(ATF) Economic events

Financial markets are seen trading on a positive note at the start of the week following a sustained flow of upbeat earnings from the world’s largest economy and abating inflation fears which took the pressure off US Treasuries.

Morgan Stanley’s strong results last week wrapped up a swathe of bumper earnings from big banks taking the S&P 500 and the Dow Jones indexes to closing record levels. While the economic recovery optimism has fueled investors risk appetite, there is also confidence that any temporary spike in inflation will not trigger an interest rate hike – US 10-year bond yields have fallen 16 basis points to 1.58% in the month so far after surging 83 basis points in the first quarter.

Growth optimism will continue to drive optimism after China’s economic recovery quickened sharply in the first quarter to record growth of 18.3%, data published on Friday showed.

“We are forecasting a very strong – but also somewhat uneven – recovery in the global economy over the next couple of years as the pandemic is gradually contained, with three key implications for asset allocation,” said John Higgins, Oliver Jones, and Oliver Allen, economists at Capital Economics.

They expect government bonds to underperform “risky” assets substantially, and sectoral rotation within many risky assets markets, favouring the industries that suffered when the pandemic struck over those that benefitted, to resume.

“We expect China’s bonds to buck the overall trend though, since China is the sole major economy that we forecast will lose momentum this year,” they said.

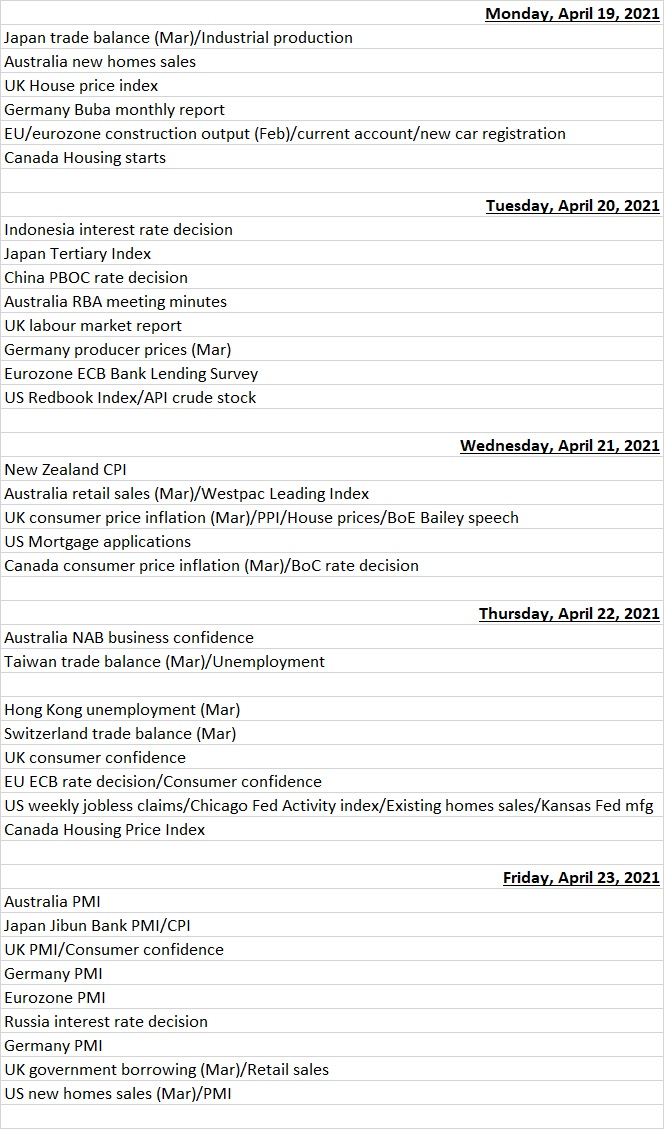

During this week, interest rate decisions are scheduled at central banks in the eurozone, China Canada, Indonesia and Russia.

The PBoC is expected to keep the LPR rate flat following the unchanged MLF rate, while no changes are seen in policy rates in the eurozone, Canada and Indonesia.

The week also sees the publication of flash PMI surveys covering more than half of the world’s economic output.

“Early indicators of economic performance at the start of the second quarter are provided by April’s flash PMIs, covering both manufacturing and services,” said Chris Williamson, Chief Business Economist, IHS Markit.

“A more worrying feature of the PMIs is the recent spike in prices. Prices globally have been rising at the sharpest rate for over a decade, linked to a combination of near-record supply delays and surging demand as economies reopen, pushing bond yields higher.”

Fund flow

Investors made big commitments to equity markets in China, UK and US in the week to April 14, eyeing major growing economies, according to data provider EPFR.

“The world’s first, second and fifth largest economies are now expected to post full year growth in excess of 6%, 8% and 5% respectively,” said Cameron Brandt, Research Director at EPFR as China Equity Funds rebounded from their first consecutive outflows since mid-3Q20 with their eighth biggest weekly inflow on record while US Equity Funds absorbed fresh money for the ninth time in the past 10 weeks and flows into UK Equity Funds hit a 51-week high.

“China Equity Funds, under pressure since mid-March after Chinese authorities suggested the country’s economic recovery has reached the point where stimulus measures can and should be dialed back, absorbed over $4 billion,” Brandt said.

Meanwhile China is getting a growing share of the money committed to the diversified Global Emerging Markets (GEM) Bond Funds. Since the beginning of 2019, China’s average allocation among this group has overtaken those for Turkey, South Africa, Colombia and Russia, according to EPFR.

“The recovery is taking shape; fixed income investors are adding beta. Recovery-geared risk pockets, like HY and EM debt funds, have outperformed for another week. Against a backdrop of low rates vol and a rates market that has now stabilised, IG funds have also seen healthy inflows for another week,” said BofA Securities analysts in a note.

They added that as the global economy reopens and macro data improves, investors are seen adding beta via higher yielding paper but they were cautious on duration as higher rates and steeper curves are detrimental for flows in longer-duration bonds.

The popularity of ESG and inflation themed investments remained unabated as SRI/ESG Equity Funds inflow tally rose past the $100 billion mark, Inflation Protected Bond Funds saw net flows since their current inflow streak began hit $32 billion and Bank Loan Funds took in fresh money for the 15th straight week.

Economic data calendar

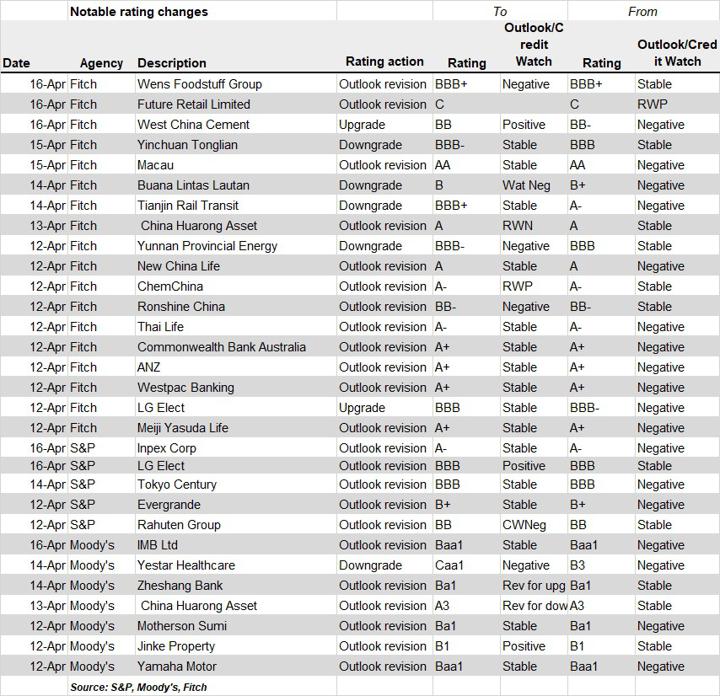

Last week’s rating changes