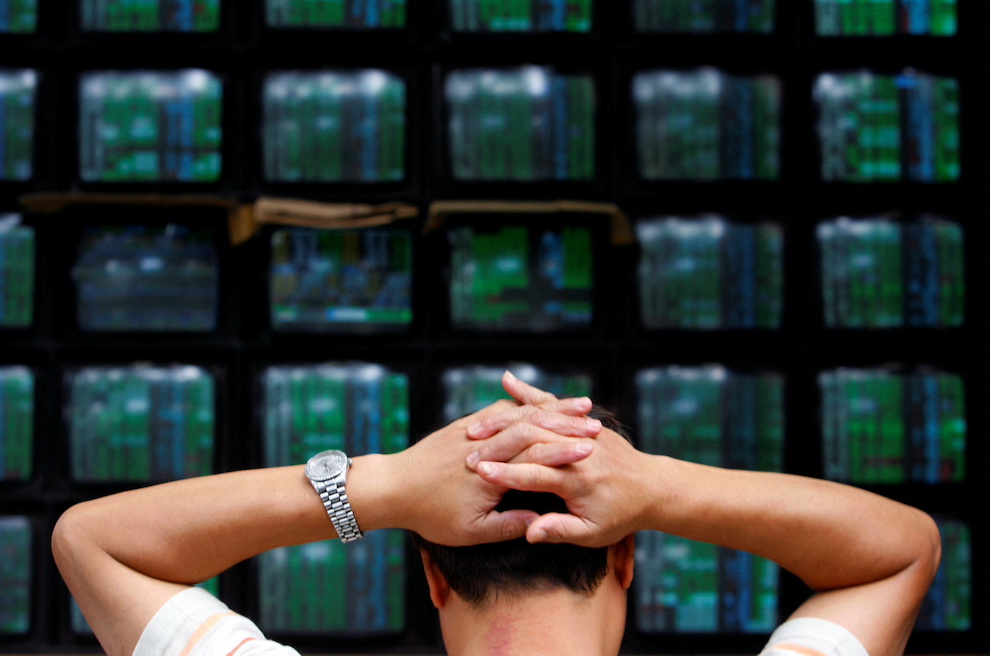

Asian equities endured another gloomy day of trading on Wednesday, as fears of a global recession took hold with central banks pushing up interest rates and worried investors turning to the US dollar sending it to new highs.

Japan’s Nikkei ended at a three-month low while Chinese stocks fell their most in five months and Hong Kong’s Hang Seng remained at an 11-year low point as spiralling borrowing costs sent shockwaves across trading floors.

Tokyo’s Nikkei share average dropped amid worsening recession fears hitting Wall Street overnight, while a media report that Apple had dropped plans to produce more iPhones also weighed on sentiment.

Also on AF: Asia Has Rebounded But China Has ‘Lost Momentum’: World Bank

The Nikkei fell 1.5% to close at 26,173.98, after hitting a July 1 low of 25,938.36 earlier. Real estate led the declines among other sectors, dropping 2.8% as the broader Topix slid 0.95% to 1,855.15.

China’s main stock benchmark tumbled to a five-month low as fears grew that rapid interest rate hikes would tip the global economy into recession.

The blue-chip CSI 300 Index and the Shanghai Composite Index both plunged at the close, with the CSI 300 at its lowest level since April 26 after dropping 1.6%.

China’s onshore yuan touched the weakest level against a rising dollar since the global financial crisis of 2008, while its offshore counterpart hit the lowest on record.

Foreign investors sold more than 3.8 billion yuan ($530 million) of Chinese shares through the Stock Connect scheme on Wednesday, following two days of net buying.

The Shanghai Composite Index dipped 1.6%, or 48.79 points, to 3,045.07, while the Shenzhen Composite Index on China’s second exchange dropped 2.6%, or 51.14 points, to 1,938.26.

Hang Seng Hammered

The Hang Seng Index slumped, languishing around 11-year lows, while the Hang Seng China Enterprises Index ended 3.1% lower.

Mainland developers listed in Hong Kong plunged more than 6%, with CIFI Holdings (Group) Co down 30%. CIFI missed payment of certain non-standard debt under a Tianjin project company, according to a report by credit intelligence provider Reorg.

Hong Kong-listed tech firms dropped 3.9%, with e-commerce giant Alibaba Group down 4.1%.

The Hang Seng Finance Index declined 3.6% with HSBC Holdings tumbling 5.8% to become the biggest drag on the Hang Seng benchmark which dropped 3.4%, or 609.43 points, to 17,250.88.

Elsewhere across the region, stocks in Jakarta rose 0.3% and were the only bright spot among Asian equities.

Indian stocks fell with Mumbai’s signature Nifty 50 index down 0.77%, or 131.35 points, at 16,876.05.

Sterling Under Fire

Globally, shares sank to two-year lows and the pound came under fire again on the back of a renewed surge in UK bond yields that have driven the government’s borrowing costs above those with heavier debt burdens such as Greece or Italy.

The International Monetary Fund (IMF) and ratings agency Moody’s criticised Britain’s new economic strategy. Investors braced for more havoc in bond markets that has already forced the Bank of England to promise “significant” action.

“It is now clear that central banks in advanced economies will make the current tightening cycle the most aggressive in three decades,” Jennifer McKeown, head of global economics at Capital Economics, said.

“While this may be necessary to tame inflation, it will come at a significant economic cost.”

The MSCI All-World index lost 0.65% to hit its lowest since November 2020, and it is heading for a 9% drop in September, which would be its biggest monthly decline since March 2020’s 13% fall.

Dollar Touches Record High Against Yuan

The safe-haven dollar has been a major beneficiary from the rout in sterling, rising to a fresh 20-year peak of 114.680 against a basket of currencies.

The dollar also touched a record high on the offshore-traded Chinese yuan at 7.2387, having risen for eight straight sessions.

The mounting pressure on emerging market currencies from the dollar’s rise is in turn adding to risks that those countries will have to keep lifting interest rates and undermine growth.

Oil prices fell again as demand worries and the strong dollar offset support from US production cuts caused by Hurricane Ian.

Key figures

Tokyo – Nikkei 225 < DOWN 1.5% at 26,173.98 (close)

Hong Kong – Hang Seng Index < DOWN 3.4% at 17,250.88 (close)

Shanghai – Composite < DOWN 1.6% at 3,045.07 (close)

London – FTSE 100 < DOWN 1.4% at 6,886.97 (0955 BST)

New York – Dow < DOWN 0.43% at 29,134.99 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China’s Yuan Plunges to Record Low Against Dollar

China Tells Brokers to Stabilise Markets for Party Congress