(ATF) The ATF indices were little change Wednesday, despite China’s 10-year government bond yield surging to 2.9% – its highest level since February 24 – amid a wall of issuance and deepening concern that liquidity is tight. The yield on China’s one-year sovereign paper also spiked, to 2.13%.

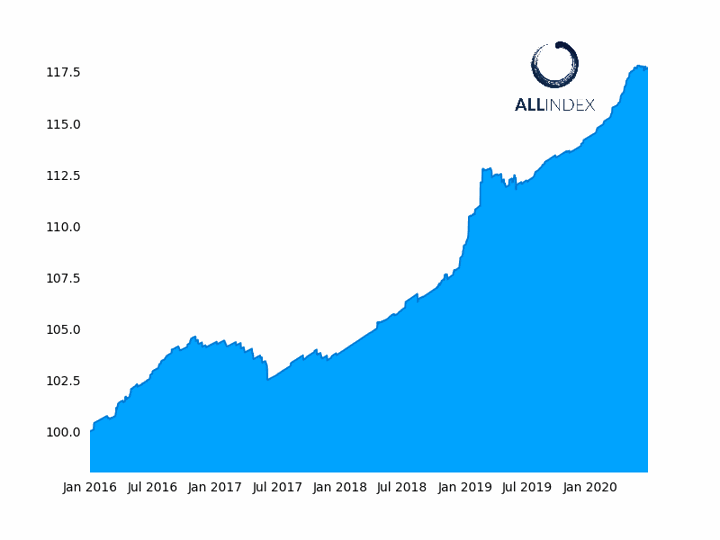

The China Bond 50 index, the flagship index, gained 0.01%, while the ATF ALLINDEX Corporates, Enterprise, and Financial gauges gained 0.02%, 0.01% and 0.02%, respectively. The ATF ALLINDEX Local Governments lost 0.02% and closed at 117.77.

-

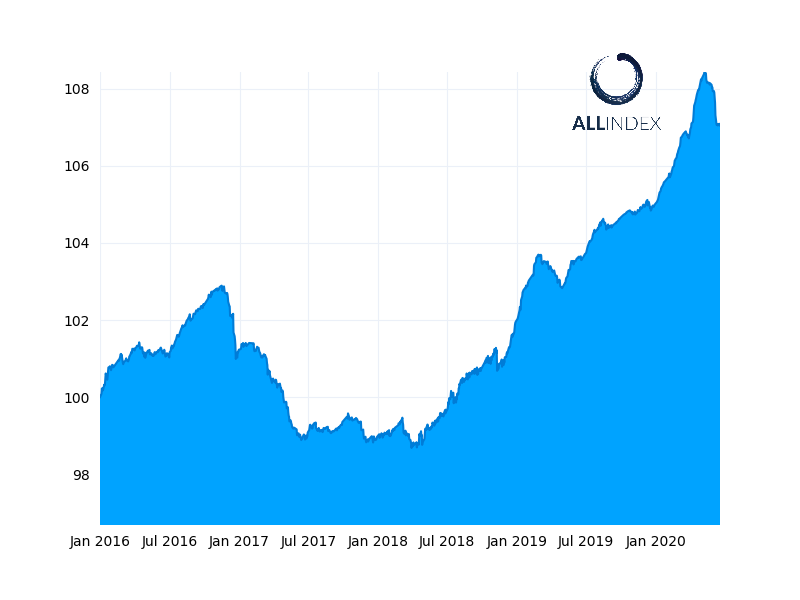

![]()

The ATF Corporate Bond Index added 0.02%

Investor worries of dwindling liquidity come on the back of Beijing’s announcement that it will issue 1 trillion yuan in bonds to finance the economic recovery, with 100 billion yuan of special treasury bonds to be auctioned on Thursday, according to Reuters.

Tighter liquidity could trigger a rise in funding costs, and impact China’s recovery. Beijing has been reluctant to cut rates following a surge in arbitrage trades that have prevented funds from flowing into the real economy. This comes after the People’s Bank of China (PBoC) pumped trillions of yuan into the financial system earlier this year, driving borrowing costs to multi-year lows.

-

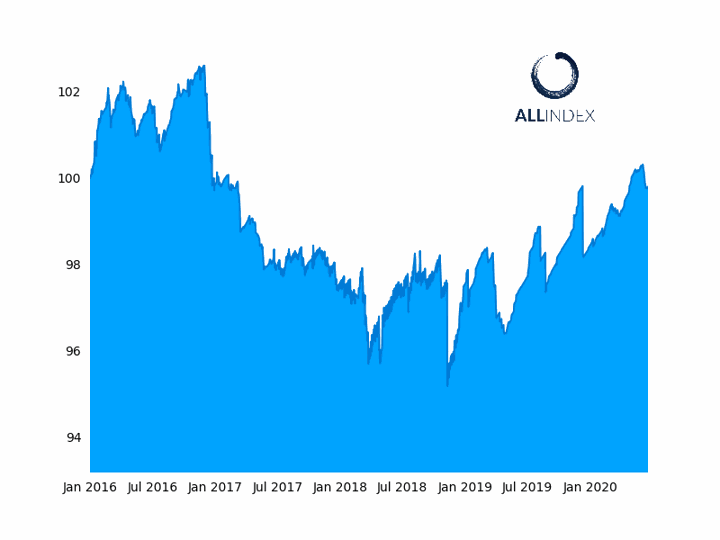

![]()

The ATF Enterprise Index advance 0.01%

However, should liquidity weigh on government bond issuance, China is likely to conduct more medium-term loan financing (MLF) injections and implement reserve requirement ratio cuts to support bond supply, according to a research note by Morgan Stanley.

-

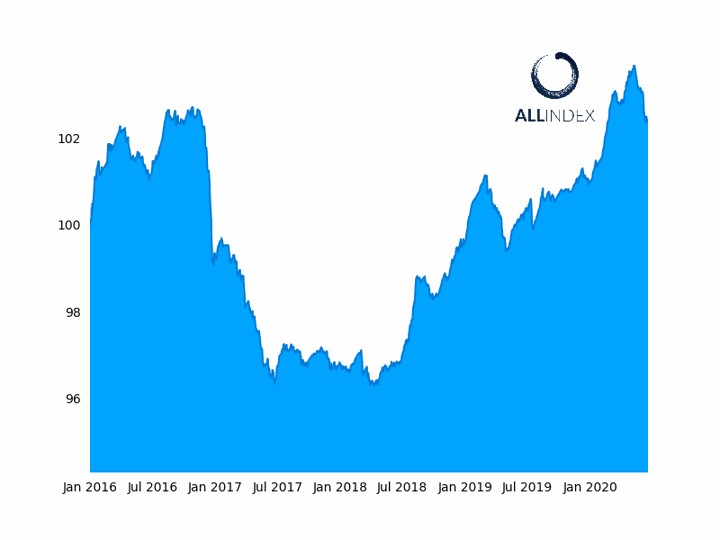

![]()

The ATF Financials Index rose 0.02%

Moreover, with the loan-prime rate just 30 basis points lower than at the end of 2019, analysts at DBS believe that this is not enough to revive domestic demand, and they expect Beijing to acknowledge the need for policy support. The Singaporean bank anticipates the possibility of a cut in both the reserve requirement ratio and interest rates in the second half of 2020.

-

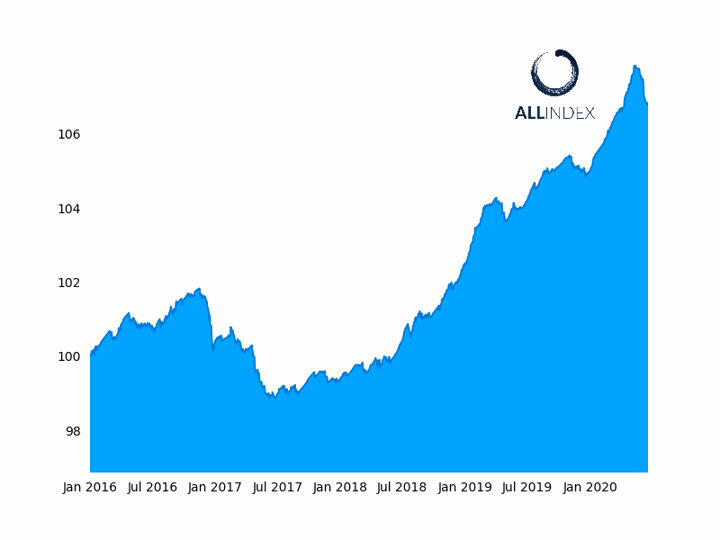

![]()

The ATF Local Government Index fell 0.02%

Despite the sell-off, DBS analysts are constructive on Chinese 10-year government bonds. The latter offer close to a 200-basis point premium over their US equivalent. This provides considerable value in a low-yield environment and is a draw for foreign investors. Furthermore, economic challenges remain, underscoring the possibility that a further increase in yields will prompt authorities to loosen liquidity.