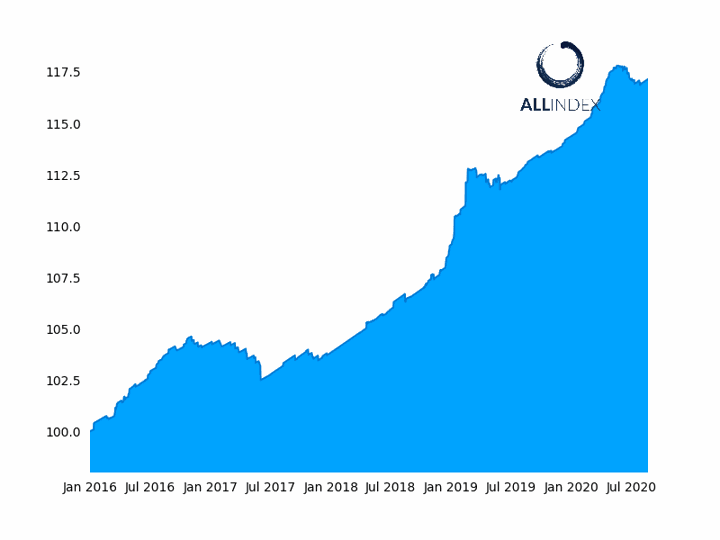

(ATF) The ATF indices closed steady to slightly positive on Thursday, as commercial banks kept the Loan Prime Rate (LPR) on hold, as per market expectations.

The one-year rate was kept unchanged at 3.85%, and the over five-year rate at 4.65% after the People’s Bank of China (PBoC) injected 300 billion yuan in the medium-term lending facility at 2.95%, a level unchanged since April this year.

The move signalled that the Loan Prime Rate would also be kept on hold on 20 August.

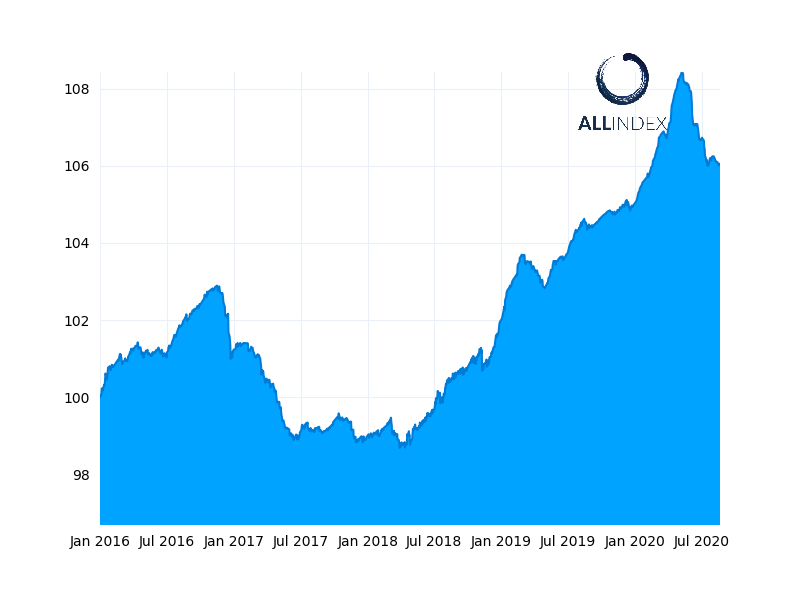

The ATF ALLINDEX Corporates sub-index rose by 0.01%.

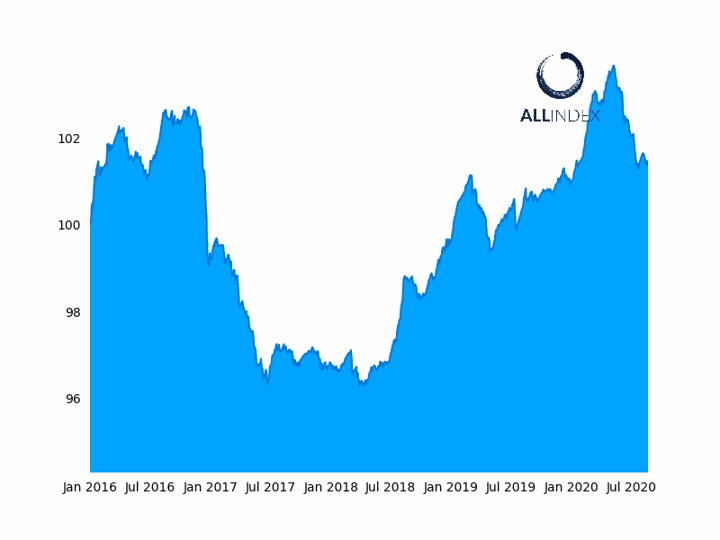

As a result, the flagship China Bond 50 index and the ATF ALLINDEX Financial gauge did not move at all, while the ATF ALLINDEX Corporates and Local Governments inched up 0.01%, and the ATF ALLINDEX Enterprise sub-index rose 0.02%.

The ATF ALLINDEX Enterprise sub-index rose 0.02%.

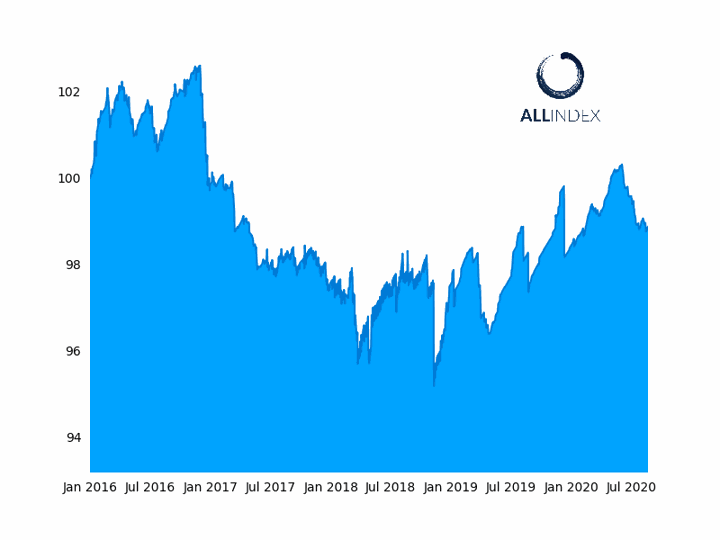

The ATF ALLINDEX Local Governments sub-index increased by 0.01%.

The MLF is a funding channel that allows the central bank to inject liquidity into the banking system and influence interest rates for longer-term loans, while the LPR is the reference rate against which all new loans, and outstanding floating-rate ones, are priced against. The latter is published on the 20th of every month, and set by a panel of commercial banks which are guided by the MLF rate.

Monday’s stimulus took the market by surprise, as its size was higher than expected. In July, the PBoC drained cash out of the financial system at the fastest pace this year as stocks soared.

The central bank’s action was likely a message to the market that it intends to keep liquidity within the banking system ample and funding costs low, even as it seeks to prevent asset bubbles in the property and stock market, according Jinny Yan, chief China economist at ICBC Standard Bank in London.

“There is an intention to show the markets that the PBoC is not becoming more hawkish and that the policy stance remains supportive but targeting the prevention of asset bubbles.”

Yan said the MLF and LPR were becoming a tool of choice in communicating the central bank’s policy stance to the market.

“There has been an ongoing process in China to reform the interest rate mechanism and ensure that policy is communicated in a more frequent manner”, she said.

“We are seeing a shift towards using the MLF/ LPR rate as a communication tool for policy, as it is a frequent and scheduled occurrence which takes place every month,” she said. This is in contrast to reserve ratio requirements (RRR) rates announcements, which occur on an ad-hoc basis and as needed, she added.

International investors can sometimes be taken off-guard by RRR rates announcements, as these might be made over the weekend or during Asia trading hours.

“As China opens up its financial and capital markets to the rest of the world, they want a tool that is of use to international investors. This is driving structural change towards policy communication, and the global pandemic has accelerated this shift.”