Asia’s major stock indexes saw a patchy start to the week with US rates concerns, China stimulus hopes, a Wall Street rally and bargain-buying all weighing on investors’ minds.

The mood across the region was subdued as the dollar steadied as traders revised their bets on when the US Federal Reserve will eventually start cutting rates in the wake of yet another blowout jobs report.

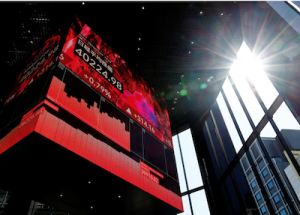

Japan’s Nikkei share average rebounded as investors scooped up beaten-down stocks on the dip, with risk sentiment running high after markets caught the tailwind from a bounce on Wall Street.

Also on AF: Musk Cancels Low-Cost EV Plans Amid Tough China Competition

The Nikkei share average was up 0.91%, or 354.96 points, to close at 39,347.04, while the broader Topix was ahead 0.95%, or 25.70 points, to 2,728.32.

The largest percentage gainers were chip-related firm Socionext Inc, up 7.19%, followed by Tokyo Electric Power Company Holdings gaining 3.93%.

The Nikkei hit an all-time high of 41,087.75 on March 22, although the index has struggled to keep above 40,000-point mark since, posting two consecutive weekly losses.

Last week, the benchmark index saw its worst weekly performance since December 2022 as US stocks slipped and profit-taking kicked in. The risk of currency intervention by Japanese authorities also weighed on the market.

Still, the Nikkei has gained 16.5% year-to-date, while analysts appeared to dismiss recent declines as signs of a larger reversal.

China stocks fell as the market reopened after extended holidays, tracking subdued regional markets on overseas rate concerns, while investors awaited more economic data.

China’s blue-chip CSI300 index was down 0.88%, with its financial sector sub-index lower by 0.22%, the consumer staples sector down 2.7%, the real estate index down 0.92% and the healthcare sub-index down 1.5%.

The Shanghai Composite Index lost 0.72%, or 22.24 points, to 3,047.05, while the Shenzhen Composite Index on China’s second exchange fell 1.78%, or 31.47 points, to 1,736.49.

Shimao Shares Slide

Chinese H-shares listed in Hong Kong rose 0.02% to 5,864.55, while the Hang Seng Index edged up 0.05%, or 8.93 points, to 16,732.85.

The tepid performance came even as Hong Kong’s leader John Lee said on Monday the authorities were considering additional measures to bolster the securities market in the Asian financial hub, which has taken a hit from China’s economic slowdown and geopolitical tensions.

Chinese property developer Shimao Group tumbled 14.3% after it said on Monday that China Construction Bank (Asia) had filed a liquidation petition against it in Hong Kong over its failure to repay loans of $201.75 million.

Elsewhere across the region, in earlier trade, Sydney, Seoul, Singapore, Mumbai and Taipei rose but Manila and Wellington were down. MSCI’s Asia ex-Japan stock index was firmer by 0.17%.

Investors’ focus this week will be on the US Consumer Price Index (CPI) report. In China, credit data, inflation readings and trade figures are also due this week.

European stock markets looked set for a muted open, with Eurostoxx 50 futures up 0.04%, German DAX futures up 0.05% and FTSE futures 0.10% higher. E-mini futures for the S&P 500 eased 0.10%.

Data on Friday showed US job growth blew past expectations in March and wages increased at a steady clip, suggesting the economy ended the first quarter on solid ground.

Markets are now pricing in a 48% chance of an interest rate cut from the Fed in June, the CME FedWatch tool showed, down from around 60% a week earlier, with July shaping up to be the new starting point for the eagerly awaited easing cycle.

Yen Weakens Again

Investors are also pricing in 62 basis points of cuts this year, less than the 75 basis points the Fed has projected.

The changing expectations on the outlook for US rates have lifted Treasury yields, with the two-year Treasury yield, which typically moves in step with interest rate expectations, up 4.8 basis points at 4.780%, the highest in over four months.

The yield on 10-year Treasury notes was up 4.6 basis points to 4.424%. The elevated yields boosted the dollar, with the euro down 0.04% to $1.0831, while sterling was last at $1.2627, down 0.07% on the day.

The Japanese yen weakened 0.11% to 151.77 per dollar as traders remain on alert for possible intervention by Japanese authorities.

The dollar index, which measures the US currency against six rivals, was at 104.34.

The European Central Bank is due to meet later this week and is widely expected to keep rates steady. Investors see almost no chance of a cut on April 11 but have fully priced in a move for June, followed by another two or three steps later this year.

In commodities, spot gold added 0.6% to $2,343.49 an ounce, having breached record peak last week.

US crude fell 1.51% to $85.60 per barrel and Brent was at $89.75, down 1.56% on the day.

Key figures

Tokyo – Nikkei 225 > UP 0.91% at 39,347.04 (close)

Hong Kong – Hang Seng Index > UP 0.05% at 16,732.85 (close)

Shanghai – Composite < DOWN 0.72% at 3,047.05 (close)

London – FTSE 100 < DOWN 0.03% at 7,908.62 (0935 GMT)

New York – Dow > UP 0.80% at 38,904.04 (Friday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Central Bank Announces $70 Billion Loans For Tech Sector

Nikkei Meltdown After Fed Puts Dampener on Rate Cut Hopes

Yellen Warns China on ‘Excess Production, Unfair Trade’

Nikkei Lifted by Weak Yen, Profit-Taking as Asia Shares Rally