Wall Street is turning more optimistic on prospects for China stocks.

JP Morgan says growth momentum is likely “bottoming out’’ and is “constructive on China equities in 2022.’’ It recommends investors “overweight China’’ on factors including policy easing and potential progress in US-China relations.

Goldman Sachs also is cautiously optimistic. While acknowledging risks from China’s zero Covid policy and regulatory crackdowns, it says equity prices already reflect many of those factors and “offer attractive valuations.’’ Its strategists recommend overweighting stocks and say the market continues to be underinvested.

France’s Societe Generale is even more upbeat. It says China has the highest upside potential (16%) of all markets in Asia, in large part because monetary policy is set to ease further. Whereas most analysts remain wary of internet stocks, SocGen is optimistic about prospects in that sector, too.

“The worst is in the past for China’s internet sector,’’ says head of Asia equity strategy Frank Benzimra. “We think that the incremental crackdown is narrowing to specific cases, in contrast to a wider crackdown six months back.’’

UBS is another investment bank that also says regulatory uncertainty is priced into China stocks. Head of Asia Pacific strategy Niall MacLeod makes a case for a market rebound this year. He sees earnings improving, especially in internet stocks, as regulatory headwinds ease.

MARKET INSIGHTS: China Stock Market Guide: Everything You Need To Know

China Stocks Uninvestable?

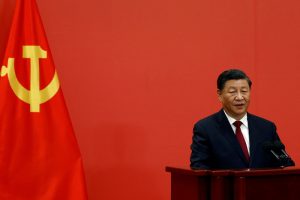

The shift follows a brutal 2021 for segments of China’s stock market that led to questions over whether policy risks had left it uninvestable. State media had said President Xi Jinping’s push for so-called “common prosperity’’ is a “profound revolution’’ and that markets ”will no longer be a paradise for capitalists.’’

The more upbeat outlook comes despite an ongoing regulatory crackdown that wiped $1.5 trillion off tech valuations, sharply slowing growth, Evergrande’s debt crisis and the added uncertainty of the Omicron variant.

Crackdowns on tech and housing prices helped push China’s CSI 300 index down almost 7% over the past year while the Hang Seng Tech index plummeted more than 34%. The Nasdaq Golden Dragon China Index, which tracks China companies listed in the US, plunged more than 42% after US regulators advanced plans to delist companies for failing to comply with auditing norms.

Not everyone is so sanguine. Morgan Stanley sees continued risks into 2022 for MSCI China, citing “earnings headwinds, extended tight liquidity, US/China non-trade tensions, and near-term property market volatility,” according to analysts led by Laura Wang.

“The MSCI China benchmark is above its five-year historical averages,’’ says Malcolm Dorson, portfolio manager for global emerging market equity products at Morae Asset Global Investment, a Korea-based investment manager. “Growth is slowing down, risk premiums are up, return on investment is below historical average levels. I wouldn’t say it’s attractive.’’

Nomura Holdings says the worst is yet to come for China and sees growth slipping to 2.9% this quarter from a year earlier

China Stocks ‘Chronically Under-owned’

Still, while many financial commentators fret over the risks from China’s crackdown on home prices and the debt crisis at property developer China Evergrande, London-based hedge fund Eurizon SLJ Capital says China’s efforts to deleverage its economy is building stronger foundations for future growth.

“Beijing will not permit a systemic crisis stemming from Evergrande,’’ say analysts Alan Wilson and Joana Freire. “Why would policymakers risk triggering a crisis when their actions were aimed to reduce such risks in the first place? Sell-side calls for a financial crisis in China miss the point entirely.”

They see China at the forefront of the global recovery in coming years and say China’s capital markets remain chronically under-owned.

“The Chinese bond and equity markets are now close to, respectively, $20 trillion and $12 trillion in size, with a small share owned by foreign investors (about 3.5% for bonds and 7% for equities),’’ they say. “The process of the world raising its exposures to Chinese assets has barely begun; inflows into both Chinese bonds and equities are likely to remain very substantial in the years ahead, which will in turn underpin a structurally stronger renminbi.’’

- By Janice Kirkel

Read more:

‘More Robust’ Beijing Bourse Set to Boost China Exchange Rivalry

How To Invest Amid China’s Era of ‘Common Prosperity:’ Societe Generale

China Media Call Xi’s Regulatory Storm a “Profound Revolution’’