropped 19 basis points last week and away from October’s 5.02% high.

It also dragged the US dollar down almost 2% on a basket of currencies last week, and helped the euro up to $1.09365 having jumped 2.1% last week.

The dollar even lost ground to the low-yielding yen, last down 0.5% at 148.89 and short of its recent top of 151.92. Expectations of another strong wage round and of a high reading for core inflation later this week has stirred more chatter about and eventual tightening by the Bank of Japan.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Bank of Japan Seen Ready to End Negative Rates in Early 2024

BOJ Not Afraid of Cost of Phasing Out Stimulus, Ueda Says

South Korea, Japan and China May Hold Summit Near Year-End