Asia’s major markets rebounded on Thursday as investors found comfort in planned talks between Russia and Ukraine, while an overnight slide in oil prices calmed some nerves about global inflationary pressures.

Foreign ministers from Russia and Ukraine will meet in Turkey in the first high-level talks between the two countries since Moscow invaded its neighbour, with Ankara hoping they could mark a turning point in the conflict.

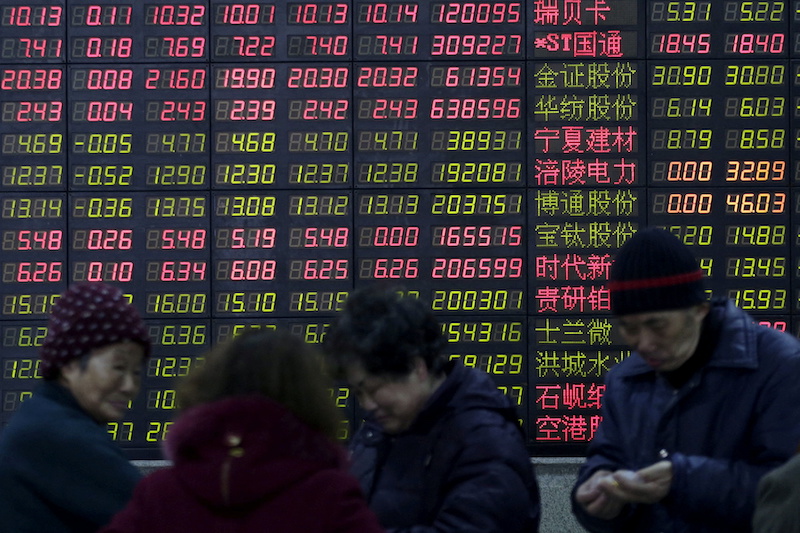

The prospect of talks had buoyed MSCI’s broadest index of Asia-Pacific shares outside Japan by 1.8%, with Tokyo adding nearly 4%, its best day since June 2020, and bourses in Taiwan and China rising more than 2% each.

Also on AF: Japan’s Fossil Fuel Dependence Complicates Russia Ban

The benchmark Nikkei 225 index ended up 3.94% or 972.87 points at 25,690.40, while the broader Topix index surged 4.04% or 71.14 points to 1,830.03.

Hong Kong finished on the front foot too, after recent Ukraine-fuelled losses, and the Hang Seng Index ended the day up 1.27%, or 262.55 points, at 20,890.26.

The Shanghai Composite Index jumped 1.22%, or 39.70 points, to 3,296.09, while the Shenzhen Composite Index on China’s second exchange climbed 2.12%, or 44.79 points, to 2,160.94.

But analysts warned the gains in Asia, which came after European stocks had enjoyed their best day in almost two years on Wednesday, were susceptible to a sharp reversal.

“The prospect of peace, an imminent de-escalation, really is pie in the sky,” said Michael Hewson, chief markets analyst at CMC Markets.

“As with any sort of bear market you always get face-ripping rallies in them, because people are reluctant to be aggressively pessimistic.”

US Inflation Figures Due

US inflation figures are also due, which could further guide expectations for the Federal Reserve’s meeting next week.

Wall Street futures were down around 0.5%, after the S&P 500 posted its biggest one-day percentage gain since June 2020 on Wednesday.

“US equities could be in a holding pattern with higher levels of volatility as investors assess the impact of the Ukraine conflict on inflation and possible Fed actions,” said David Chao, a Hong Kong-based global market strategist at Invesco.

The MSCI world equity index, which tracks shares in 50 countries, was up 0.2%.

Oil steadied after falling over 12% in the previous session as investors weighed whether major producers would boost supply to help plug the gap in output from Russia sparked by sanctions.

Brent crude futures added over 3% on Thursday to $114.64 a barrel, and US crude rose 1.73% to $110.58.

Kremlin’s Economic War Accusation

The Kremlin accused the United States on Wednesday of declaring an economic war on Russia that was sowing mayhem through energy markets, and put Washington on notice it was considering its response to a ban on Russian oil and energy.

European Union leaders will also phase out buying Russian oil, gas and coal, a draft declaration showed on Thursday, as the bloc seeks to reduce its reliance on Russian sources of energy, following a ban from the United States.

Higher energy prices fed into expectations the US Federal Reserve will raise interest rates by 25 basis points at its policy meeting next week.

Data due later in the day is expected to show US consumer inflation racing at a 7.9% annualised clip in February.

The dollar index was up 0.2% at 98.234, after tumbling 1.2% overnight amid the euro and equities’ surge.

Key figures around 0820 GMT

Tokyo – Nikkei 225> UP 3.9% at 25,690.40 (close)

Hong Kong – Hang Seng Index> UP 1.3% at 20,890.26 (close)

Shanghai – Composite> UP 1.2% at 3,296.09 (close)

London – FTSE 100> DOWN 0.2% at 7,175.02

Brent North Sea crude> UP 3.4% at $114.94 per barrel

West Texas Intermediate> UP 2.3% at $111.24

New York – Dow> UP 2.0% at 33,286.25 (Wednesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Amazon Announces 20-for-1 Stock Split, $10bn Share Buyback

China Regulator Said to Bar Banks from Promoting Hong Kong SPACs