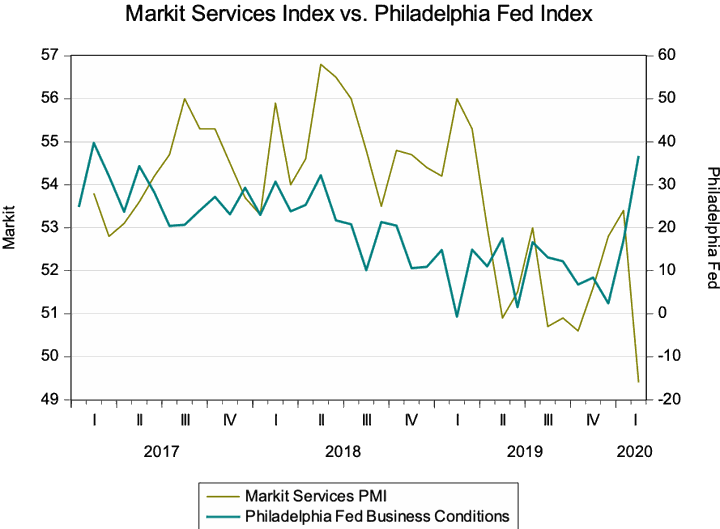

Stock markets shuddered Friday morning after the economic data firm Markit published the lowest number in years for its US services index of purchasing managers. At 49.4, the Markit services index shows a contracting US services sector. Services drove US economic growth during 2019, while manufacturing contracted by about 1%. Yesterday, the Philadelphia Federal Reserve business conditions index showed its biggest jump since June 2009, pointing in the opposite direction. Which should investors believe?

In a February 21 press release, Markit’s economists suggested that the plunge in their index was motivated by “speculation regarding coronavirus,” noting that business confidence and employment still were rising: “Although only fractional overall, the rate of decline was the strongest in the series history (since October 2009). New export orders also fell as firms reported greater hesitancy among clients to place orders amid speculation regarding coronavirus . As a result, services companies increased their workforce numbers at a softer rate. That said, business confidence reached the strongest since last June.”

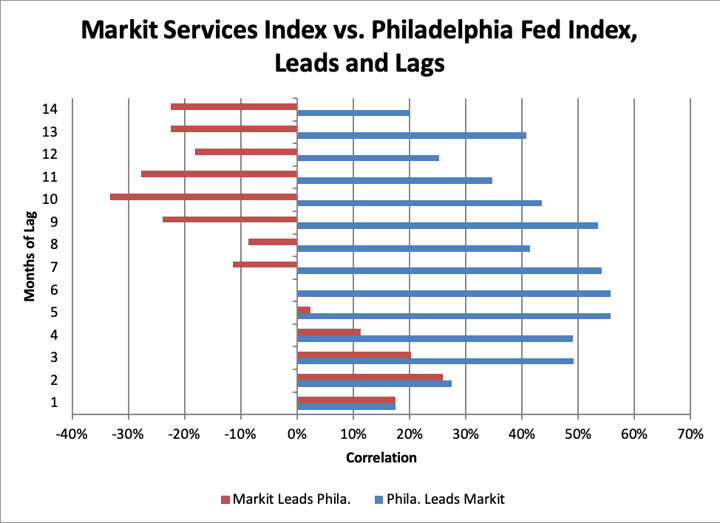

There is a simple way to judge which survey gives a better gauge of future economic activity. That’s the extent to which past values of one survey predict future values of the other. By this measure, the Philadelphia Fed index looks forward while the Markit survey looks backward.

The chart below shows the correlation of leads and lags in the two surveys.

It is striking that past values of the Philadelphia index are highly correlated with future values of the Markit survey. Each month’s reading for the Philadelphia index, in other words, shows a correlation of around 50% with subsequent values of the Markit Index over the following three to nine months.

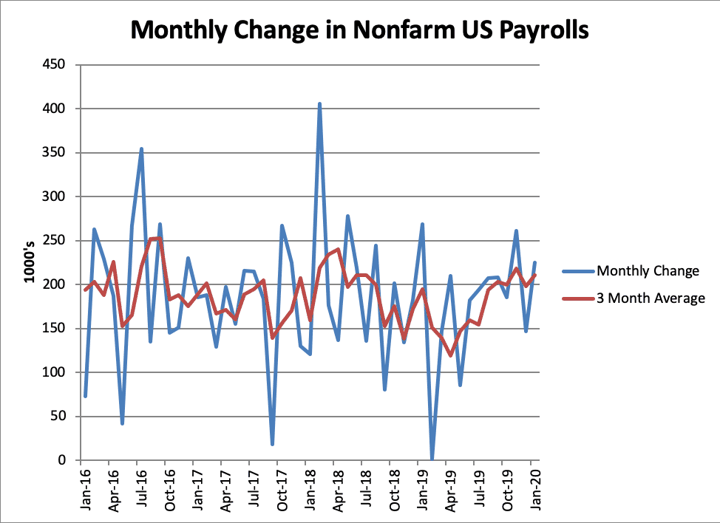

The winner is the Philadelphia Federal Reserve. Another corroborating piece of evidence is the Bureau of Labor Statistics’ monthly survey of US establishments. Hiring by US companies was at the high end of its recent range in January. That would be hard to reconcile with shrinking business in the services sector.