(ATF) Chinese credits were little changed Thursday as investors clamoured for equities and other riskier assets on hopes that the new US administration would bring stability to markets and Sino-American ties.

Corporates led declines as it emerged that Tsinghua Unigroup, the Chinese conglomerate that has long sought to become a semiconductor powerhouse, is facing mounting debt woes while its key chip units fail to sell.

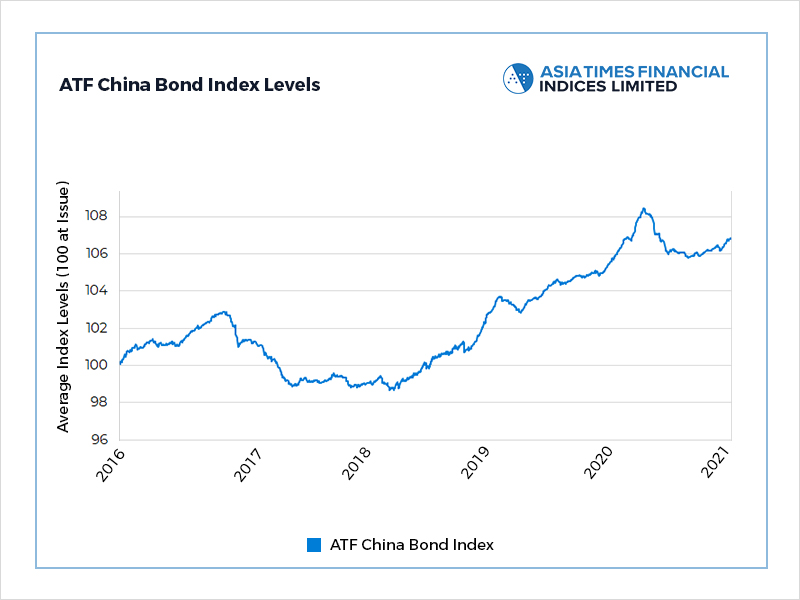

The ATF China Bond 50 Index climbed 0.01%. A 16-day 0.57% rally – the strongest start to a year in data going back to 2015 – ended Tuesday on concern that resurgent coronavirus clusters would prompt more economy-sapping lockdowns.

The transition of power in the US to Joe Biden raised investor appetite for risk, sending stock markets around the world higher. Investors are betting he will take a more conciliatory stance on China after four years in which Donald Trump launched a prolonged trade war with China and subjected its tech industry to punitive sanctions.

Also on ATF

- Fiscal spending optimism sustains rally

- China’s multiple bond investment channels get busy

- Biden slams China’s move to put sanctions on ex-Trump officials

However, newly appointed Treasury Secretary Janet Yellen‘s warning that those policies may not be quickly rolled back also weighed on fixed-income assets.

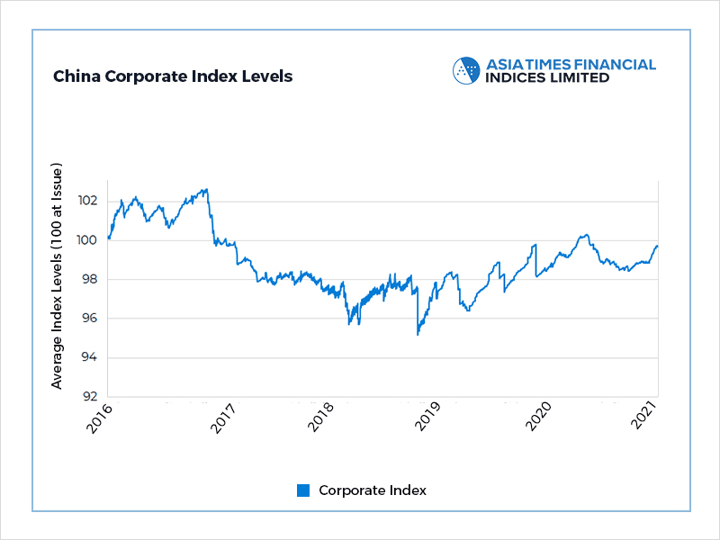

Declines were led by the bonds of private companies. The Corporates sub-index slid 0.03%, the steepest decline since before Christmas.

Best known for an unsuccessful $23 billion bid for US chipmaker Micron Technology in 2015, Unigroup shocked investors in November with a default on a 1.3 billion yuan ($200 million) bond.

Including that bond, Unigroup has now either defaulted or had cross-defaults triggered on seven onshore and offshore bonds worth about $3.6 billion, according to Refinitiv data.

That’s sparked concern of another spate of defaults, which sparked a selloff in corporate and local government bonds last year.

Those non-payments were largely confined to companies within China’s sprawling state-owned enterprise sector. The creation of regulations to reform SOEs over the next three years has brightened the outlook for the sector.

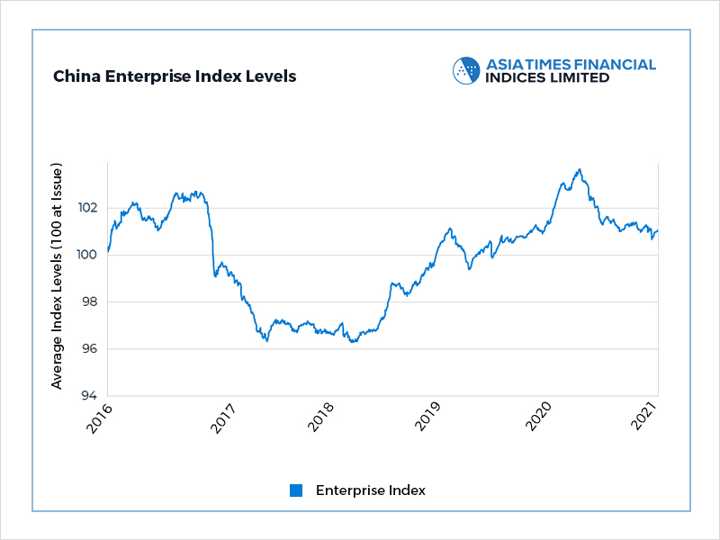

The Enterprise sub-index climbed 0.03% Thursday led by the 5.18% bond of CITIC Corporation, whose yield fell 0.15%. The gauge has climbed 0.39% in the past 14 days on easing concern of defaults.