Recent negative headlines about bitcoin’s environmental cost could open the way for central banks to dominate the digital currency space

(AF) Privately created digital currencies are having a torrid 2021. A first quarter that saw the price of bitcoin more than double to a high of around $64,000 has given way to a second quarter of lower prices and a flash crash on May 19 that took quotes down to little over $30,000.

Concern about the energy consumption of bitcoin mining helped to drive the most recent bout of volatility after Tesla founder Elon Musk’s May 13 tweet that the electric vehicle (EV) firm would no longer accept the cryptocurrency for purchases due to environmental concerns.

By many estimates, that may clear the way for central bank digital currencies (CBDCs) to dominate the virtual currency space. They are not expected to create comparable environmental challenges as they will not involve the “proof of work” computing power used to create bitcoin.

It could also be argued that CBDCs will be more environmentally sound than traditional “fiat” currencies, with their production of bank notes that use polymers in a bid to combat forgery and are therefore hard to recycle.

Also on ATF

China crypto confusion causes bitcoin volatility, CBDC speculation

BOJ begins experimenting with digital yen CBDC

OCC ruling signals further innovation for stablecoins, CBDCs

And a move to develop CBDCs could disintermediate many existing commercial banking functions that are energy intensive, including the use of physical branches.

“The key criteria for central banks are speed, scalability, the need for it to be very efficient and for the cost to be low,” Dragon IT Security founder Richard Dennis told AF. Dragon is advising multiple central banks on CBDC plans and sees particular benefits from their adoption for emerging market economies with developing payments systems.

Index moves

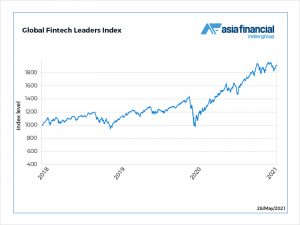

The growing importance of CBDCs to the global financial system was illustrated in the AF Global Fintech Leaders Index (AFCFIN), which slumped the most in a year after Musk’s announcement.

The pioneers in CBDC development were minor economies such as Finland and the Bahamas, but the move towards official global endorsement of digital currencies will be shaped by central banks from bigger countries that have more widely used existing currencies. The biggest central banks will nevertheless have a disproportionate role in shaping CBDC adoption.

China is more advanced than other major economies with its digital yuan project, but the Bank of England is accelerating its work on what has inevitably been dubbed a potential “Britcoin”. And the Federal Reserve is finally flexing its muscles as the arbiter of how digital currencies might interact with what remains the world’s reserve currency – the US dollar.

Fed chairman Jerome Powell released a video outlining his thoughts on digital currencies on Thursday May 20 – which itself was a novel method for communication by a Fed chief.

He said that the central bank will release detailed comments on digital currencies, CBDCs and regulation of new payments systems in the summer. Comments have been invited from the public and politicians.

“We think it is important that any potential CBDC could serve as a complement to, and not a replacement of, cash and current private-sector digital forms of the dollar, such as deposits at commercial banks,” Powell said. Its a comment that will be welcomed by bankers, who often complain that fintech firms are engaging in regulatory arbitrage by offering services with less direct supervision than banks.

“We will ask for public comment on issues related to payments, financial inclusion, data privacy, and information security,” Powell said of the Fed’s CBDC feedback plans.

He also issued what was effectively a warning that the Fed could seek to exercise veto powers on global CBDC development.

“Irrespective of the conclusion we ultimately reach, we expect to play a leading role in developing international standards for CBDCs, engaging actively with central banks in other jurisdictions as well as regulators and supervisors here in the United States throughout that process,” Powell said.

First out of the blocks

The CBDC projects already underway have focused on improving payments efficiency and offering access to distributed ledger technology and tokens.

Central banks are keen to ensure that any shift towards digital currencies includes improving access for unbanked customers. Initiatives to make finance more sustainable that are currently parallel to digital projects could easily converge with this goal.

Bank of England deputy governor Jon Cunliffe on May 13 delivered a speech that outlined some goals the central bank has for its own digital currency initiative, which is picking up momentum.

“Digital public money would operate alongside private money – as cash does now,” Cunliffe wrote. The central infrastructure in the model would be operated by the Bank of England. All customer-facing services, however, would be provided by private-sector firms, banks and non-banks alike, who would be able to plug into the Bank of England infrastructure and integrate digital public money into the services they offered.”.

Like Powell, Cunliffe noted that there are major questions to be answered before a CBDC proceeds, such as tackling inclusion and data privacy.

“The experience of the last 12 months has highlighted the risks of digital exclusion generally,” he wrote. “As the economy becomes increasingly digitised, the social consequences of exclusion from digital money will become more severe.

“This is not simply due to the growing importance of internet transactions. We already see a small but growing number of examples in which cash is not accepted for face to face transactions,” Cunliffe added, announcing that a joint Treasury and Bank of England task force will soon provide an update on the UK’s CBDC plans.

What about the incumbents?

Inclusion and privacy concerns are important for the retail uses of coming CBDCs, but for wholesale banking adoption the concerns and interests of financial sector incumbents are a major factor.

SWIFT, the commercial bank-owned international payments system, risks being disintermediated by widespread CBDC adoption, so it was no surprise when it recently commissioned consultants from Accenture to help make a case for its continuing involvement in wholesale financial transactions.

“CBDCs will present new challenges and new opportunities, requiring new solutions. At the same time, there is little advantage in reinventing the wheel,” SWIFT articulated in a report jointly released with Accenture on May 11. “We expect central banks will launch CBDCs with differing design decisions and objectives. SWIFT is agnostic to different types of CBDC models and aims to support and orchestrate transactions involving the full range of models.”

SWIFT intends to focus on its current key role facilitating cross-border payments as it starts to experiment with ways to interact with CBDCs.

Like a private-sector crypto investor, Accenture is keen to be involved with as many potentially lucrative public CBDC projects as possible, and it is providing funds for a venture called the Digital Dollar Project, which aims to explore designs and uses for an American CBDC – and prompt the Fedto speed the pace of progress for its own plans.

It has enlisted former US Commodity Futures Trading Commission (CFTC) chairman Chris Giancarlo to help this effort.

“The US doesn’t need to be first to (issue a) central bank digital currency, but it does need to be a leader in setting standards for the digital future of money, which is why our pilot testing collaboration with Accenture and other partners is so critical,” Giancarlo said in a May 3 announcement of the project. “We need to better understand how to balance the complex issues of a CBDC and how to incorporate key societal values, like privacy rights, financial inclusion and rule of law. Together, this project team will conduct research, experiment and develop thought leadership in an open manner in the interest of informing public policy.”.

The mention of “key societal values” by a former US regulator who was appointed as a Republican nominee to run the CFTC is an indication that the coming race to develop CBDCs could quickly run up against geopolitical rivalries.

China takes a lead

China’s recent digital yuan experiments have not involved energy-intensive mining comparable to the creation of new bitcoin, and its regulators contributed to the May plunge in the value of bitcoin by warning that key private cryptocurrency services are forbidden in the country.

But China is still home to much of the bitcoin mining that takes place globally, often using electricity that is created by use of coal power – which is environmentally unsound by most measures.

In March, China proposed the creation of global rules for CBDC development.

“Interoperability should be enabled between CBDC systems of different jurisdictions,” Mu Changchun, the director-general of the People’s Bank of China’s digital currency institute, said at a Bank for International Settlements seminar.

“Information flow and fund flows should be synchronised so as to facilitate regulators to monitor the transactions for compliance,” he said. “We also propose a scalable and overseen foreign exchange platform supported by DLT (distributed ledger technology like blockchain) or other technologies.”

That could be interpreted as a bid to keep CBDC development focused on its technological challenges, and to head off the digital equivalent of an arms race between central banks run by rival powers, especially the US and China.

But Powell’s May 20 speech was effectively a warning of the key role the US expects to play in CBDC development.

And if environmental, social and governance factors start to weigh more heavily with other central banks looking at digital currency developments, then China’s goal may become more challenging.

- Editing by Mark McCord