(ATF) Chinese financial bonds led gains on the nation’s benchmark gauge of corporate and municipal debt Monday as investors bet that Joe Biden’s defeat of Donald Trump in the US election would boost foreign inflows.

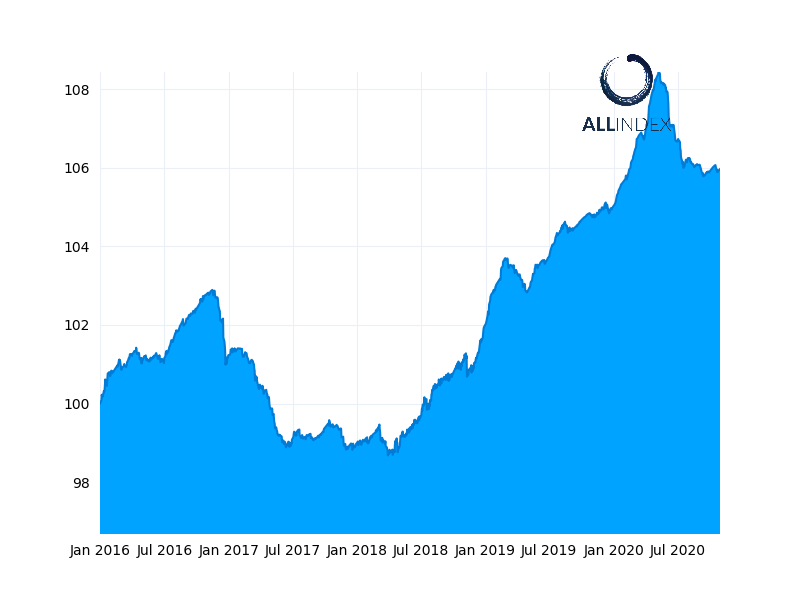

The securities of Xiamen International Bank, China CITIC and Everbright were among the biggest gainers, helping to send the ATF China bond 50 Index 0.3% higher, its 13th consecutive day of advances.

Read More: The Asia Eight: Daily must-reads from world’s most dynamic region

That’s the longest winning streak since a 16-day run in April. The gauge has risen 0.23% in the latest stretch, compared with 1.18% in the earlier run.

All of the Allindex sub-indexes, Financials, Corporates, Enterprises and Local Governments, also gained 0.03%.

Biden’s victory has lifted hopes that hostilities between the world’s two largest economies pursued by Trump would ease. Combined with recent measures taken by Chinese regulators to ease foreign investment, analysts expect more foreign money to reach China’s capital markets.

The result has also boosted investor appetite for riskier debt, including higher-yielding Chinese corporate credits, on expectation that Trump’s policy-by-Twitter style will reduce market volatility.