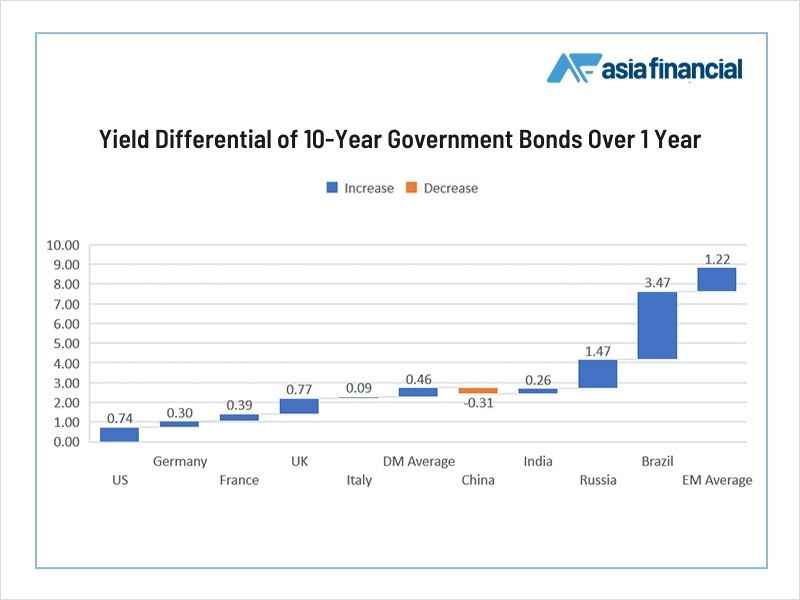

A steady rise in 10-year government bond yields in developed markets is ringing alarm bells in emerging nations.

The chart shows that in the past year, the yields on the benchmark 10-year government securities in richer nations have risen by an average of 46 basis points. One basis point is 0.01%.

Yields rise when bond prices fall and their upward march is often a signal that investors expect hawkish central banks to raise interest rates.

Increases in the cost of borrowing in developed nations boosts the relative value of assets issued there, making them more attractive to investors.

The resulting capital flight tends to stoke volatility in emerging economies’ markets. That’s likely to be amplified at a time when emerging economy governments grapple with weak growth, soaring inflation and energy prices following the Covid shock.

The outcome will depend on nations’ reactions to the higher-yield environment.

The impacts are by no means likely to be equal across emerging nations. The economic picture in China, for example, is very different to that in many other economies, with divergences in growth, inflation, the pace of vaccinations and new infections. All those factors will influence how individual central banks adjust policy in the future.

“We expect asynchronous growth in emerging markets to continue, which is highly likely to drive divergence in central bank reaction functions across the region,” said Alan Wilson, emerging market debt portfolio manager at Eurizon Capital, in a recent note.

• By Karan Mehrishi

Also on AF

Emerging Markets Face Heightened Risk of Financial Crises as Rates Rise: Nomura