Asian indexes began the week in uncertain mood with optimism from the US over an easing up in the Fed’s rate hikes policies balanced out by weak factory data and continued Covid outbreaks in China.

Stock markets wobbled with some hopeful the US might take its foot of the gas on interest rates. That saw Wall Street rally before the weekend break and that fed into Asian markets on Monday.

Japan’s Nikkei share average ended at a six-week high, tracking that strong finish on Wall Street, with technology shares leading the charge.

Also on AF: Hong Kong Suggests Expanding Crypto Trade to Retail Market

The Nikkei index rose 1.78% to 27,587.46, its highest since September 20, and marked its biggest one-day gain since October 14. The broader Topix index climbed 1.6% to 1,929.43.

Japan’s electrical appliances sector rose 2.78%, the most among the 33 industry sub-indexes on the Tokyo Stock Exchange, after its components gave robust forecasts.

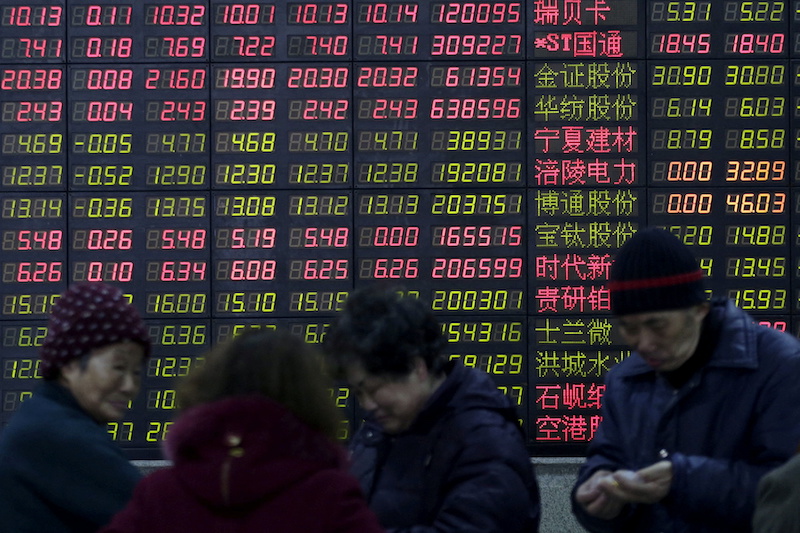

But China’s stocks fell to a three-and-a-half-year closing low while Hong Kong shares posted their biggest monthly loss in 14 years, as weak factory activity data and fresh Covid outbreaks compounded China growth fears.

China’s factory activity unexpectedly fell in October, weighed by softening global demand and strict domestic Covid-19 curbs, which hit production, travel and shipping in the world’s second-largest economy, data showed on Monday.

The yuan fell and is heading for its longest monthly losing streak since 1994.

The soft data, and rising Covid infections deepened concerns over China growth. Last week, global investors dumped China assets after President Xi Jinping consolidated power at the 20th Communist Party Congress, triggering worries over China’s policy directions.

Gloomy China Outlook

The gloomy economic outlook hit China’s energy, financials and property stocks, despite a jump in tech and defence stocks.

China’s benchmark CSI300 Index fell 0.9% to 3508.7 points, the lowest closing level since February 2019.

The Shanghai Composite Index lost 0.8% while the Shanghai Composite Index dipped 0.77%, or 22.44 points, to 2,893.48. The Shenzhen Composite Index on China’s second exchange was up 0.38%, or 7.21 points, to 1,886.41.

Hong Kong’s Hang Seng Index fell to the lowest level since early 2009, the depth of the Global Financial Crisis. The benchmark lost 14.7% in October, the biggest monthly loss in 14 years.

Its listed Chinese developers tumbled as much as 7% to a new closing low, as a slump in struggling developer Longfor Group further dented fragile confidence in the sector.

The Hang Seng Index dropped 1.18%, or 176.04 points, to 14,687.02 but the Hang Seng Tech Index rebounded 1.1%.

Focus on Fed Meeting

Elsewhere across the region, equities in Singapore rose as much as 2.3% and were set for their best day in nearly nine months, while stocks in Malaysia climbed 1.2% to their highest level in more than a month. Stocks in Indonesia and Thailand also edged higher.

Indian stocks were up too with Mumbai’s signature Nifty 50 index up 1.27%, or 225.40 points, at 18,012.20.

Globally, the main focus this week will be on the Federal Reserve meeting on Tuesday and Wednesday and US jobs data on Friday, though in Asia there will also be attention on Chinese economic data and the Reserve Bank of Australia’s Tuesday meeting.

The dollar paused its retreat, rising to 148.28 yen in the Asia session and holding firm at $0.9955 per euro.

Brent crude futures hovered at $95.46 a barrel. Spot gold held at $$1,641 an ounce.

Key figures

Tokyo – Nikkei 225 > UP 1.78% at 27,587.46 (close)

Hong Kong – Hang Seng Index < DOWN 1.18% at 14,687.02 (close)

Shanghai – Composite < DOWN 0.77% at 2,893.48 (close)

London – FTSE 100 > UP 0.15% at 7,058.30 (0945 GMT)

New York – Dow > UP 2.59% at 32,861.80 (Friday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China’s Factory Activity Set to Slip Close to Contraction: Poll

China Central Bank Pledges Credit Support But a Stable Yuan