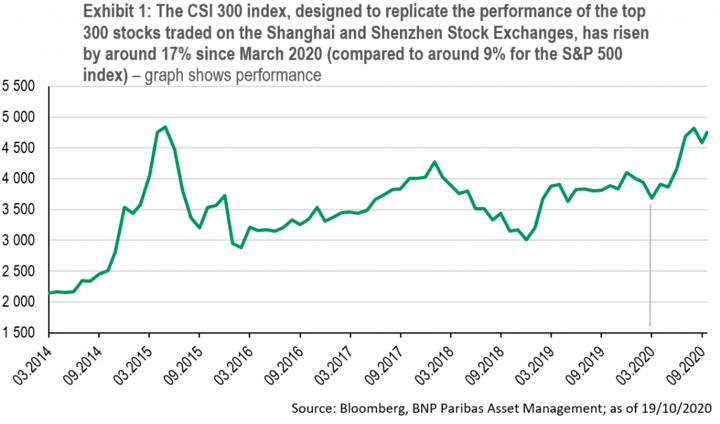

(ATF) In the past, China’s stock markets were prone to boom and bust. After a rally that has seen the CSI 300 index rise by about 17% since March, David Choa, head of BNP Paribas Asset Management’s Greater China Equities team in Hong Kong, explains why this time may be different for Chinese equities.

Compared with the 2015 market cycle and relative to equity markets in other regions, I have no doubt that Chinese equity markets are now on a much better footing. This year’s rally has had a different set of factors driving it.

Strong fundamentals

China has so far achieved better control of Covid-19 than many other major economies. The country is close to emerging from the coronavirus tunnel and its real-time economic indicators are largely back to pre-Covid levels. China’s second-quarter gross domestic product GDP figures were actually positive! The economy expanded by 4.9% year-on-year in the third quarter with industrial growth driving the recovery. China is likely to be the sole major economy to register positive growth in 2020.

China’s economy is now better balanced than in the past. Its constant structural economic reforms are helping it to shift consumption and investment to meet domestic demand, backed by fast-growing, innovative homegrown technology and healthcare champions.

If there was either a resurgence of coronavirus in China or greater geopolitical tension, the country would still have considerable fiscal and monetary firepower to maintain stability, as the government has shown restraint in such measures in the past few months.

China’s authorities today have better control of the balance sheet. Reducing risk in the financial system remains a top priority. Beijing is getting on top of shadow banking to limit market risks. For example, the use of margin lending to buy equities is less prevalent now than it was in 2015, while inflows into Chinese stocks this year reflect increased risk appetite rather than a surge in borrowing.

Highly supportive technical factors

While China has until now been underweight in many international investors’ portfolios, in my view we are seeing the tide starting to reverse. In the post-pandemic world, investors are likely to need a standalone China allocation rather than just holding Chinese stocks via an emerging market allocation.

Accelerating reform in China’s capital markets is providing more efficient access to the local market. Foreign investors seem to have been reassured by a more predictable regulatory landscape, underpinned by Beijing’s five-year planning system. The goals are a) to improve the allocation of capital; and b) to develop long-term pension and insurance products that will offer savers an alternative to speculating on property or accepting meagre returns on bank deposits.

This year’s renminbi strength reflects overseas money flowing into China’s asset markets. Chinese government bonds currently yield about 3%, dwarfing yields in advanced economies. Leading bond and stock index providers have added China to their main emerging market benchmarks. Beijing is determined not to interrupt this trend. Foreign capital has an important role in developing China’s financial markets and recapitalising the banking system.

The effects of quantitative easing 2.0 include abundant liquidity and investors are looking for regions with economic growth and finding very little – but they see opportunities in China.

China’s tech sector is more diverse

There has been much discussion about the fact that a small number of tech stocks have driven the rally in US equities this year. Tech is also a hot segment in China, but the situation is different for several reasons.

While the US equity market has just a few truly dominant tech players, the sector in China is more diversified. There is more than one leader in each segment. For example, there are numerous large e-commerce players, none of which dominates the segment.

Tech development in many sectors is still in its infancy. China has fast-growing companies across the whole value chain – from upstream to downstream, from hardware to software, cloud and infrastructure. Historically, China’s tech focus has been on consumer applications. It is now shifting to business applications where there is huge catch-up potential versus global peers. This is a key area for growth.

Consumption

The Chinese government is continuing to push for more local consumption, particularly when the economic recovery in the rest of the world is on a weaker footing. Wealth levels have reached an inflection point: China’s consumers want a better lifestyle in terms of education, leisure and food rather than just branded physical goods.

And don’t forget, China still has enormous traditional industrial and manufacturing sectors. Brands and companies that capitalise upon the digital transformation to improve their image, gain new sales channels such as online platforms and improve productivity – such as through using better data to flatten distribution channels. They are winning market share and are secondary beneficiaries of the tech boom.

Innovation doesn’t stop with tech

China is moving up the value chain in the healthcare sector, from globally competitive contact research organisations conducting cutting-edge research for global biotech firms, to medical device manufacturers producing equipment such as computed tomography scanning and imaging systems. The quality gap with China’s international peers is narrowing and advances are being made at a much lower cost.

In conclusion, three key themes stand out for this asset class:

Innovation

China is devoting resources and placing much emphasis on promoting technology development, to not only escape from dependence on US tech, but also because China has large traditional sectors such as industrials that urgently need to upgrade their productivity.

China is unique in the sense that it is not only a major manufacturing hub; it has a vast domestic market. This gives it more potential synergies and gains on both fronts.

In turn, this means the beneficiaries can be found beyond the traditional technology enablers such as the big internet consumer names. Healthcare and even non-tech consumer and industrial companies that can improve their sales and margins via extensive digital transformation will benefit.

Consumption

China’s consumers are already beyond the point of wanting simply Western-branded products. They now seek a better lifestyle. The equity market sectors that stand to benefit extend beyond the traditional retail sectors to areas such as education, healthcare and well-being, entertainment and food consumption.

Given China’s enormous population, this is a vast market with many emerging local brands that are gaining awareness and winning business from consumers.

Consolidation

As the pace of growth in China moderates after a decade of rapid expansion, companies need to think about more than just revenue. They need to focus more on R&D, productivity and costs. Those with progressive mindsets should be able to increasingly pull away from the competition and drive consolidation. This looks set to happen not only in the old industrial sectors, but also in the new economy.

In our view, these major themes appear likely to stand the test of time, regardless of external factors such as Covid-19. Indeed, the aftermath of the pandemic is accelerating them.