(ATF) The ATF indices closed with mixed results on Friday, ahead of a crucial couple of weeks for China in the third quarter.

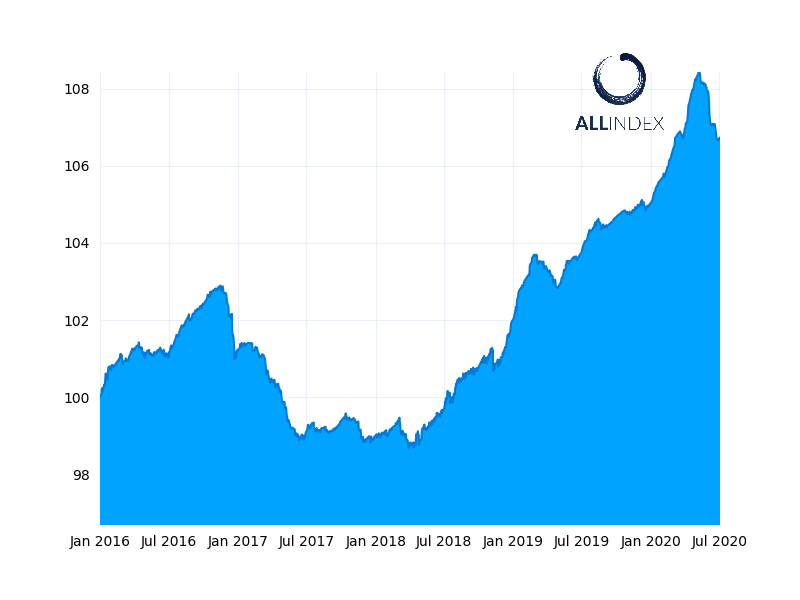

The China Bond 50 index, the flagship index, dropped 0.02%, along with the ATF ALLINDEX Local Governments and ATF ALLINDEX Corporates which retreated 0.09% and 0.12%. The ATF ALLINDEX Financial closed flat, while the ATF ALLINDEX Enterprise gained 0.01%.

China will be keen to maintain the momentum of its improving economic fundamentals for Q2, after a historic slump in Q1 when its economy contracted 6.8%. Although the latest manufacturing and non-manufacturing PMI figures indicate that economic growth accelerated in June, concerns over wage growth and job cuts in the export sector remain substantial.

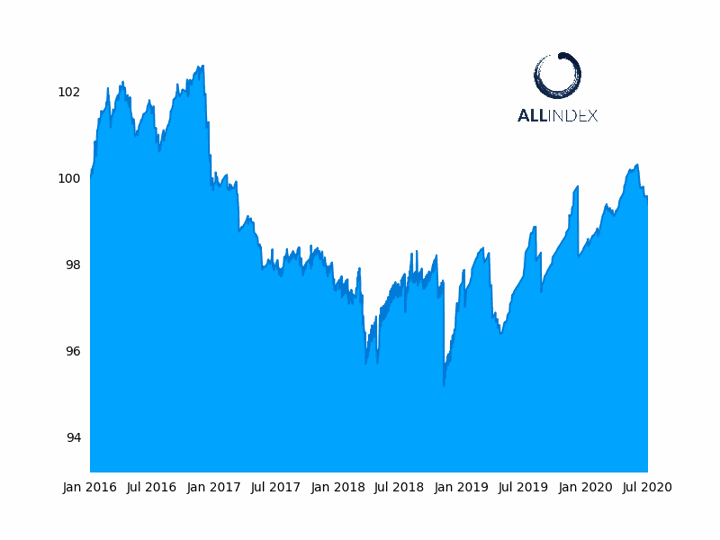

The ALLINDEX Corporates Index fell 0.12%.

Jinny Yan, Chief China Economist at ICBC Standard Bank in London, anticipates some meaningful cuts in monetary policy rates as we head into the second half. “In the coming weeks, we can expect a further lowering of the Reserve Requirement Ratio to kick-off Q3 growth,” she said. “Even if activity in infrastructure and construction are picking up, and domestic consumption from the latest PMI readings are looking ok, the lack of wage growth and risk of layoffs are a concern.”

Other measures such as a cut in the Medium-Term Lending Facility rate may also be on the cards to maintain the impetus of the recovery, she said.

July is seen as a crucial month for rate cuts as such measures are traditionally taken at the beginning of the quarter.

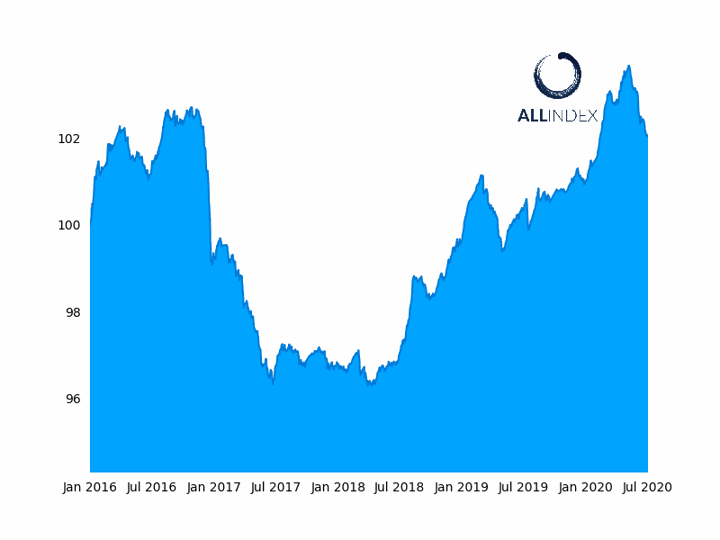

The ALLINDEX Enterprise Index climbed 0.01%.

Many observers were expecting a Reserve Ratio Requirement cut in June, following a call by the State Council, as reported. However, the PBoC has still not enacted such a cut, and also opted to keep the rates on its medium-term loans unchanged at 2.95% last month. This, along with a cut in the re-lending and re-discounting rates to ensure credit reaches the real economy, indicated a shift towards a more targeted easing policy.

However, the pause was likely due to a concern over using an excess of monetary stimulus too soon, leaving fewer tools to stimulate the economy in the second half of the year, said Yan.

“Targeted and broad-based easing are not mutually exclusive and may even happen together,” she said. “But timing is everything for the PBoC”.

The ALLINDEX Financials Index was unchanged.

The month of July will also be a critical period for banks. Beijing has requested for them to effectively lower interest rates by sacrificing 1.5 trillion yuan ($212bn) in profits in order to finance cheap loans, lower fees, and defer loan obligations in order to support SMEs. This amounts to around 75% of the entire net profit of the commercial banking industry in 2019, according to the South China Morning Post, which based the calculation on data from the China Banking and Insurance Regulatory Commission.

The PBoC has been ensuring and managing liquidity to the banking system through its open-market operations. In the first week of July, the PBoC drained a net 490 billion yuan ($69bn). This was the biggest weekly net drain since the week ending on 21 February, compared with an injection of 480 billion yuan on a net basis a week earlier, according to Reuters. This could suggest that lenders are under less pressure to handle demand for funds.

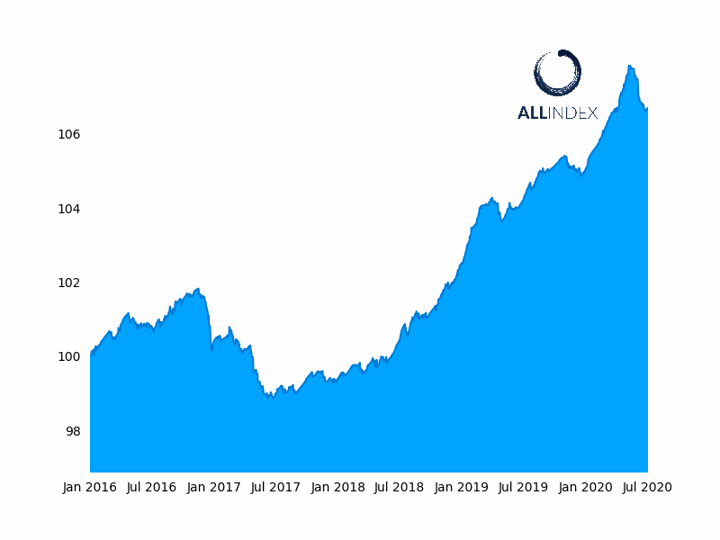

The ALLINDEX Local Government Index fell 0.09%.