(ATF) The benchmark China bond index fell from a six-month high Tuesday as a poor reception to the year’s first sale of green debt were poorly received and as default concerns heightened over convertible securities.

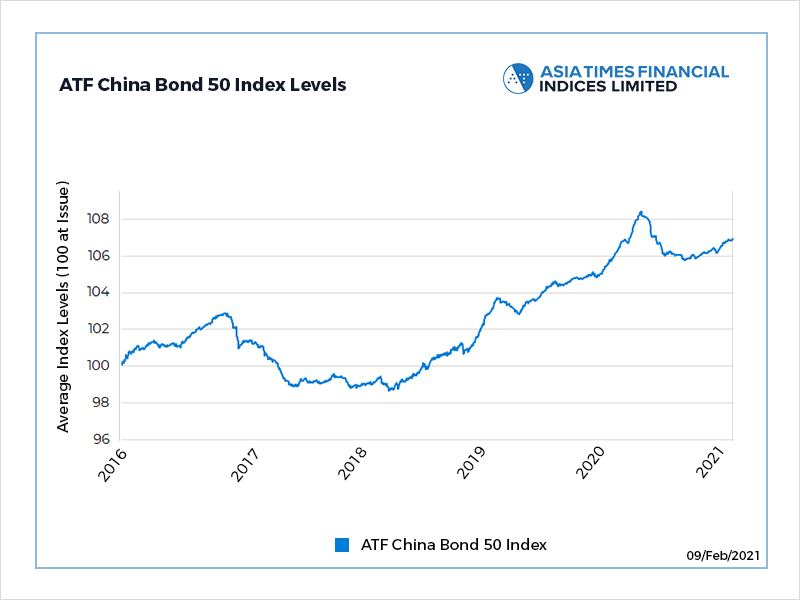

The China Bond 50 Index of returns on China’s most liquid AAA corporate and local government bonds fell 0.02% to 106.92. It reached 106.94 on Monday, the highest since June 6.

Declines were led by the debt of industrial and utility companies. The 4.1% bond of Zhuhai Da Heng Qin Investment slid 0.72, the biggest loser, while the 3.95% note of Gansu Provincial Highway Aviation Tourism Investment Group slid 0.36.

Also on ATF

- Reflation trade boosts Asia

- More pain Down Under for Aussie gas producers

- China backs merger of Shenzhen’s main stock and SME boards

- Bitcoin extends record streak in Asia trading; Ethereum hits peak

China’s first batch of “carbon neutrality” bonds received a lukewarm welcome from investors who demand higher yields. The poor showing underscored the country’s challenge to fund President Xi Jinping’s pledge to go carbon neutral by 2060.

Five Chinese power companies and one airport operator began on Sunday to raise a combined 6.4 billion yuan ($992.4 million) to finance clean energy and low-carbon projects. Four of the issuers, including China Three Gorges Corp and State Power Investment Corp extended their subscription period citing market conditions.

“The issuers are not happy with the price investors are willing to offer,” said a bond investor at insurer PICC, who declined to be named.

The convertible bond market is feeling the pressure of regulatory scrutiny and tighter domestic cash conditions, causing prices to fall sharply.

Declines in the prices of these bonds, which are hybrid securities with features of both bonds and stocks, have taken the CSI convertible bond index to seven-month lows this week and down nearly 7% in just about two weeks.

Many of the convertible bonds are trading below their 100 yuan par value, reflecting both the drop in the underlying prices of the companies’ stocks as well as worries about default and demand for the bonds.

“Falling below the par value means investors have concerns about a company and its current stock price, worrying there could be potential problems for the company,” said Li Chao, a retail investor in Hebei province.

- Reporting by Reuters