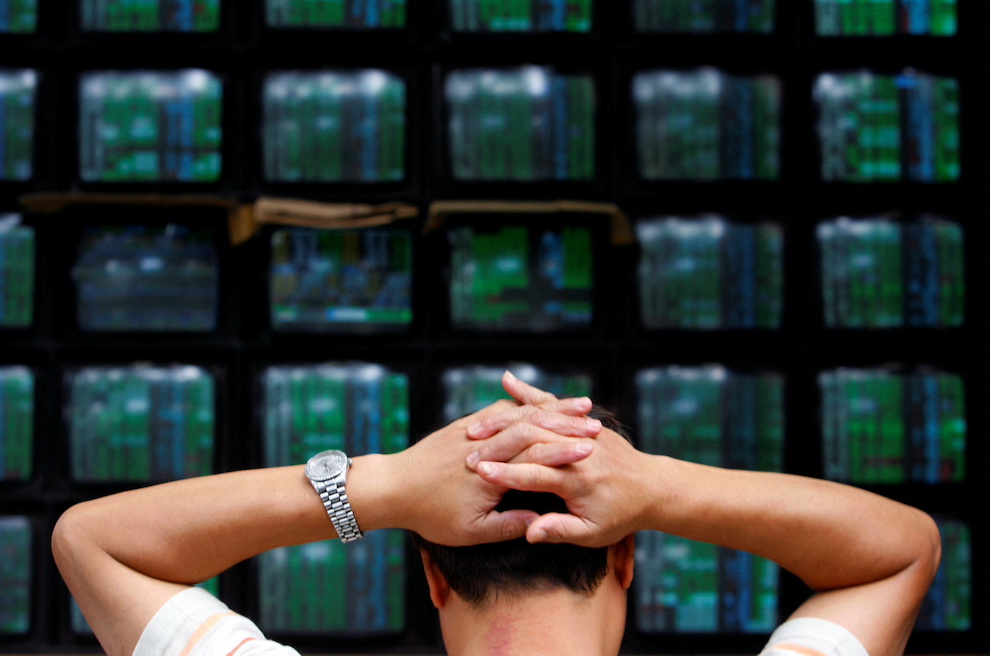

Asia’s major markets were in retreat on Thursday as anxiety over the global economic outlook and fears of recession deepened the air of gloom over trading floors.

Japan’s Nikkei share average did manage to snap a four-day losing streak after the Federal Reserve hiked its interest rate by 75 basis points, the biggest increase since 1994, as it tries to rein in US inflation.

But that was the only minor highlight across the region as investors focused on the impact of surging inflation and the likely consequences of the Fed’s rate increase as central banks tighten.

Also on AF: China Project Approvals Surge Six Times in May to Boost Growth

The Nikkei ended the day up 0.4% at 26,431.20, rebounding from its lowest close since May 12 on Wednesday, but that was still near the day’s lows. The broader Topix gained 0.64% to 1,867.81.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.1%, erasing earlier gains.

China stocks closed down in a bumpy day’s trade, erasing earlier gains. The blue-chip CSI300 index fell 0.7%, to 4,250.06, while the Shanghai Composite Index lost 0.6% to 3,285.38 points.

Real estate developers lost 1.3% after data showed China’s May new home prices fell for the second month this year, as widespread Covid-19 curbs dented already weak buyer confidence in the property market.

Hong Kong’s Hang Seng Index had a bad day dropping 2.17%, or 462.78 points, to 20,845.43. The territory’s tech index was 3.3% lower, with heavyweights Alibaba, Tencent and Meituan all down between 3% and 4%

Indian stocks also suffered with Mumbai’s signature Nifty 50 index down 2.07%, or 324.30 points, at 15,367.85.

The MSCI’s benchmark for global stocks gave up earlier gains and by 0803 GMT was down 0.3%. The initial positive reaction to the widely expected 75 basis point rate hike by the US Federal Reserve also fizzled out.

Dollar Regains Footing

Later on Thursday the focus will turn to the Bank of England, which is also expected to raise rates to tackle inflation, a day after the European Central Bank promised fresh support to temper a bond market rout.

The pan-European STOXX 600 was down more than 1%, while S&P 500 e-mini futures fell 1.8%.

“There’s a lot of nervousness. After the initial relief to the Fed … markets seem to have woken up that it is still a 75 basis point rate hike,” Giuseppe Sersale, strategist and portfolio manager at Anthilia in Milan.

“If even the Swiss central bank surprisingly raises by half a point clearly investors imagine that the tightening of central banks is still very violent. There is very little to be cheerful about,” he added.

After retreating from a 20-year peak following the Fed meeting, the dollar regained its footing in the Asian session. The global dollar index, which tracks the greenback against a basket of six peers, was last up 0.5% at 105.29.

US Treasury yields rose with the 10-year yield at 3.362% from a close of 3.291% on Wednesday.

Oil prices recovered from a steep drop as investors focused on tight supplies. Brent crude was last up 0.3% to $118.8 per barrel and US crude added 0.2% to $115.6.

Key figures

Tokyo – Nikkei 225 > UP 0.4% at 26,431.20 (close)

Hong Kong – Hang Seng Index < DOWN 2.17% at 20,845.43 (close)

Shanghai – Composite < DOWN 0.61% at 3,285.38 (close)

New York – Dow > UP 1.0% at 30,668.53 (close)

- Reuters with additional editing by Sean O’Meara

Read more:

US Fed Move to Raise Interest Rates Ripples Across Asia

Hong Kong Follows US Federal Reserve in Raising Base Rate