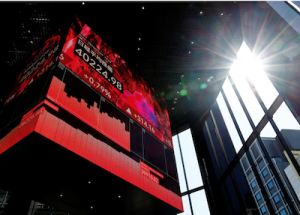

Asian stocks were on the back foot on Thursday after hopes of a sooner-rather-than-later US rates cut were dashed, sending the dollar flying to a 34-year high against the beleaguered yen.

Data overnight showed US inflation in March once again came in hotter-than-expected, decimating the chance of a rate cut in June. Investors, who had been hanging onto the expectation of a cut in two months’ time, now see September as the most likely timing for the easing cycle to start.

Japan’s benchmark stock index fell in the wake of Wall Street’s data-induced slide, while the yen slumped.

The Nikkei share average edged down 0.35%, or 139.18 points, to close at 39,442.63, though the broader Topix was ahead 0.15%, or 4.17 points, to 2,746.96.

The dollar stood at 153.02 yen, having touched 153.24 earlier in the day – its highest level since 1990.

Also on AF: China Firms Order Dozens of Ships For EV, Exports Surge

As the yen slid, Japanese authorities repeated that they were prepared to take action if necessary, hinting at a government intervention. Japan last stepped into the currency markets to prop up the yen in October 2022.

China shares were the outlier, rising as strong performances in copper and gold miners offset the drag from weak consumer data, while Hong Kong stocks tracked overnight losses in Wall Street.

China released worse-than-expected March consumer data on Thursday, maintaining pressure on policymakers to launch more stimulus as demand remains weak. Consumer prices in the world’s second-largest economy rose by a muted 0.1% in March from a year ago, versus a 0.7% rise in February.

China’s blue-chip CSI300 index was flat, inching back 0.01%, with its financial sector sub-index losing 0.23%, the consumer staples sector down 0.86%, its real estate index dropping nearly 1% and the healthcare sub-index slipping 1.04%.

The Shanghai Composite Index rose 0.23%, or 6.91 points, to 3,034.25, while the Shenzhen Composite Index on China’s second exchange edged up 0.08%, or 1.32 points, to 1,721.59.

Chinese H-shares listed in Hong Kong fell 0.7% to 5,974.63, while the Hang Seng Index was down 0.26%, or 44.14 points, at 17,095.03. A sub-index tracking energy shares rose 1.3%, while the IT sector fell 0.6%.

Elsewhere across the region, in earlier trade, Sydney, Singapore, Wellington, Taipei, Bangkok and Manila slipped, while Seoul and Mumbai edged up. MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.3%, paring some earlier losses.

Europe was set for a subdued open ahead of the European Central Bank meeting, with Eurostoxx 50 futures little changed. The ECB is all but certain to hold rates steady but the focus is on whether officials would back a rate cut in June.

Asian Bonds Sell-Off

US stock futures were little changed after Wall Street fell around 1% overnight. Treasuries also steadied after yields surged 20 basis points to their highest levels since November.

Fed minutes out overnight also showed that officials had started to worry that inflation progress might have stalled before the March inflation data, with some raising the possibility that the current policy rate was not restrictive enough.

Asian bonds extended the heavy sell-off in Treasuries. The 10-year Australian government bond yield jumped 14.5 basis points to 4.259%, its highest since mid-February, while the 10-year Japanese bond yield rose 6 bps to 0.855%, its highest since early November.

US Treasuries, meanwhile, steadied on Thursday. The benchmark ten-year yield was flat at 4.5416%, having surged 18 bps overnight, and the two-year yield held at 4.9588%, after a rise of 22 bps the previous session.

In currencies, the dollar was buoyant at a five-month high against its major peers at 105.14, having surged 1.1% overnight, the biggest daily jump in more than a year

In commodities, metal prices were resilient in the face of a strong dollar while oil held gains after advancing more than 1% following an Israeli strike that killed three sons of a Hamas leader, fuelling worries that ceasefire talks might stall.

Brent rose 0.15% to $90.62 a barrel and US crude was 0.1% higher at $86.33 per barrel.

Gold prices gained 0.3% to $2,338.79 per ounce, charging towards record highs, after losing 0.8% overnight.

Key figures

Tokyo – Nikkei 225 < DOWN 0.35% at 39,442.63 (close)

Hong Kong – Hang Seng Index < DOWN 0.26% at 17,095.03 (close)

Shanghai – Composite > UP 0.23% at 3,034.25 (close)

London – FTSE 100 < DOWN 0.14% at 7,949.79 (0940 BST)

New York – Dow < DOWN 1.09% at 38,461.51 (Wednesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Hong Kong Poised to Green-Light First Spot Bitcoin ETFs

Fitch Cuts China Outlook to Negative, Citing Debt, Growth Risks

Germany Reliance on China Remains Ahead of Scholz Visit

Hang Seng Rallies Despite China Downgrade, Nikkei Slips