(ATF) Returns on Chinese corporate bonds rose amid signals the central bank is pausing stimulus measures and as officials said they’d concentrate firepower on boosting the recovery in the private sector.

Financial bonds advanced after the People’s Bank of China (PBoC) resumed its programme of liquidity injections into the financial sector and following an announcement that profitability among brokerages had increased under recent capital market reforms. The debt of Henan Investment Group and Henan Transport Investment Group also climbed after the province was named among regions that would benefit from new government measures to improve local economies hit by the coronavirus.

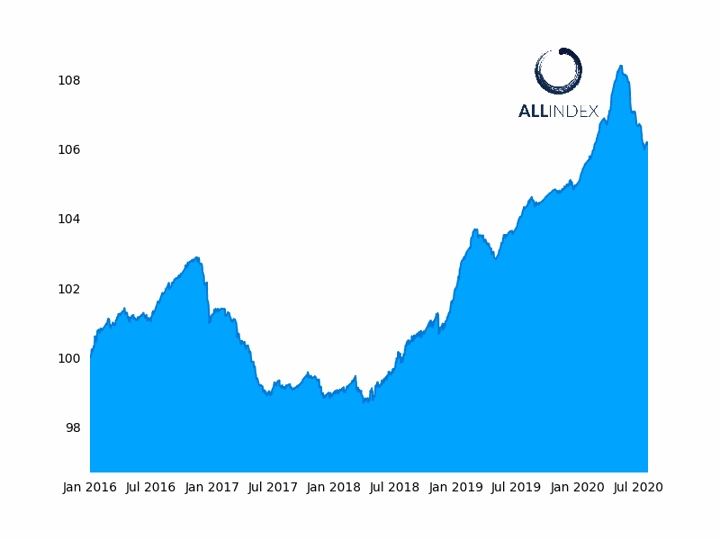

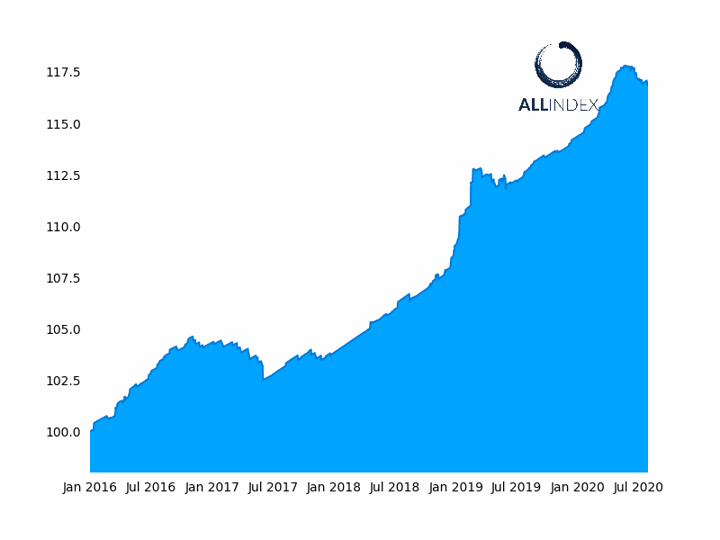

The ATF China Bond 50 Index climbed 0,05%

The benchmark ATF China Bond 50 Index climbed 0.05% after snapping a six-day winning streak yesterday. Among the ALLINDEX sub gauges, Corporates advanced 0.03%, Enterprises added 0.01%, Financials rose 0.04% and Local Governments jumped 0.07%.

Chinese corporate debt returns are showing signs of recovery from a selloff sparked at the height of the coronavirus pandemic in March by investors moving into special bonds issued to counter the pandemic’s economic fallout. Recent gains have coincided with signals the PBoC will continue a two-month pause in stimulus measures, which tend to erode the appeal of fixed-income securities. Sovereign-bond yields near record lows have also made riskier corporate debt more attractive to investors.

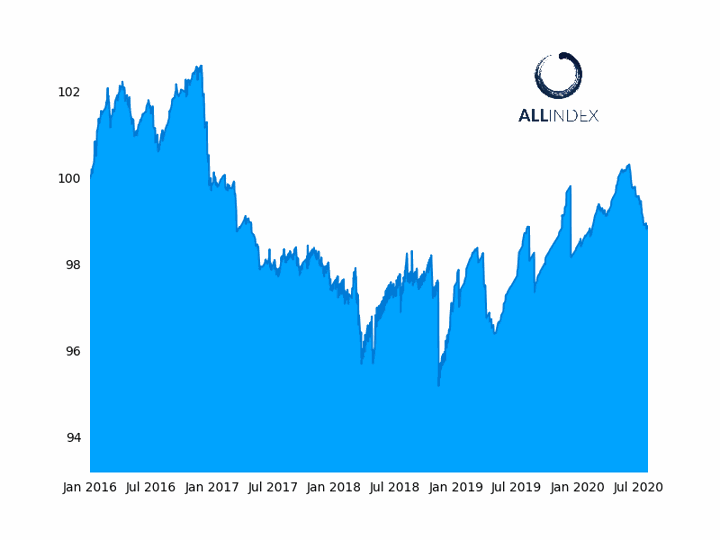

The ALLINDEX Corporates Index advanced 0.03%

Financials climbed after the Securities Association of China said the nation’s 134 listed brokerages saw operating revenue rise 19.3% to 213.4bn yuan in the first half of the year. Net profits edged up 25% to 83.3bn yuan. Of those, 124 reported profit growth in the first half, statistics showed.

CITIC Securities bonds added 0.47, Haitong Securities increased 0.32 and China Securities advanced 0.36.

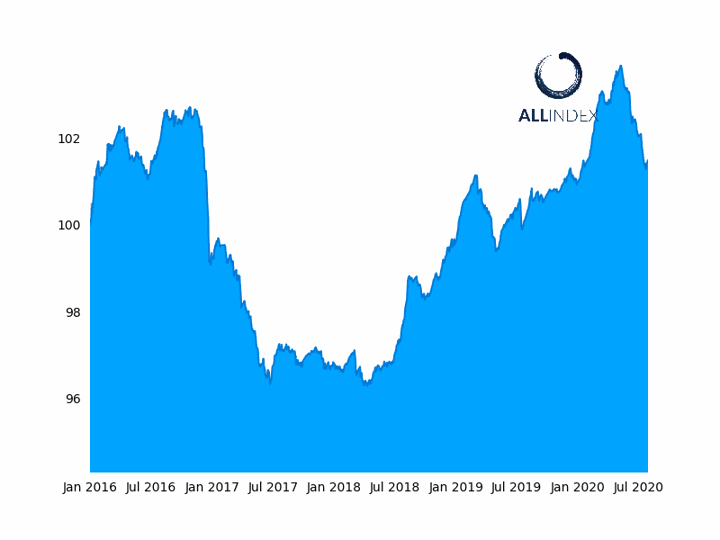

The ALLINDEX Enterprises Index added 0.01%

China has sought to reform its capital markets to prevent bubbles appearing in sectors such as real estate, to lure more foreign investment and also to deflate the huge build up of corporate debt that threatened to weigh down the economy.

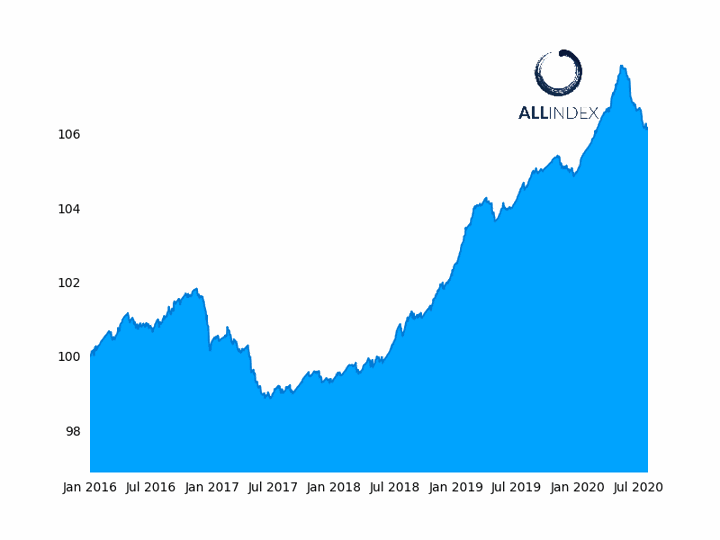

The ALLINDEX Financials Index increased 0.04%

The PBoC injected 70 billion yuan ($11.5bn) into the banking system on Monday to give lenders enough liquidity to continue funnelling funds into recovery efforts for the private sector. Bonds of banks rose, including Bank of Jiangsu (0.01).

Local Governments climbed the most as more fiscal stimulus was promised for the regions. Bonds of The People’s Government of Ningbo rose 0.89 following an announcement that the local Communist Party had ordered the creation of a “high-level innovation centre” in the city. Henan Investment Group and Henan Transport Investment Group saw their debt increase 0.78 and 0.01, respectively.

The ALLINDEX Local Government Index jumped 0.07%