Traders say a range of Asian markets experienced modest foreign outflows in April because of the rise in US Treasury yields.

This stems from expectations that the US Federal Reserve will keep interest rates elevated for longer in its fight to reduce inflation.

Data from stock exchanges in Taiwan, India, Indonesia, Vietnam, the Philippines, Thailand, and South Korea revealed that foreign investors sold a net $2.54 billion in regional equities last month – the largest monthly net outflow since November 2023.

ALSO SEE: Cambodian Plan For China-Funded Mekong Canal Worries Hanoi

These outflows, however, pale in comparison to the roughly $18.57 billion in net foreign inflows seen during the first quarter.

“Higher Treasury yields on a pushback in Fed’s rate cuts, geopolitical tensions in the Middle East and higher oil prices were looked upon as potential reasons for profit-taking,” Yeap Jun Rong, a market strategist at IG, said.

Taiwan stocks saw $2.23 billion in foreign outflows last month, ending a five-month streak of consecutive inflows.

Foreign investors withdrew $1.14 billion from Indonesian equities, $1.04 billion from Indian markets, and $190 million from Vietnamese stocks.

South Korea, Philippines see inflows

Conversely, South Korea and the Philippines attracted foreign inflows of $1.79 billion and $162 million, respectively.

“Korean equities as a whole should remain sensitive to the global AI/semiconductor investment theme,” said Jason Lui, head of APAC equity and derivative strategy at BNP Paribas.

“In our view, we are still in the cyclical rebound stage for memory pricing.”

US Fed chair Jerome Powell left interest rates steady last week, and flagged that rate cuts could be postponed due to persistent inflation in the first quarter.

The renewed optimism over US rate cuts pushed Asian shares to 15-month highs on Tuesday, with some analysts betting on a rebound in foreign demand for regional equities in May.

“With these headwinds seeing some signs of cooling and the US earnings season delivering yet another quarter of stellar outperformance, dip buyers are seen stepping in to hold the fort into the month of May,” IG’s Jun Rong said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

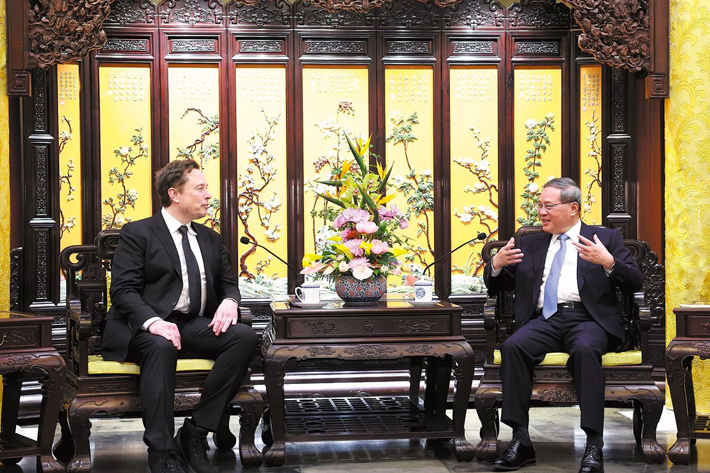

Tesla’s EV Sales in China Down 18% Year-on-Year in April

China Home Sales Plunge by Half During May Day Holiday

EV-Maker Zeekr Plans First Major Chinese IPO in US in Two Years