(ATF) In a game-changing reform that could reshape India’s bond market and the saving habits of the nation, the Reserve Bank of India, in its monetary policy announced on Friday, allowed retail investors to open gilt accounts with the central bank and trade in government bonds.

The retail investors can take positions both in primary and secondary markets, the RBI added.

This is a “revolutionary move” and “a giant step” by India, said experts, that will provide retail investors greater access to the government bond market via a new direct investment option – something that bond market experts have been long suggesting.

Read more: Bank of China issues $500 million in bonds as Yulan makes its debut

It will also help the government borrow easily for financing deficit. In the Union Budget for fiscal year 2021-21 announced last Monday, the government had set a target of borrowing $1.6 trillion (Rs 12 trillion) for financing the fiscal deficit of 9.5% of GDP.

“As part of continuing efforts to increase retail participation in government securities and to improve ease of access, it has been decided to move beyond aggregator model and provide retail investors online access to the government securities market – both primary and secondary – along with the facility to open their gilt securities account (‘Retail Direct’) with the RBI. Details of the facility will be issued separately,” the RBI said in a statement.

“Encouraging retail participation in the Government securities market has been the focus area of the Government of India and the RBI,” the central bank said.

A Government Security (G-Sec) is a tradeable instrument issued by the Government or the State Governments. It acknowledges the Government’s debt obligation.

TREASURY BILLS

These instruments are usually issued for short term- called treasury bills with maturities of less than one year – or long term – called Government bonds with maturities of one year or more.

In India, the Central Government issues both, treasury bills and bonds while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

“This is a huge move. The gilt market in India could be bigger than the (bank) fixed deposit market (estimated to be $18 trillion) due to its certainty of returns and almost zero credit risk. So far retail investment in gilts was stymied by access. Unlike bank branches, there were no RBI branches for an investor to walk in and buy gilts,” Dhruv Mehta, Chairman of Sapient Wealth Advisors & Brokers told Asia Times Financial.

IMPROVED ACCESS

By allowing retail investors open gilt accounts directly, RBI will not only improve the access for retail investors but also democratise and facilitate government’s borrowings, he added.

Although the government had allowed retail participation in G-Sec auctioning around two years back, and investors are also permitted to buy G-Secs and T-bills via the two stock exchanges (NSE and BSE) “there is hardly any direct retail participation in gilts primarily because of lack of easy availability of gilts,” says Harsh Roongta, founder of Fee Only Investment Advisers Llp, a SEBI-registered investment adviser.

That’s because, for one, these auctions take place on Fridays, while those for T-bills are held on Wednesdays. Besides, just five per cent of these auctions are reserved for non-competitive bidding by retail investor.

“The liquidity of gilts is extremely low on the exchanges (as well) because these instruments are typically held by large institutional investors like banks and mutual funds. With the RBI opening gilts to retail investors, I am sure market makers will emerge to provide two-way quotes to gilts traded in the secondary markets as well,” said Mehta.

The growth of fixed deposit products of banks, however, could get hurt but Das added: “Considering the banks have so many other functions and services which they render, we feel that this will not undermine the flow of deposits to banks or mutual funds.”

RATES UNCHANGED

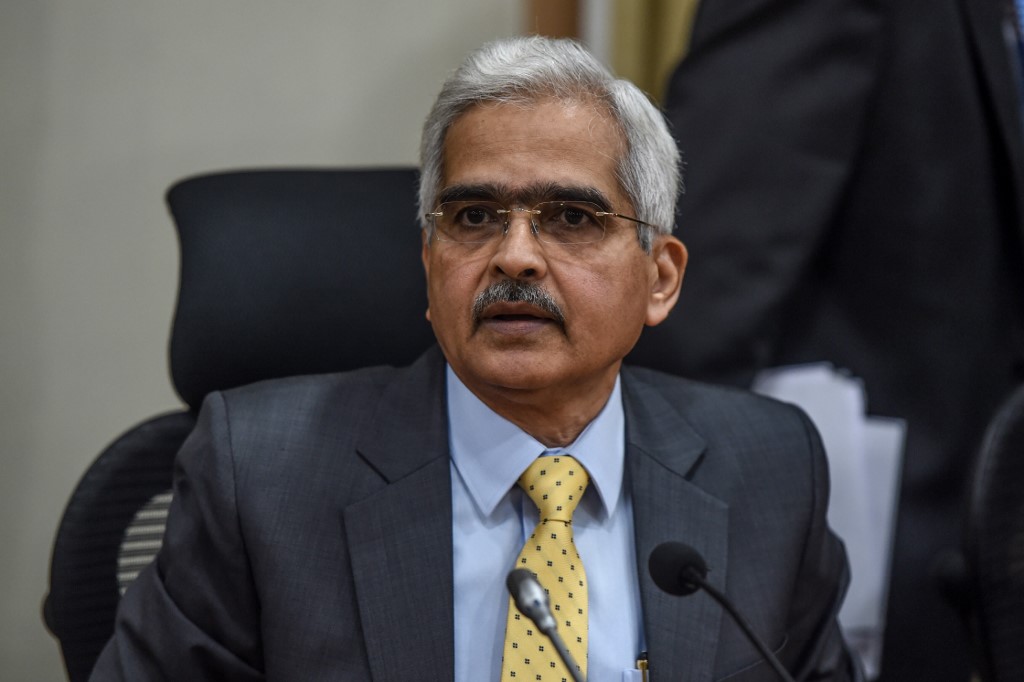

In another significant announcement and as widely expected, the RBI decided to keep the benchmark repo rate, ruling at the lowest since 2020, unchanged at 4%, and the reverse repo rate at 3.35%.

The repo rate has been cut by a total 115 basis points since March 2020 to cushion the shock from the pandemic, following a 135-bps reduction since beginning of 2019.

Das said that in view of the Covid and the resultant stress in the system, the monetary policy committee (MPC) unanimously decided to keep rates on hold.

“Overall, with RBI reiterating the dovish stance on rates, we see policy rates on status quo in FY22. The liquidity stance is unlikely to diverge from the accommodative policy stance in the near term especially as current liquidity deluge is not necessarily feeding into present inflation dynamics,” said Madhavi Arora of Emkay Global.

The RBI governor also exuded optimism on the economy and projected a 10.5% growth rate for the GDP in the financial year 2021-22.

HARDENING PRICES

Commenting on the recent hardening of prices in the economy, he said that inflation should be at 5.2% for the current quarter, and 5.2-5% for the first half of the next fiscal which “would be within the limit of RBI’s policy mandate of keeping the consumer price index (CPI) inflation within 2-6%”.

“The growth outlook has turned more positive, which also appears to have convinced the Committee to stand pat. Governor Das stated that signs of recovery have strengthened further since the last meeting and that the Union Budget for FY21/22 would help to reinvigorate domestic demand. Given this, it seems that further cuts to policy rates are now unlikely,” Shilan Shah, Senior India Economist at Capital Economics told ATF.

But Shah also said that despite all the optimism over the recovery, the economy will still suffer repercussions from the crisis over the coming years, most notably a heavily impaired banking sector.

That will prevent a rapid return to the pre-crisis GDP trend, according to him, which is why, “the RBI would continue with the accommodative stance of monetary policy as long as necessary – at least through the current financial year and into the next year – to revive growth on a durable basis,” he said.