(ATF) All the ATF indices retreated on Tuesday as uncertainty continues to weigh on China’s fixed-income market. The China Bond 50 index, the flagship index, lost 0.08%, while the ATF ALLINDEX Corporates, Enterprise, Financial and Local Governments 0.01%, 0.10%, 0.04% and 0.15% respectively.

Last week, statements made by the State Council calling contrasted with those made by the governor of the People’s Bank of China (PBoC), Yang Li, and lead to some divergence in the market as to the likely direction of China’s monetary policy.

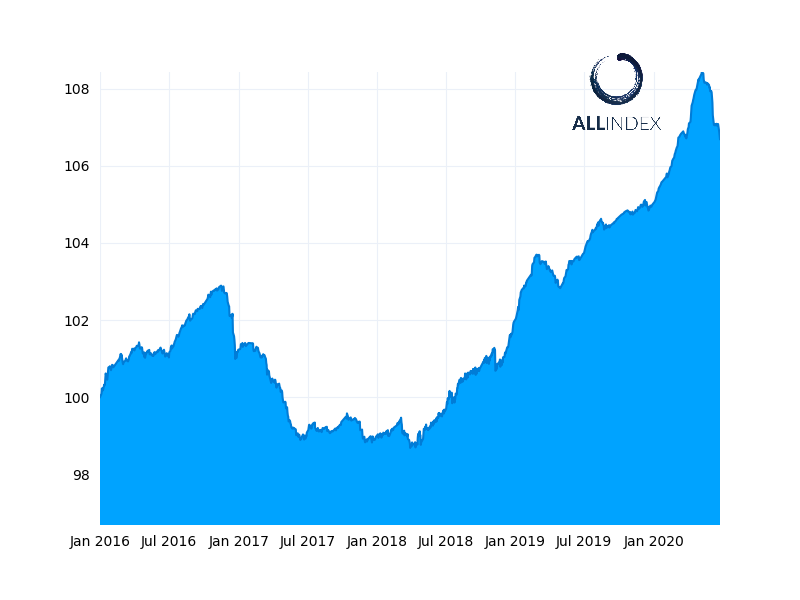

The ATF Corporates Index fell 0.01%.

While the PBoC official intimated that a withdrawal of policy tools will be necessary given the negative impact of accommodative policies, the State Council called for a cut in the reserve requirement ratio and pledged to guide down lending rates and bond yields, as reported.

One possible explanation to the contrasting statements is that the PBoC takes a longer-term perspective towards monetary easing, according to Janice Xue in a research note from Bank of America, and are anxious to preserve monetary policy ammunition.

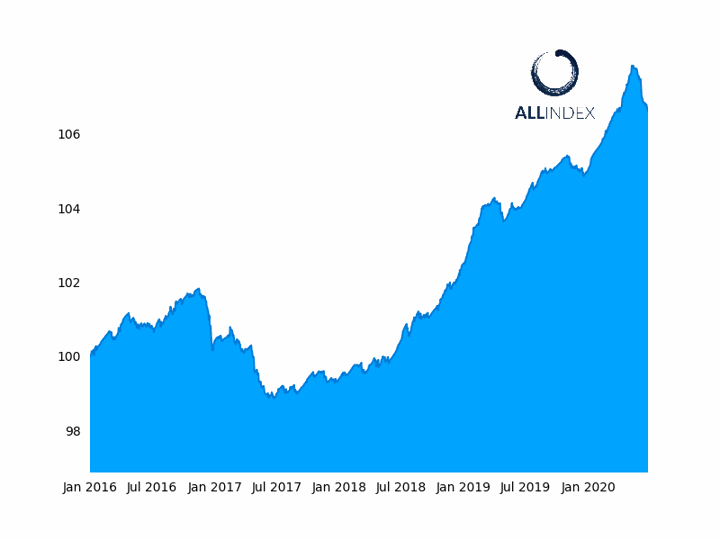

The ATF Financials Index fell 0.04%.

Central bank policymakers are responsible for managing a portfolio of mandates including employment, inflation exchange rate and financial stability, and the priority of each will shift over time. Given the steady recovery of the domestic economy, the PBoC has been in a position to slow the pace of easing and focus on other concerns such as financial market risk and exchange rate stability, she said.

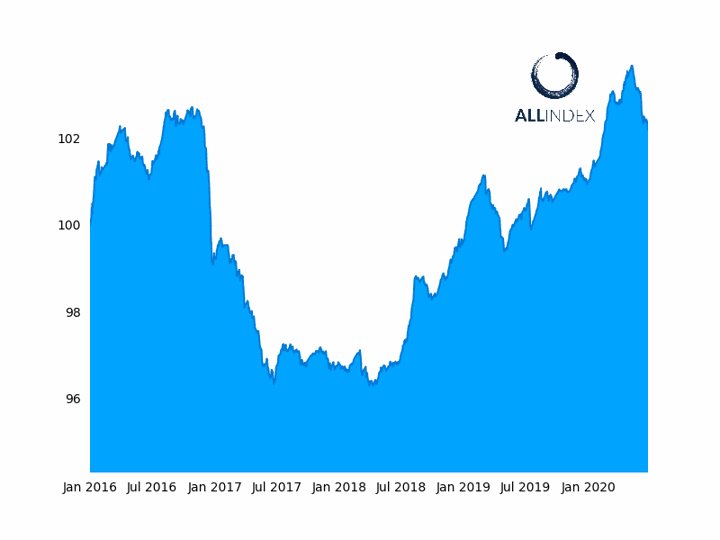

The ATF Enterprise Index fell 0.10%.

However, the threat of reduced global demand combined with higher borrowings costs, likely to become evident in the third quarter, could drive the government to greater easing. The PBoC’s current hold on lending rates does not necessarily signal a shift in monetary stance, added Xue.

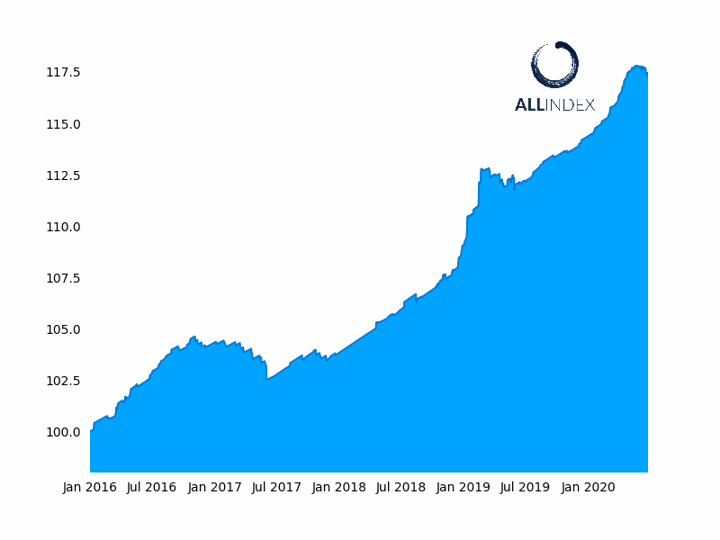

The ATF Local Governments Index fell 0.15%.

China’s benchmark lending rates were held steady on Monday for the second month running after the People’s Bank of China (PBoC) opted to keep borrowing costs on medium-term loans unchanged last week, as reported. The one-year loan prime rate was left unchanged at 3.85% from the previous monthly fixing while the over five-year remained at 4.65%.

PLEASE NOTE: Markets were shut in China on Thursday June 25 for the Dragon Boat Festival.