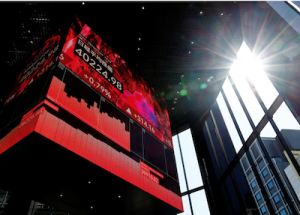

Asia’s major stock indexes made cautious progress on Tuesday with investor attention on the next key US inflation report and a string of economic data due later this week.

China is also scheduled to release March inflation, trade and credit lending data in the next few days.

Japan’s Nikkei share average ended higher for a second session as chip-related stocks rose and a weaker yen lifted sentiment.

Also on AF: Top US Republican Senator Backs Forced Sale of TikTok

The Nikkei share average was up 1.08%, or 426.09 points, to close at 39,773.13, while the broader Topix was ahead 0.97%, or 26.37 points, to 2,754.69.

The Nikkei had jumped 0.9% on Monday after falling 1.96% in its biggest daily decline almost in a month on Friday.

The Japanese yen weakened 0.03% versus the greenback at 151.86 per dollar, holding near a 34-year high of 151.975 yen hit last month.

Finance Minister Shunichi Suzuki said authorities would not rule out any options in dealing with excessive yen moves, reiterating his warning that Tokyo is ready to act against the currency’s recent sharp declines.

Chip-related shares rose, with Tokyo Electron jumping 3.53% and Advantest rising 1.06%. Lasertec climbed 3.43%.

China stocks edged ahead with investors subdued ahead of a raft of domestic economic data due later this week, including its first-quarter gross domestic product (GDP) figures.

Meanwhile, China’s Premier Li Qiang said during a Monday symposium with economic experts and businessmen that the country will make macro policies more consistent and pay attention to precise policy implementation, state media reported.

China’s blue-chip CSI300 index was down 0.08% at 3,527.4 points, with its financial sector sub-index lower by 0.03%, the consumer staples sector down 0.34%, the real estate index down 0.5% and the healthcare sub-index up 0.08%.

Fading US Rate Cut Hopes

But the Shanghai Composite Index edged up 0.05%, or 1.48 points, to 3,048.54, while the Shenzhen Composite Index on China’s second exchange rose 0.82%, or 14.30 points, to 1,750.80.

Chinese H-shares listed in Hong Kong rose 0.41% to 5,892.76, while the Hang Seng Index gained 0.57%, or 95.22 points, to close at 16,828.07.

Elsewhere across the region, in earlier trade, Sydney, Singapore and Taipei were also in positive territory but Seoul, Mumbai and Wellington slipped. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.2%.

Expectations for US rate cuts have been evaporating and where in January markets had expected more than 150 basis points in cuts, investors now are not even sure of half that many.

Annualised headline US inflation is seen rising to 3.4% in March from 3.2% a month earlier. US two-year yields, which track short-term interest rate expectations, are their highest since late November at 4.801%, while ten-year yields also hit 2024 highs of 4.46% on Monday.

The dollar has struggled to follow the rates higher, however, with the euro firm in case of a hawkish surprise from the ECB and the commodity currencies rallying. The euro was at $1.0860.

The ECB is expected to hold interest rates but flag a cut the markets have priced for June.

Key figures

Tokyo – Nikkei 225 > UP 1.08% at 39,773.13 (close)

Hong Kong – Hang Seng Index > UP 0.57% at 16,828.07 (close)

Shanghai – Composite > UP 0.05% at 3,048.54 (close)

London – FTSE 100 > UP 0.16% at 7,956.02 (0934 BST)

New York – Dow < DOWN 0.03% at 38,892.80 (Monday close)

- Reuters with additional editing by Sean O’Meara

Read more:

US Won’t Allow Chinese Imports to Kill New Industries: Yellen

China Property Firm Shimao to Fight $202m Liquidation Suit

China Central Bank Announces $70 Billion Loans For Tech Sector

Nikkei Lifted by Bargain-Buying, Hang Seng Flat on Policy Bets