Chinese officials ordered more than 70 mines in Inner Mongolia to ramp up coal production by nearly 100 million tonnes as the country battles its worst power crunch and coal shortages in years.

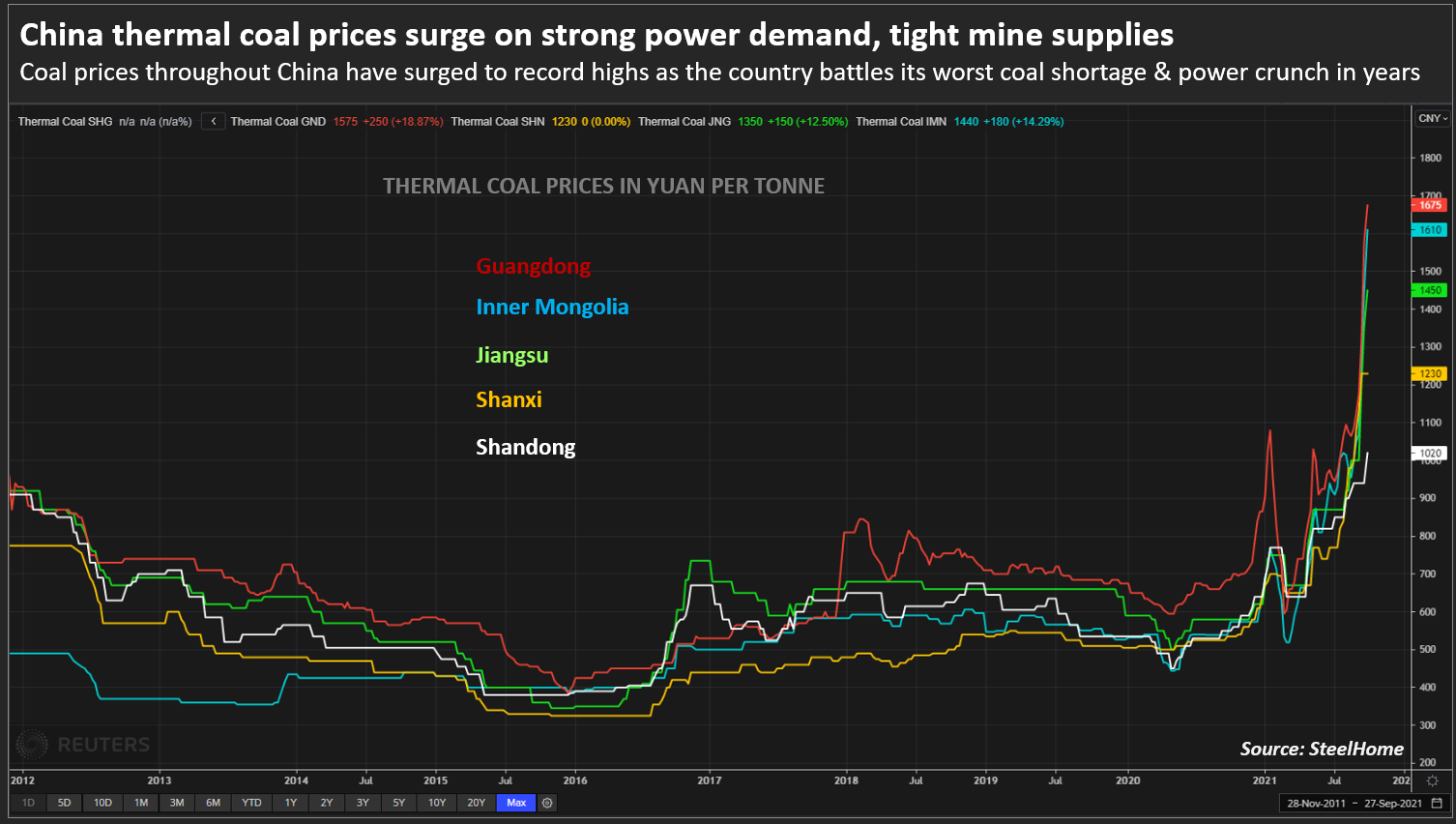

The move is the latest attempt by Chinese authorities to boost coal supply amid record-high prices and shortages of electricity that have led to power rationing across the country, crippling industrial output.

The proposed increase would make up nearly 3% of China‘s total thermal coal consumption.

In an urgent notice dated Thursday October 7, the Inner Mongolia regional energy department asked the cities of Wuhai, Ordos and Hulunbuir, as well as Xilingol League, or prefecture, to notify 72 mines that they may operate at stipulated higher capacities immediately, provided they ensure safe production.

An official with the region’s energy bureau confirmed the notice but declined to say how long the production boost would be allowed to last.

The notice followed a meeting on the same day during which the regional authorities mapped out measures for winter energy supplies in response to mandates from China‘s State Council, or Cabinet, the state-run Inner Mongolia Daily reported on Friday.

“The (government’s) coal task force shall urge miners to raise output with no compromise, while the power task team shall have the generating firms guarantee meeting the winter electricity and heating demand,” the newspaper said.

“This demonstrates the government is serious about raising local coal production to ease the shortage,” said a Beijing-based trader, who estimated the production boost may take up to two to three months to materialise.

The 72 mines listed by the Inner Mongolia energy bureau, most of which are open pits, previously had authorised annual capacity of 178.45 million tonnes.

The notice proposed they increase their production capacity by 98.35 million tonnes combined, according to Reuters calculations.

“It will help alleviate the coal shortage but cannot eliminate the issue,” Lara Dong, senior director with IHS Markit, said.

“The government will still need to apply power rationing to ensure the balancing of the coal and power markets over the winter,” she said.

China‘s Zhengzhou thermal coal futures briefly slumped 6% on Friday morning after opening up nearly 3%. The contract was down 3.2% at 1,287 yuan ($197.50) per tonne at 0400 GMT.

Raising Imports

Inner Mongolia is China‘s second-biggest coal-producing region, churning out just over 1 billion tonnes in 2020 and accounting for more than a quarter of the national total, official data show.

However, that output was down 8% in 2020 and was falling every month from April through July this year, partly due to an anti-corruption probe initiated last year by Beijing targeting the coal sector, which led to lower production as miners were banned from producing above approved capacity.

Neighbouring Shanxi province, China‘s biggest coal region, had to close 27 coal mines this week due to flooding.

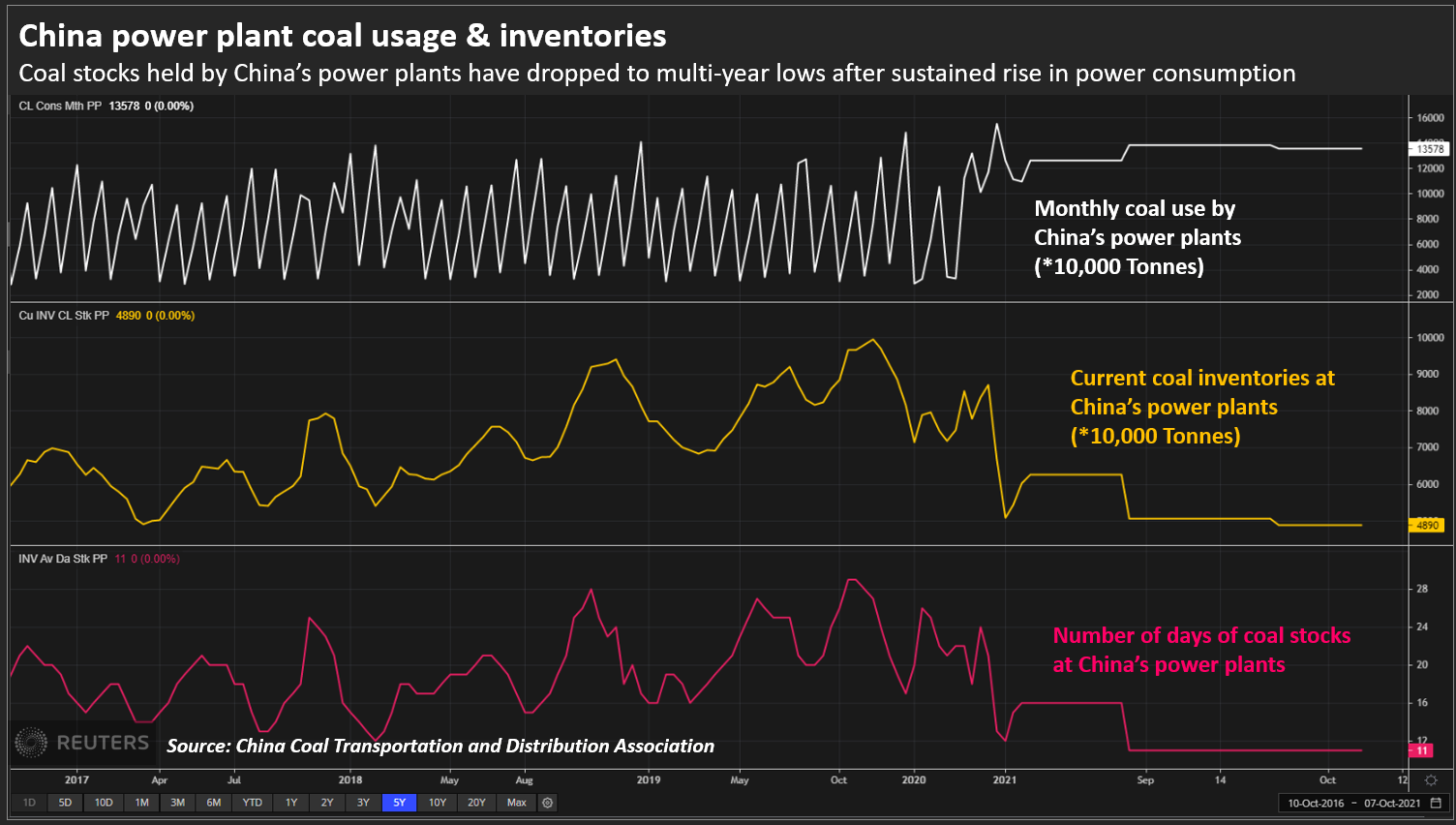

Coal inventories at major Chinese ports were at 52.34 million tonnes in late September before a week-long national holiday that started October 1, down 18% from the same period last year, data compiled by China Coal Transportation and Distribution Association showed.

Meanwhile, coal consumption is climbing as northeastern China has kicked off the winter heating season, with major power plants having stockpiles for around 10 days of use, down from more than 20 days last year.

To ensure power and heating supply to residential users, China has reopened dozens of other mines and approved several new ones.

The government has also called for “appropriately” raising coal imports to levels on par with last year, analysts said, after imports fell nearly 10% in the first eight months.

It has even released Australian coal from bonded storage despite a nearly year-long unofficial import ban on coal imports from Australia, and utilities have tapped rare supply sources like Kazakhstan and the United States.

• Reuters and additional editing by Jim Pollard

ALSO SEE:

China Turns To Stranded Australian Coal to Curb Power Woes

China Seeks To Quell Power Crunch Fears, As Coal Prices Soar, Winter Nears

China’s Power Crunch Begins To Weigh on Economic Outlook