(ATF) In Hong Kong, the transition from face-to-face to contactless interactions has been swift and widespread as a result of the Covid-19 pandemic.

The so-called “new normal” economic activities such as online shopping, digital payments, and remote working have accelerated as consumers and businesses adapt to the new environment. As a result, e-commerce sales and the transactions over the faster payment systems (FPS) rose sharply in 2020, with the latter having grown by more than 80% compared with the first half of last year.

Traditional sectors such as education and healthcare have also switched to new digital technologies to facilitate e-learning and telemedicine, respectively, during this period.

This transition, which is supportive of Hong Kong’s longer-term growth potential, is not new. It reflects a continuation of structural changes in consumers’ preferences and business models that began before the social unrest in 2019 and the pandemic. This shift has been notable in areas such as e-commerce, digital payments and spending on information and communications technology (ICT).

A boom in e-commerce

For example, ICT spending by businesses and the government more than doubled in one decade, reaching HK$90 billion ($11.6 billion) in 2018. On the e-commerce front, more than one-third of Hong Kong residents made purchases online in 2019, and the share of online sales of total business receipts also grew significantly from close to zero in 2000 to about 6% in 2018.

These trends are expected to accelerate in the post-pandemic economy due to underlying shifts in consumers’ preference and businesses. The 2020 Annual Consultation Report on Hong Kong, published by the ASEAN+3 Macroeconomic Research Office (AMRO), shows that not everyone will benefit equally from this shift.

Some segments of households and small and medium-sized enterprises (SMEs), as well as the hard-hit sectors, would benefit less than the other sectors in the “new normal” economy, potentially leading to widening skills gap and economic inequalities.

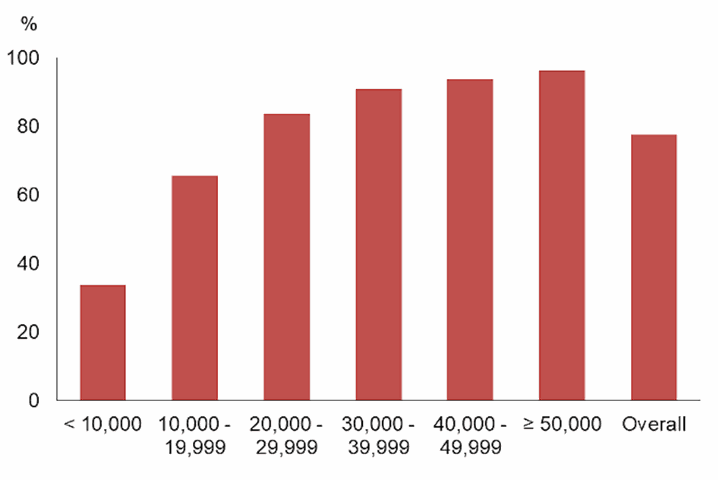

Although close to 94% of Hong Kong residents have access to the internet at home – which is among the highest rates in the world, lower-income households have much less access to basic ICT and internet connectivity compared to the higher-income families (see Figure 1).

Figure 1: Share of households with personal computer and internet access by monthly household income, 2020

Source: Thematic Household Survey Report 69: Personal Computer and Internet Penetration). Hong Kong Census and Statistics Department

This digital divide can in turn have significant effects on students’ educational outcomes should home-based e-learning become a permanent feature of future education. In addition, statistics show that smaller firms tend to be less engaged in e-commerce activities than larger firms (see Figure 2), disadvantaging them in the “new normal”.

Figure 2: Firms receiving and placing orders online, 2019

Source: Hong Kong Census and Statistics Department

In light of this, there is certainly scope for policymakers to facilitate a more rapid and inclusive transition to the “new normal” economy. First, continue to bolster ICT spending, digital skills training for workers, and supporting smaller firms’ digital capacities.

Previously, the government had rolled out several measures to boost firms’ digital capabilities. One example is the launch of the Distance Business Programme (D-Biz), funded by the Anti-Epidemic Fund, to encourage firms to adopt digital solutions during the pandemic. Another initiative is the Reindustrialisation and Technology Training Programme launched in 2018 to support workers’ training in advanced technologies and digital skills.

Inclusivity is the key

As such, D-Biz should be enhanced so that smaller SMEs can have access to greater support. The duration of the scheme can potentially be extended to support Hong Kong’s digitisation efforts and spur greater ICT investments more broadly.

Workers in the hard-hit sectors should also be encouraged to explore these re-skilling opportunities.

Secondly, there is a need to boost digital literacy and accessibility for lower-income households, particularly schooling-age children in these families. This can be achieved through targeted subsidies, cash or in-kind transfers, for example, through the provision of e-learning devices or subsidised internet bills.

As in other economies, the pandemic has accelerated the transition from traditional to online economic activities in Hong Kong. Providing necessary support for businesses and households will enable the economy to reap this opportunity toward digital transformation.