(ATF) Just as the global economy is showing signs of a post-pandemic recovery, a new source of uncertainty is now upon us. On 3 November, United States voters will elect into office their president, all 435 House of Representatives, and 35 out of 100 Senators. The US sets the economic tone for the rest of the world, so global investors are keenly following the election and its likely impact on the economy and markets.

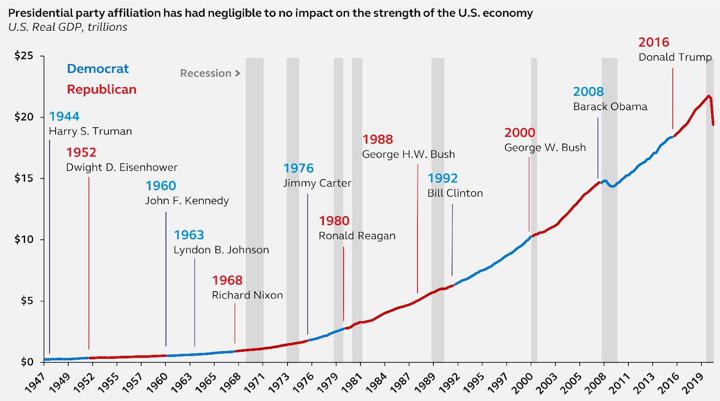

Given the differing approaches of the Democratic and Republican parties on a range of issues, investors should remain objective through the election year and focus on the fundamentals driving markets. Our research dating back to 1928 shows that significantly adjusting portfolio allocations to position for the most likely winner is an unnecessary, long-term investment strategy. Markets continuously reprice the probability of future economic policies so election-related volatility is to be expected but typically short-lived.

Once the elections pass, markets should reassert a trajectory driven by the economic recovery and easy financial conditions created by historically accommodative monetary policy and ample liquidity, Investors are also better suited following the Federal Reserve while monitoring structural issues (such as potential regulation of Big Tech and the growing US deficit), earnings performance, and policy stimulus.

Additionally, there are no statistical correlations between the political party in office and equity market performance. In fact, post-World War II, the median annualized returns over the three-year periods following elections were a strong 13%. So, irrespective of the party in power, US stock markets tend to follow a path led by fundamentals, rewarding investors for the economic growth both parties have focused on creating over the past 70 years.

Source: US Federal Reserve, Principal Global Asset Allocation, as of August 2020.

Alternatively, there is a bias for 10-year US treasury yields, which have moved 36 basis points higher during periods of full Democratic control versus -16.8 bps under a divided government and 1.8 bps when Republicans are in full control.

What could make this election different?

While longer-term return paths align with the growth trajectory, there could still be short-term volatility induced by the electoral process. An unprecedented turnout is expected for this year’s elections and as much as 25% of total votes could be cast using mail-in ballots. There is already noise around the process of counting mail-in votes, which has increased the probability that there may not be a confirmed outcome for several days or even weeks after the election date.

While equity markets are already pricing in some of this uncertainty, they are not prepared for something that ends up either in courts or with Congress for a final resolution. In that case, markets could correct meaningfully in anticipation of a fractious sharing of power if it is not a clean sweep for the winning party. Yet, that will likely make equities attractive from a longer-term perspective.

What are the implications for investors in Asia?

While both President Trump and his Democratic opponent, former Vice President Joe Biden, are likely to follow expansionary policies, a Democratic administration will likely result in higher taxes. US corporate taxes could rise from 21% to 28% while individual taxes for higher income individuals could rise to accommodate a large infrastructure spending plan.

Higher US fiscal and current account deficits, low US real yields, and an expensive dollar should cause investor allocations to rise in emerging markets, including Asia. This possibility is making emerging markets equities and fixed income more attractive, especially as they are complemented by improving growth dynamics, a decent pace of economic re-opening despite rising new Covid cases, cheaper valuations, and relative underperformance in the past few years.

The relationship between the US and China, which is at its lowest in several years, could also be altered by the election. While the strategic tussle has an element of permanence to it irrespective of who wins the election, the approach to solving the issues will likely be different – and probably less fractious – if a new administration is elected. Having said that, markets will concentrate on growth and ignore the noise, as they did during the last four years when US and offshore Chinese equities outperformed most other equities. Because of inherent strengths, both remain preferred investment destinations, alongside beneficiaries of the cyclical recovery like South Korea.

Fiscal policy decisions will certainly factor into the equation, too. If a new stimulus package is not agreed upon before the election, it’s likely that common ground will be found after to help spur the US economy and, along with it, the global economy. The impact of such a package will reflect in Asia through higher exports, with key beneficiaries being the open trade economies like Singapore, Korea, Taiwan, and China.

Overall, investors should patiently ride out election volatility and focus on the fundamentals. While risks are abundant, the fundamentals are generally positive. Equity valuations are rich, but they can stay rich in an environment of extremely low interest rates. Investors should devise well-diversified, asset allocation plans based on their life cycles and stay true to them while navigating these uncertain times.

# Binay Chandgothia is managing director & portfolio manager at Principal Global Investors

Disclaimer: Investing involves risk, including possible loss of principal. Expressions of opinion and predictions are accurate as of the date of this communication and are subject to change without notice. There is no assurance that such projections will occur. Principal Global Investors leads global asset management at Principal®