(ATF) The Chinese bond market held broadly steady on Friday and is likely set for a period of low volatility, even as broader market participants will be watching closely for signs of positive developments in the US-China trade talks next week.

The flagship China Bond 50 index stayed steady, while the ATF ALLINDEX Local Governments, Corporates and Enterprise inched up 0.01%, 0.01 and 0.02% respectively.

The flagship ATF China Bond 50 index stayed steady on Friday.

A coupon payment weighed on the ATF ALLINDEX Financial sub-index, which closed down 0.12%.

In contrast, the yuan broke above 6.9 against the dollar for the first time since January, after China’s central bank set central parity of the yuan against the US dollar at 6.9107 on Friday, as reported.

“The strength of the yuan is supported by China’s economic recovery paired with general dollar weakness on the back of further deterioration in the US economy and global uncertainties,” said Jinny Yan, chief China economist at ICBC Standard Bank in London.

Talks could boost yuan

“Any constructive development in the US-China trade talks could lead to yet a further strengthening of the Chinese currency against the dollar.”

China and the US have agreed to hold trade talks in the coming days to discuss the Phase One trade deal after the virtual meeting slated for Saturday 13 August was postponed.

Thursday’s announcement by the US Department of Transportation that the two countries will allow the number of flights between them to double could signal a possible easing of recent tensions. Earlier this month, US Secretary of State Mike Pompeo pushed for American technology firms to sever ties with Chinese companies.

China has a strong incentive to fulfil its commitment to the Phase One trade deal with the US, even if the country has fallen short of the agreed purchase targets due to the Covid-19 pandemic, according to Ting Lu, chief China economist at Nomura.

Nomura estimates that China’s purchases of US goods reached $40.3 billion in the first half of 2020, versus the agreed target of $83 billion.

The country is likely willing to import more grain from the US to replenish its food reserves which have been affected by the global pandemic, but sharp drops in energy prices could make meeting the target for energy imports a challenge, the Japanese bank said in a research report. However, it noted significant uncertainties around the trade deal, or any other future trade deals, given the stand-off between the two countries on the technology front.

Any developments in the trade talks are unlikely to impact the domestic bond market. “The key drivers of China’s domestic bond market are supply and demand and these are currently quite balanced,” said Yan. “We are seeing record local and central government bond issuance, but also strong demand domestically and from global institutional investors.”

Analysts speculate that issuance will reach well over 1 trillion yuan ($144 billion) in the month of August alone, according to China Banking News.

Bond purchases reach all-time high

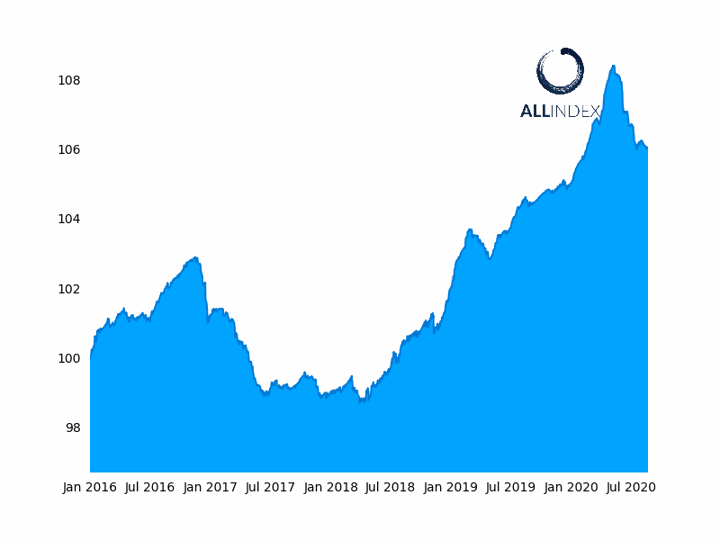

Meanwhile, foreign purchases of Chinese bonds reached an all-time high in the second quarter of this year of $33.5 billion, according to MarketWatch, spurred by the strong performance of Chinese debt over other debt markets.

The spread between 10-year Chinese government bond yields over US Treasuries of the same tenor is currently 237% basis points. China’s 10-year government bond closed at a yield of 3.01% on Friday.

In July, inflows reached $20 billion, the highest month on record, the news outlet stated, citing Exante Data. This dynamic, coupled with the fact that that the benchmark rate is set to be unchanged for the time being, points to very little yield volatility in the domestic bond market, Yan stated.

The Loan Prime Rate announced on 20 August was kept unchanged for the fourth successive month at 3.85% for the one-year rate and 4.65% for the over five-year rate.

However, Yan noted that recent regulatory clampdowns to prevent asset bubbles in the property and equity markets have led to liquidity squeezes that could impact higher-yielding bonds.

In July, the PBoC drained cash out of the financial system at the fastest pace this year as stocks soared, as reported.