Alleged business partners of the Adani family invested $430 million in the Indian conglomerate’s stocks via “opaque” Mauritius funds that “obscured” their involvement, according to a global network of investigative journalists.

The Organised Crime and Corruption Reporting Project (OCCRP) said on Thursday that a review of files from multiple tax havens and internal Adani Group emails shows two individual investors – Nasser Ali Shaban Ahli from Dubai and Chang Chung-Ling from Taiwan – with “longtime business ties” to the Adani family used offshore structures to buy and sell Adani shares.

Reuters has not independently verified OCCRP’s assertions, and Ahli and Chang did not respond to requests seeking comment.

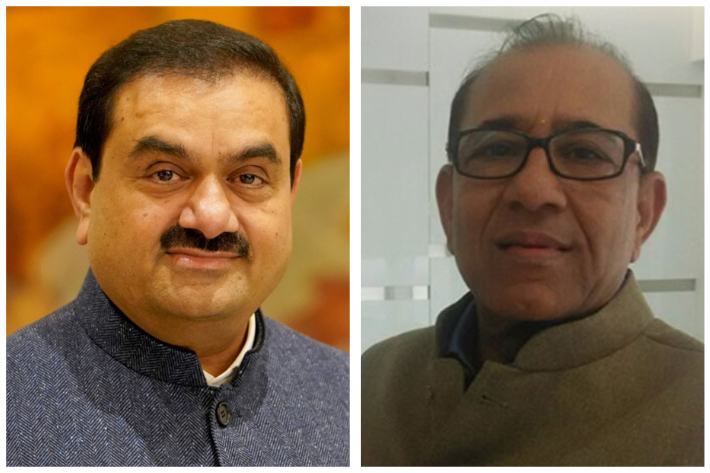

The Adani Group, controlled by billionaire Gautam Adani who was the third-richest man in the world before the scandal erupted in January, said it categorically rejected what it called recycled allegations “in their entirety”.

ALSO SEE: China’s Manufacturing Falls for 5th Month, Services Also Down

Shares of Adani firms fall again

The OCCRP report, which comes after US-based short-seller Hindenburg Research accused the Adani Group in January of improper business dealings, pushed down shares of Adani Group companies on Thursday and revived corporate governance concerns.

Shares of Adani Enterprises, the flagship company of the group, fell 3.5%, while Adani Ports, Adani Power, Adani Green, Adani Total Gas and Adani Wilmar slid between 2%-4.5% each.

“If true, it could mean a violation of Indian financial market regulator SEBI laws for publicly listed stocks, that could sway the outcome or push SEBI to dig deeper in its ongoing investigation into the group,” CreditiSights senior research analyst R Lakshmanan said.

SEBI, the Securities and Exchange Board of India, did not respond to requests for comment.

Days following the January report, Adani group stocks lost $150 billion in market value and remain down around $100 billion following a recovery in recent months after it repaid some debt and regained some investor confidence.

‘Evidence suggests trading coordinated by family’

Between them, at the peak of their investment in June 2016, Ahli and Chang held free-floating shares of four Adani Group units – Adani Power, Adani Enterprises, Adani Ports, and Adani Transmissions – ranging from 8% to about 14% stakes in the companies through two Mauritius-based funds, the report said.

At one point, their investment in Adani funds was worth $430 million, the report said.

Under Indian laws, every company needs to have 25% of its shares held by public shareholders to avoid price manipulation.

While OCCRP said there was no evidence Chang and Ahli’s money for their investments came from the Adani family, its reporting and documents – including an agreement, corporate records and an email – showed there “is evidence” that their trading in Adani stock “was coordinated with the family.”

It said that Ahli and Chang were associated with companies of the group as well as with Vinod Adani, who is a brother of Gautam Adani. Vinod Adani did not respond to a Reuters request for comment.

“The question of whether this arrangement is a violation of the law rests on whether Ahli and Chang should be considered to be acting on behalf of Adani ‘promoters,’ a term used in India to refer to the majority owners of a business,” OCCRP said.

If so, OCCRP said, the stake of promoters in Adani holdings would exceed the 75% limit allowed for insider ownership.

OCCRP probe validates report: Hindenburg

Hindenburg said on platform X on Thursday that the OCCRP report ‘validated’ issues it flagged with respect to the offshore funds owning at least 13% of the public float in multiple Adani stocks through “associates of Vinod Adani”.

Adani Group had called Hindenburg’s January claims misleading and without evidence and said it always complied with laws.

In a statement to OCCRP, Adani Group said the Mauritius funds investigated by reporters had already been named in the Hindenburg report and the “allegations are not only baseless and unsubstantiated but are rehashed from Hindenburg’s allegations.”

India’s Supreme Court has appointed a panel to oversee a SEBI probe based on the Hindenburg report. The panel in May said the regulator had so far “drawn a blank” in investigations into the suspected violations.

Last week, SEBI said its report was nearing completion and its investigation on some offshore deals was taking time as some entities were located in tax haven jurisdictions. The regulator “shall take appropriate action based on outcome of the investigations,” it said.

SEBI also said it examined one Adani group transaction for violation of minimum public float rules, an issue that the OCCRP report also flagged.

In an interview with a reporter from the Guardian, OCCRP said Chang said he knew nothing about any secret purchases of Adani stock. He asked why journalists were not interested in his other investments and said, “We are a simple business.”

- Reuters with additional editing by Jim Pollard

ALSO SEE:

India Regulator ‘Draws A Blank’ In Adani Foreign Links Probe

Probe Into Some Adani Offshore Deals for Disclosure Violations

Adani Seeks More Time to Pay $4bn Debt

All Eyes on India Market Regulator Amid Adani Share Sale Probe

Indian Protesters Say Modi Favoured Adani as Losses Top $110bn

Shares of India’s Adani Group Plunge After Scathing US Report